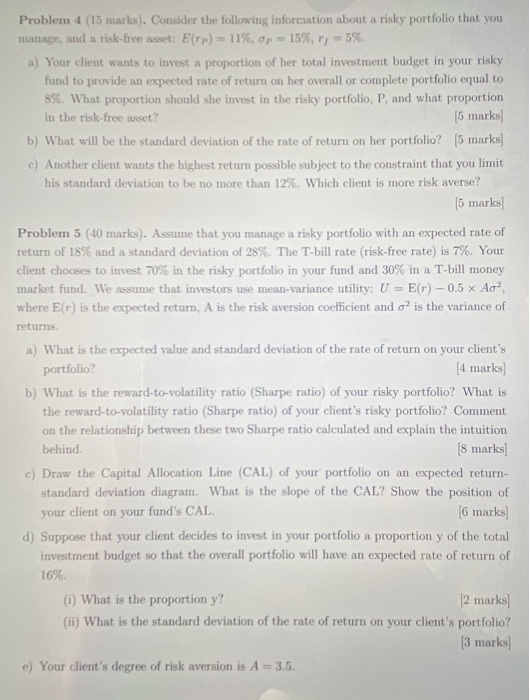

Problem 4 (15 marks). Consider the following information about a risky portfolio that you manage, and a risk-free asset: E(Tp) = 11%, p = 15%, r = 5%. a) Your client wants to invest a proportion of her total investment budget in your risky fund to provide an expected rate of return on her overall or complete portfolio equal to 8%. What proportion should she invest in the risky portfolio, P, and what proportion in the risk-free asset? (5 marks) b) What will be the standard deviation of the rate of return on her portfolio? [5 marks) c) Another client wants the highest return possible subject to the constraint that you limit his standard deviation to be no more than 12%. Which client is more risk averse? (5 marks) Problem 5 (40 marks). Assume that you manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%. The T-bill rate (risk-free rate) is 7%. Your client chooses to invest 70% in the risky portfolio in your fund and 30% in a T-bill money market fund. We assume that investors use mean-variance utility: U = E(r) - 0.5 x Ao?, where E(r) is the expected return, A is the risk aversion coefficient and o? is the variance of returns. a) What is the expected value and standard deviation of the rate of return on your client's portfolio? (4 marks) b) What is the reward-to-volatility ratio (Sharpe ratio) of your risky portfolio? What is the reward-to-volatility ratio (Sharpe ratio) of your client's risky portfolio? Comment on the relationship between these two Sharpe ratio calculated and explain the intuition behind (8 marks] c) Draw the Capital Allocation Line (CAL) of your portfolio on an expected return- standard deviation diagram. What is the slope of the CAL? Show the position of your client on your fund's CAL. [6 marks) d) Suppose that your client decides to invest in your portfolio a proportion y of the total investment budget so that the overall portfolio will have an expected rate of return of 16% (1) What is the proportion y? [2 marks] (ii) What is the standard deviation of the rate of return on your client's portfolio? [3 marks) e) Your client's degree of risk aversion is A=3.5. Problem 4 (15 marks). Consider the following information about a risky portfolio that you manage, and a risk-free asset: E(Tp) = 11%, p = 15%, r = 5%. a) Your client wants to invest a proportion of her total investment budget in your risky fund to provide an expected rate of return on her overall or complete portfolio equal to 8%. What proportion should she invest in the risky portfolio, P, and what proportion in the risk-free asset? (5 marks) b) What will be the standard deviation of the rate of return on her portfolio? [5 marks) c) Another client wants the highest return possible subject to the constraint that you limit his standard deviation to be no more than 12%. Which client is more risk averse? (5 marks) Problem 5 (40 marks). Assume that you manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%. The T-bill rate (risk-free rate) is 7%. Your client chooses to invest 70% in the risky portfolio in your fund and 30% in a T-bill money market fund. We assume that investors use mean-variance utility: U = E(r) - 0.5 x Ao?, where E(r) is the expected return, A is the risk aversion coefficient and o? is the variance of returns. a) What is the expected value and standard deviation of the rate of return on your client's portfolio? (4 marks) b) What is the reward-to-volatility ratio (Sharpe ratio) of your risky portfolio? What is the reward-to-volatility ratio (Sharpe ratio) of your client's risky portfolio? Comment on the relationship between these two Sharpe ratio calculated and explain the intuition behind (8 marks] c) Draw the Capital Allocation Line (CAL) of your portfolio on an expected return- standard deviation diagram. What is the slope of the CAL? Show the position of your client on your fund's CAL. [6 marks) d) Suppose that your client decides to invest in your portfolio a proportion y of the total investment budget so that the overall portfolio will have an expected rate of return of 16% (1) What is the proportion y? [2 marks] (ii) What is the standard deviation of the rate of return on your client's portfolio? [3 marks) e) Your client's degree of risk aversion is A=3.5