Answered step by step

Verified Expert Solution

Question

1 Approved Answer

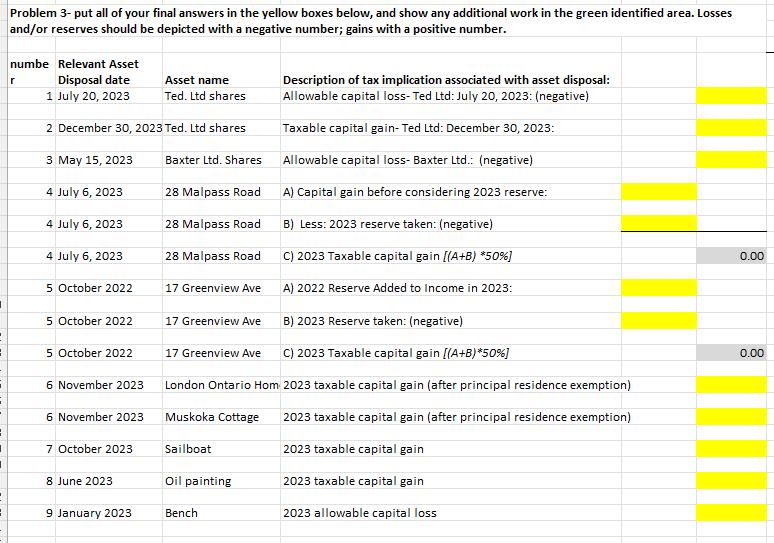

Problem 3-put all of your final answers in the yellow boxes below, and show any additional work in the green identified area. Losses and/or

Problem 3-put all of your final answers in the yellow boxes below, and show any additional work in the green identified area. Losses and/or reserves should be depicted with a negative number; gains with a positive number. numbe Relevant Asset r Disposal date 1 July 20, 2023 Asset name Ted. Ltd shares Description of tax implication associated with asset disposal: Allowable capital loss- Ted Ltd: July 20, 2023: (negative) 2 December 30, 2023 Ted. Ltd shares 17 Greenview Ave Taxable capital gain-Ted Ltd: December 30, 2023: Allowable capital loss- Baxter Ltd.: (negative) A) Capital gain before considering 2023 reserve: B) Less: 2023 reserve taken: (negative) C) 2023 Taxable capital gain [(A+B) *50%] A) 2022 Reserve Added to Income in 2023: B) 2023 Reserve taken: (negative) 3 May 15, 2023 Baxter Ltd. Shares 4 July 6, 2023 28 Malpass Road 4 July 6, 2023 28 Malpass Road 4 July 6, 2023 28 Malpass Road 5 October 2022 5 October 2022 17 Greenview Ave 5 October 2022 17 Greenview Ave 6 November 2023 6 November 2023 7 October 2023 Sailboat 2023 taxable capital gain 8 June 2023 Oil painting 2023 taxable capital gain 9 January 2023 Bench 2023 allowable capital loss C) 2023 Taxable capital gain [(A+B)*50%] London Ontario Hom 2023 taxable capital gain (after principal residence exemption) Muskoka Cottage 2023 taxable capital gain (after principal residence exemption) 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started