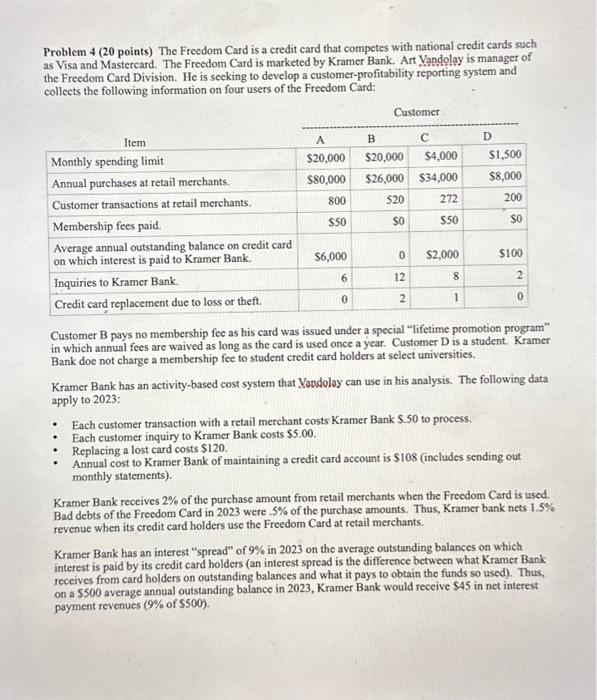

Problem 4 (20 points) The Freedom Card is a credit card that competes with national credit cards such as Visa and Mastercard. The Freedom Card is marketed by Kramer Bank. Art Vandolay is manager of the Freedom Card Division. He is seeking to develop a customer-profitability reporting system and collects the following information on four users of the Freedom Card: Customer B pays no membership fee as his card was issued under a special "lifetime promotion program" in which annual fees are waived as long as the card is used once a year. Customer D is a student. Kramer Bank doe not charge a membership fee to student credit card holders at select universities. Kramer Bank has an activity-based cost system that Xandolay can use in his analysis. The following data apply to 2023: - Each customer transaction with a retail merchant costs Kramer Bank $.50 to process. - Each customer inquiry to Kramer Bank costs $5.00. - Replacing a lost card costs $120. - Annual cost to Kramer Bank of maintaining a credit card account is $108 (includes sending out monthly statements). Kramer Bank receives 2% of the purchase amount from retail merchants when the Freedom Card is used. Bad debts of the Freedom Card in 2023 were .5% of the purchase amounts. Thus, Kramer bank nets 1.5% revenue when its credit card holders use the Freedom Card at retail merchants. Kramer Bank has an interest "spread" of 9% in 2023 on the average outstanding balances on which interest is paid by its credit card holders (an interest spread is the difference between what Kramer Bank receives from card holders on outstanding balances and what it pays to obtain the funds so used). Thus, on a $500 average annual outstanding balance in 2023, Kramer Bank would receive $45 in net interest payment revenues (9% of $500). 1. Compute the 2023 customer profitability of the four representative card users of the Freedom Card (11 points) 2. Develop profiles of (a) profitable card holders and (b) unprofitable card holders for Kramer Bank. (3 points), 3. Vandolay has an internal proposal that Kramer Bank discontinue a sizable number of low-volume credit card customers. What factors should he consider in evaluating and responding to this proposal? ( 3 points) 4. How can Kramer Bank transform unprofitable customers into profitable customers? (3 points)