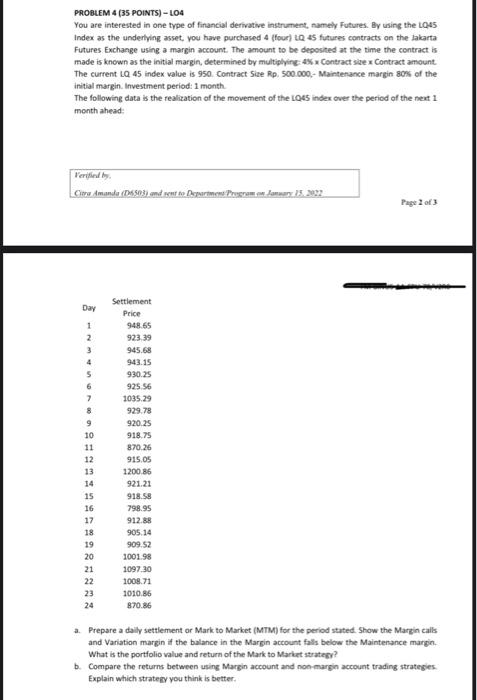

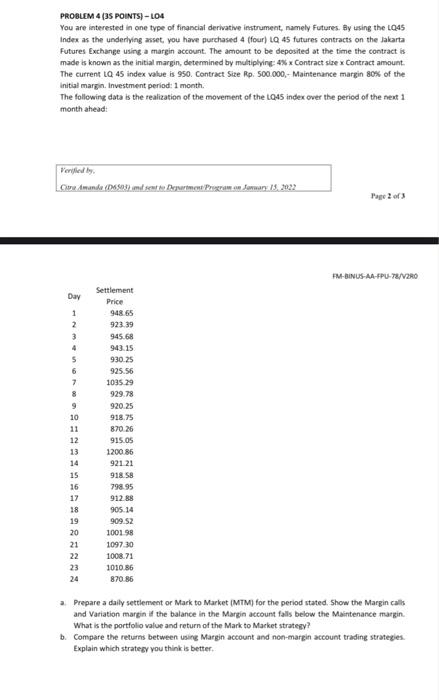

PROBLEM 4 (35 POINTS) -LO4 You are interested in one type of financial derivative Instrument, namely Futures. By using the L045 Index as the underlying asset, you have purchased 4 (four) LQ 45 futures contracts on the lakarta Futures Exchange using a margin account. The amount to be deposited at the time the contract is made is known as the initial margin, determined by multiplying 4% Contract size Contract amount The current LQ 45 index value is 950 Contract Size Rp. 500.000,- Maintenance margin 80% of the initial margin. Investment period: 1 month The following data is the realization of the movement of the Los index over the period of the next 1 month ahead: Perfil Cima Amanda (63 and to De Pray 15.2002 Page 2 of 3 Day 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Settlement Price 948.65 92339 945.68 943.15 930.25 92556 1035.29 929.78 920.25 918.75 870.26 915.05 1200 86 921.21 918.58 798.95 912.88 905.14 909.52 1001.98 1097.30 1008.71 1010.86 870.86 a. Prepare a daily settlement or Mark to Market (MTM) for the period stated. Show the Margin calls and Variation margin if the balance in the Margin account falls below the Maintenance margin What is the portfolio value and return of the Mark to Market strategy? b. Compare the returns between using Margin account and non margin account trading strategies Explain which strategy you think is better PROBLEM 4 (3S POINTS) - 04 You are interested in one type of financial derivative instrument, namely Futures. By using the 1945 Index as the underlying asset you have purchased 4 (four) LQ 45 futures contracts on the Jakarta Futures Exchange using a margin account. The amount to be deposited at the time the contract is made is known as the initial margin, determined by multiplying 4% x Contract sisex Contract amount The current LQ 45 index value is 950. Contract Size Rp. 500.000,- Maintenance margin 80% of the Initial margin. Investment period: 1 month The following data is the realization of the movement of the LQ45 index over the period of the next 1 month ahead Verified by Commande D803 meters Power: 13.2022 Page 2 of 2 FM-BINUS-AA-PU-78/V2R0 Day 1 2 3 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Settlement Price 948.65 923.39 945.68 943.15 930.25 925.56 1035.29 929.78 920.25 918.75 870 26 915.05 1200.86 921 21 918 58 798.95 91288 905.14 909.52 1001 98 1097 30 1008.71 1010.86 870.86 a Prepare a daily settlement or Mark to Market (MTM) for the period stated. Show the Margin calls and Variation margin if the balance in the Margin account falls below the Maintenance margin. What is the portfolio value and return of the Mark to Market strategy? b. Compare the returns between using Margin account and non-margin account trading strategies. Explain which strategy you think is better. PROBLEM 4 (35 POINTS) -LO4 You are interested in one type of financial derivative Instrument, namely Futures. By using the L045 Index as the underlying asset, you have purchased 4 (four) LQ 45 futures contracts on the lakarta Futures Exchange using a margin account. The amount to be deposited at the time the contract is made is known as the initial margin, determined by multiplying 4% Contract size Contract amount The current LQ 45 index value is 950 Contract Size Rp. 500.000,- Maintenance margin 80% of the initial margin. Investment period: 1 month The following data is the realization of the movement of the Los index over the period of the next 1 month ahead: Perfil Cima Amanda (63 and to De Pray 15.2002 Page 2 of 3 Day 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Settlement Price 948.65 92339 945.68 943.15 930.25 92556 1035.29 929.78 920.25 918.75 870.26 915.05 1200 86 921.21 918.58 798.95 912.88 905.14 909.52 1001.98 1097.30 1008.71 1010.86 870.86 a. Prepare a daily settlement or Mark to Market (MTM) for the period stated. Show the Margin calls and Variation margin if the balance in the Margin account falls below the Maintenance margin What is the portfolio value and return of the Mark to Market strategy? b. Compare the returns between using Margin account and non margin account trading strategies Explain which strategy you think is better PROBLEM 4 (3S POINTS) - 04 You are interested in one type of financial derivative instrument, namely Futures. By using the 1945 Index as the underlying asset you have purchased 4 (four) LQ 45 futures contracts on the Jakarta Futures Exchange using a margin account. The amount to be deposited at the time the contract is made is known as the initial margin, determined by multiplying 4% x Contract sisex Contract amount The current LQ 45 index value is 950. Contract Size Rp. 500.000,- Maintenance margin 80% of the Initial margin. Investment period: 1 month The following data is the realization of the movement of the LQ45 index over the period of the next 1 month ahead Verified by Commande D803 meters Power: 13.2022 Page 2 of 2 FM-BINUS-AA-PU-78/V2R0 Day 1 2 3 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Settlement Price 948.65 923.39 945.68 943.15 930.25 925.56 1035.29 929.78 920.25 918.75 870 26 915.05 1200.86 921 21 918 58 798.95 91288 905.14 909.52 1001 98 1097 30 1008.71 1010.86 870.86 a Prepare a daily settlement or Mark to Market (MTM) for the period stated. Show the Margin calls and Variation margin if the balance in the Margin account falls below the Maintenance margin. What is the portfolio value and return of the Mark to Market strategy? b. Compare the returns between using Margin account and non-margin account trading strategies. Explain which strategy you think is better