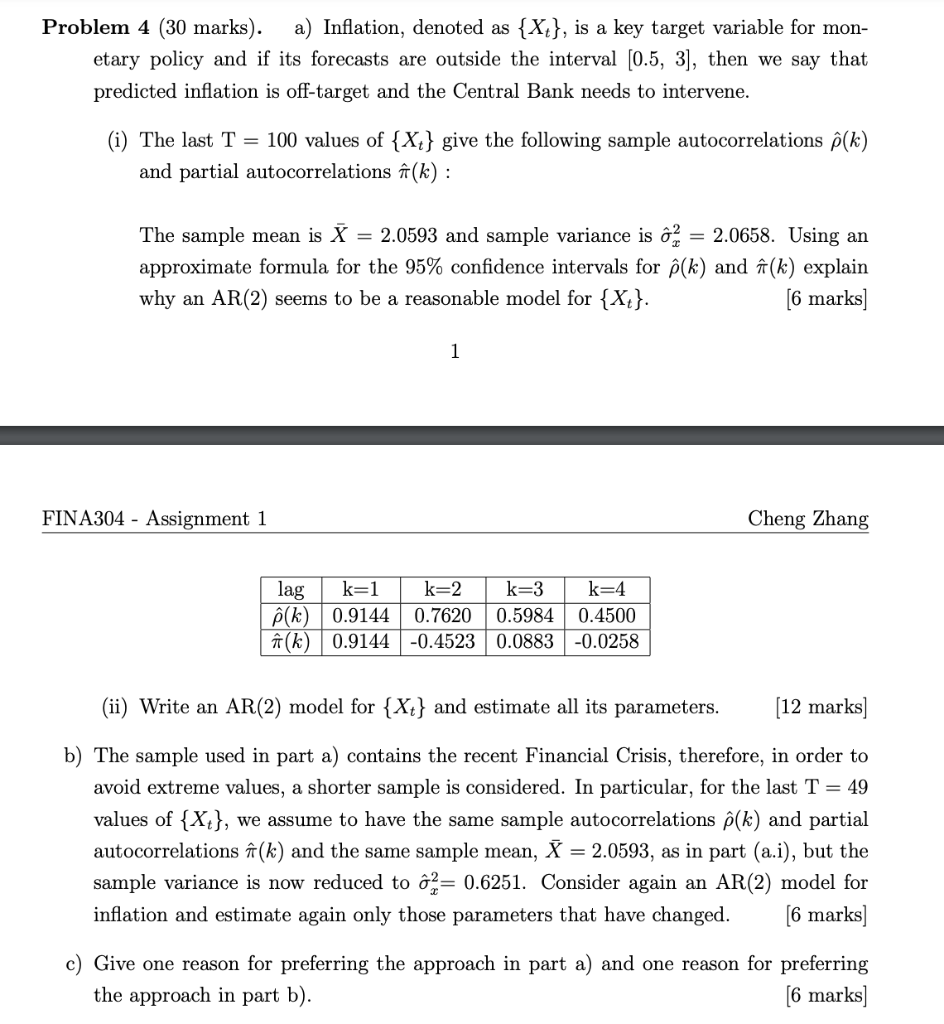

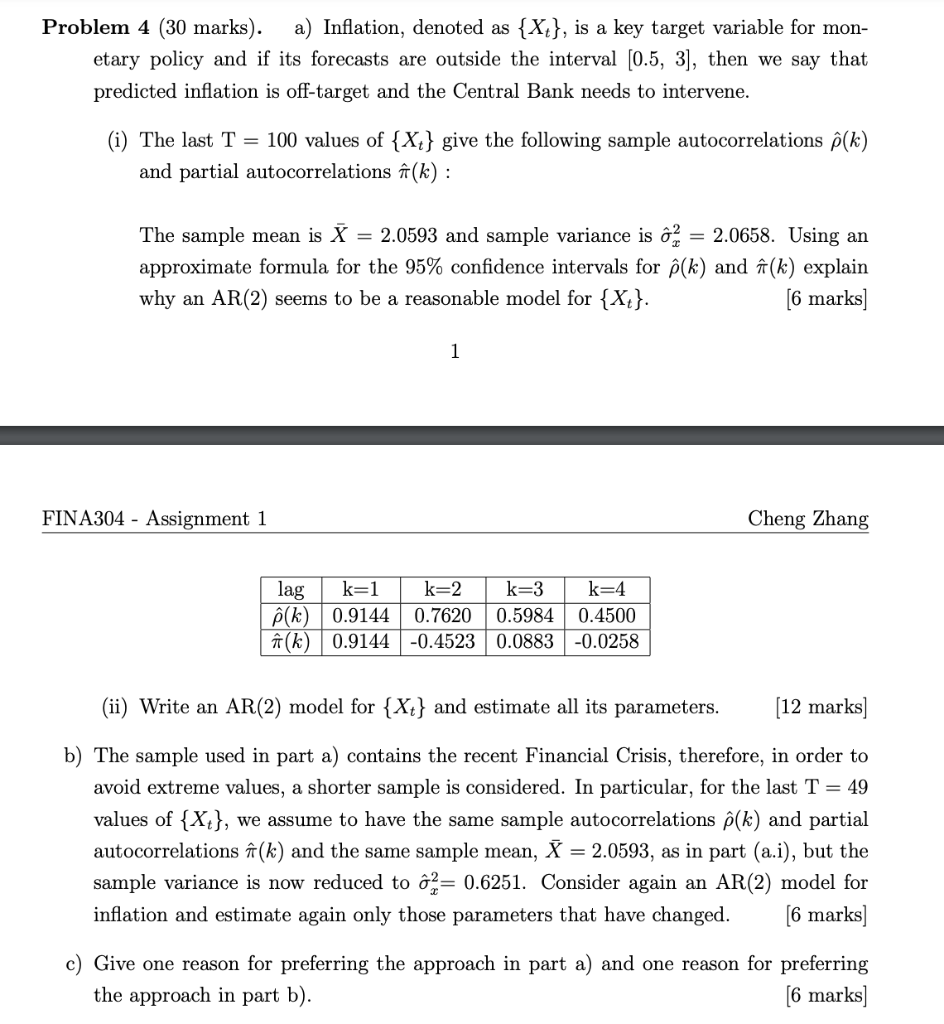

Problem 4 (30 marks). a) Inflation, denoted as {X{}, is a key target variable for mon- etary policy and if its forecasts are outside the interval (0.5, 3], then we say that predicted inflation is off-target and the Central Bank needs to intervene. (i) The last T = 100 values of {Xt} give the following sample autocorrelations p(k) and partial autocorrelations (k): The sample mean is X = 2.0593 and sample variance is m = 2.0658. Using an approximate formula for the 95% confidence intervals for (k) and (k) explain why an AR(2) seems to be a reasonable model for {Xt}. [6 marks] 1 FINA304 - Assignment 1 Cheng Zhang lag k=1 k=2 k=3 k=4 (k) 0.9144 0.7620 0.5984 0.4500 (k) 0.9144 -0.4523 0.0883 -0.0258 (ii) Write an AR(2) model for {Xt} and estimate all its parameters. (12 marks] b) The sample used in part a) contains the recent Financial Crisis, therefore, in order to avoid extreme values, a shorter sample is considered. In particular, for the last T = 49 values of {X{}, we assume to have the same sample autocorrelations p(k) and partial autocorrelations (k) and the same sample mean, X = 2.0593, as in part (a.i), but the sample variance is now reduced to = 0.6251. Consider again an AR(2) model for inflation and estimate again only those parameters that have changed. [6 marks] c) Give one reason for preferring the approach in part a) and one reason for preferring the approach in part b). [6 marks] Problem 4 (30 marks). a) Inflation, denoted as {X{}, is a key target variable for mon- etary policy and if its forecasts are outside the interval (0.5, 3], then we say that predicted inflation is off-target and the Central Bank needs to intervene. (i) The last T = 100 values of {Xt} give the following sample autocorrelations p(k) and partial autocorrelations (k): The sample mean is X = 2.0593 and sample variance is m = 2.0658. Using an approximate formula for the 95% confidence intervals for (k) and (k) explain why an AR(2) seems to be a reasonable model for {Xt}. [6 marks] 1 FINA304 - Assignment 1 Cheng Zhang lag k=1 k=2 k=3 k=4 (k) 0.9144 0.7620 0.5984 0.4500 (k) 0.9144 -0.4523 0.0883 -0.0258 (ii) Write an AR(2) model for {Xt} and estimate all its parameters. (12 marks] b) The sample used in part a) contains the recent Financial Crisis, therefore, in order to avoid extreme values, a shorter sample is considered. In particular, for the last T = 49 values of {X{}, we assume to have the same sample autocorrelations p(k) and partial autocorrelations (k) and the same sample mean, X = 2.0593, as in part (a.i), but the sample variance is now reduced to = 0.6251. Consider again an AR(2) model for inflation and estimate again only those parameters that have changed. [6 marks] c) Give one reason for preferring the approach in part a) and one reason for preferring the approach in part b). [6 marks]