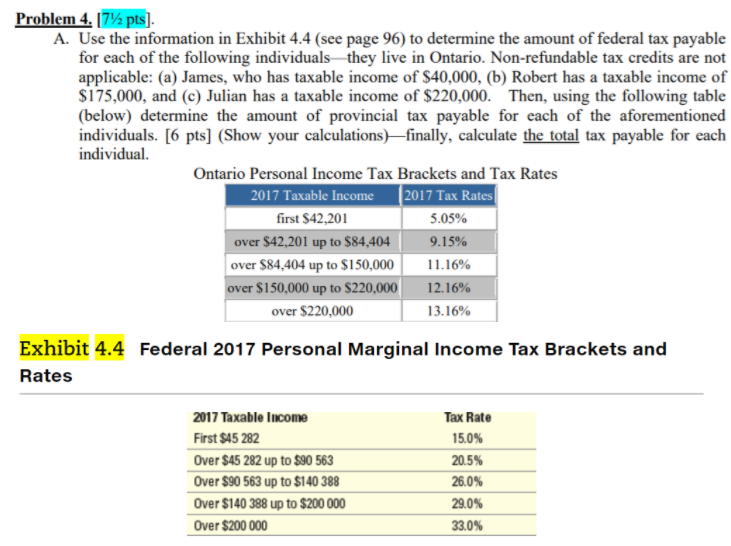

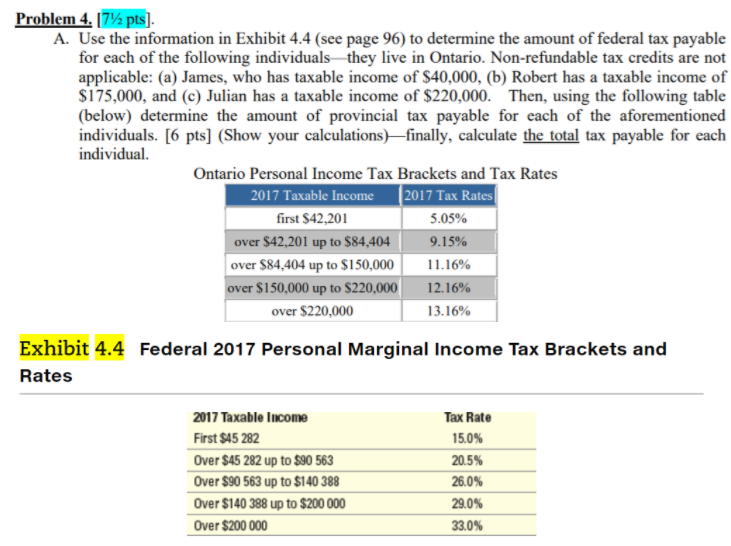

Problem 4. 1772 pts] A. Use the information in Exhibit 4.4 (see page 96) to determine the amount of federal tax payable for each of the following individuals they live in Ontario. Non-refundable tax credits are not applicable: (a) James, who has taxable income of $40,000, (b) Robert has a taxable income of $175,000, and (c) Julian has a taxable income of $220,000. Then, using the following table (below) determine the amount of provincial tax payable for each of the aforementioned individuals. [6 pts] (Show your calculations)finally, calculate the total tax payable for each individual. Ontario Personal Income Tax Brackets and Tax Rates 2017 Taxable Income (2017 Tax Rates first $42,201 5.05% over $42,201 up to $84,404 9.15% over $84,404 up to $150,000 11.16% over $150,000 up to $220,000 12.16% over $220,000 13.16% Exhibit 4.4 Federal 2017 Personal Marginal Income Tax Brackets and Rates 2017 Taxable Ticome First $45282 Over $45 282 up to $90 563 Over $90 563 up to $140 388 Over $140 388 up to $200 000 Over $200 000 Tax Rate 15.0% 20.5% 26.0% 29.0% 33.0% Problem 4. 1772 pts] A. Use the information in Exhibit 4.4 (see page 96) to determine the amount of federal tax payable for each of the following individuals they live in Ontario. Non-refundable tax credits are not applicable: (a) James, who has taxable income of $40,000, (b) Robert has a taxable income of $175,000, and (c) Julian has a taxable income of $220,000. Then, using the following table (below) determine the amount of provincial tax payable for each of the aforementioned individuals. [6 pts] (Show your calculations)finally, calculate the total tax payable for each individual. Ontario Personal Income Tax Brackets and Tax Rates 2017 Taxable Income (2017 Tax Rates first $42,201 5.05% over $42,201 up to $84,404 9.15% over $84,404 up to $150,000 11.16% over $150,000 up to $220,000 12.16% over $220,000 13.16% Exhibit 4.4 Federal 2017 Personal Marginal Income Tax Brackets and Rates 2017 Taxable Ticome First $45282 Over $45 282 up to $90 563 Over $90 563 up to $140 388 Over $140 388 up to $200 000 Over $200 000 Tax Rate 15.0% 20.5% 26.0% 29.0% 33.0%