Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4 - 4 3 ( Algo ) Cost Flows; Application of Overhead [ LO 4 - 3 , 4 - 4 , 4 -

Problem Algo Cost Flows; Application of Overhead LO

Dream Makers is a small manufacturer of gold and platinum jewelry. It uses a job costing system that applies overhead on the basis of direct labor hours. Budgeted factory overhead for the year was $ and management budgeted direct laborhours. The company had no Materials, WorkinProcess, or Finished Goods Inventory at the beginning of April. These transactions were recorded during April:

a April insurance cost for the manufacturing property and equipment was $ The premium had been paid in January.

b Recorded $ depreciation on an administrative asset.

c Purchased pounds of highgrade polishing materials at $ per pound indirect materials

d Paid factory utility bill, $ in cash.

e Incurred hours and paid payroll costs of $ Of this amount, hours and $ were indirect labor costs.

f Incurred and paid other factory overhead costs, $

g Purchased $ of materials. Direct materials included unpolished semiprecious stones and gold. Indirect materials included supplies and polishing materials.

h Requisitioned $ of direct materials and $ of indirect materials from Materials Inventory.

i Incurred miscellaneous selling and administrative expenses, $

j Incurred $ depreciation on manufacturing equipment for April.

k Paid advertising expenses in cash, $

I. Applied factory overhead to production on the basis of direct labor hours.

n Completed goods costing $ during the month.

n Made sales on account in April, $ The Cost of Goods Sold was $Req

Req

Req

Req COGM

Req COGS

Req.

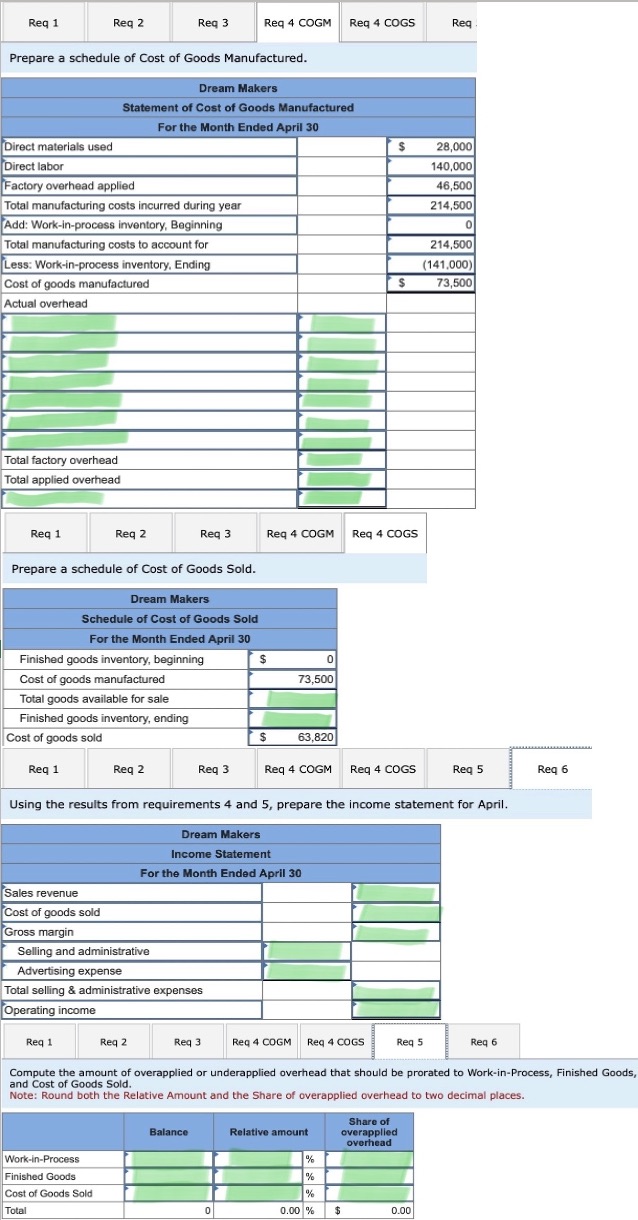

Prepare a schedule of Cost of Goods Manufactured.

Prepare a schedule of Cost of Goods Sold.

Using the results from requirements and prepare the income statement for April.

Compute the amount of overapplied or underapplied overhead that should be prorated to WorkinProcess, Finished Goods,

and Cost of Goods Sold.

Note: Round both the Relative Amount and the Share of overapplied overhead to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started