Answered step by step

Verified Expert Solution

Question

1 Approved Answer

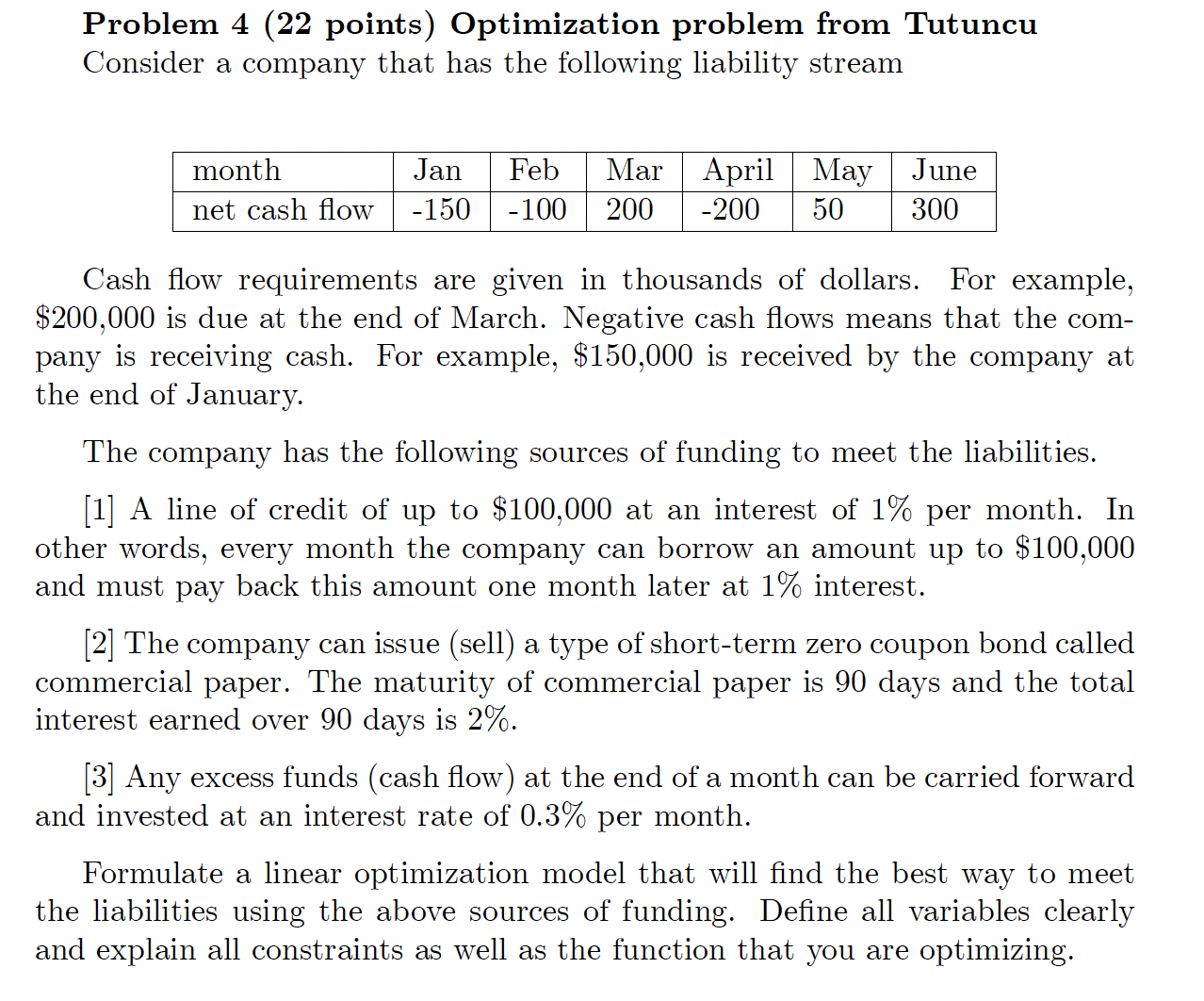

Problem 4 ( 2 2 points ) Optimization problem from Tutuncu Consider a company that has the following liability stream Cash flow requirements are given

Problem points Optimization problem from Tutuncu

Consider a company that has the following liability stream

Cash flow requirements are given in thousands of dollars. For example,

$ is due at the end of March. Negative cash flows means that the com

pany is receiving cash. For example, $ is received by the company at

the end of January.

The company has the following sources of funding to meet the liabilities.

A line of credit of up to $ at an interest of per month. In

other words, every month the company can borrow an amount up to $

and must pay back this amount one month later at interest.

The company can issue sell a type of shortterm zero coupon bond called

commercial paper. The maturity of commercial paper is days and the total

interest earned over days is

Any excess funds cash flow at the end of a month can be carried forward

and invested at an interest rate of per month.

Formulate a linear optimization model that will find the best way to meet

the liabilities using the above sources of funding. Define all variables clearly

and explain all constraints as well as the function that you are optimizing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started