Answered step by step

Verified Expert Solution

Question

1 Approved Answer

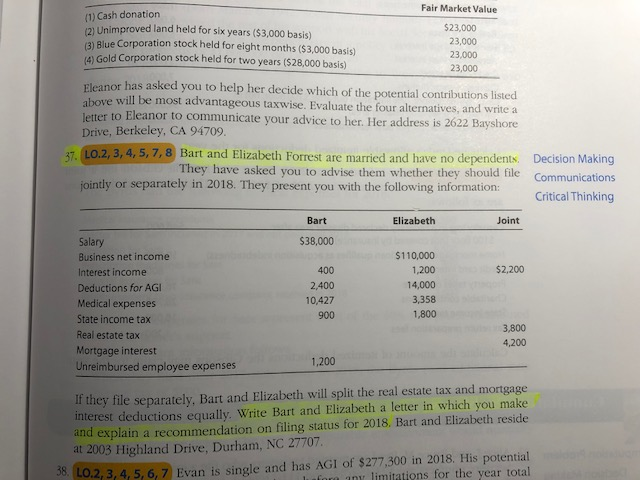

Problem 37. Write Bart and Elizabeth a letter in which you make and explain a recommendation on filing status for 2018. Fair Market Value (1)

Problem 37. Write Bart and Elizabeth a letter in which you make and explain a recommendation on filing status for 2018.

Fair Market Value (1) Cash donation mUnimproved land held for six years ($3.000 basis) (3) Blue Corporation stock held for eight months ($3,000 basis) A) Gold Corporation stock held for two years ($28,000 basis) $23,000 23,000 23,000 23,000 Eleanor has asked you to help her decide which of the potential contributions listed above will be most advantageous taxwise. Evaluate the four alternatives, and write a letter to Eleanor to communicate your advice to her. Her address is 2622 Bayshore Drive, Berkeley, CA 94709. 7LO.2, 3, 4, 5, 7, 8 Bart and Elizabeth Forrest are married and have dependents. Decision Making They have asked you to advise them whether they should file Communications no jointly or separately in 2018. They present you with the following information: Critical Thinking Bart Elizabeth Joint Salary $38,000 $110,000 Business net income $2,200 1,200 400 Interest income 14,000 Deductions for AGI Medical expenses 2,400 3,358 10,427 1,800 900 State income tax 3,800 Real estate tax 4,200 Mortgage interest Unreimbursed employee expenses 1,200 If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally, Write Bart and Elizabeth a letter in which you make and explain a recommendation on filing status for 2018. Bart and Elizabeth reside at 2003 Highland Drive, Durham, NC 27707. 8Lo.2, 3, 4, 5, 6, 7 Evan is single and has AGI of $277,300 in 2018. His potential lafora any limitations for the year totalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started