Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4 - 4 5 ( LO . 4 ) Nell and Kirby are in the process of negotiating their divorce agreement, to be finalized

Problem LO

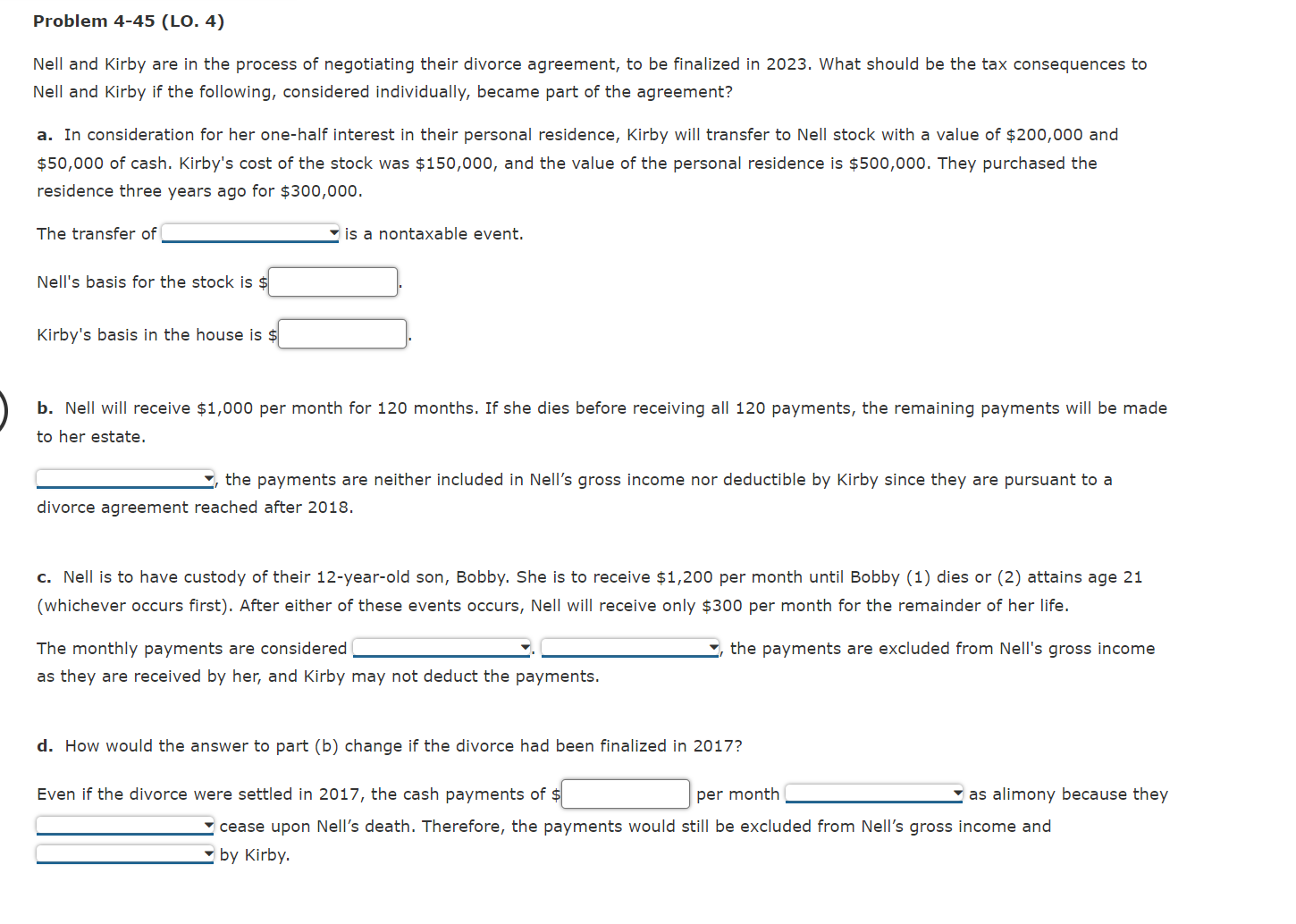

Nell and Kirby are in the process of negotiating their divorce agreement, to be finalized in What should be the tax consequences to

Nell and Kirby if the following, considered individually, became part of the agreement?

a In consideration for her onehalf interest in their personal residence, Kirby will transfer to Nell stock with a value of $ and

$ of cash. Kirby's cost of the stock was $ and the value of the personal residence is $ They purchased the

residence three years ago for $

The transfer of

is a nontaxable event.

Nell's basis for the stock is $

Kirby's basis in the house is $

b Nell will receive $ per month for months. If she dies before receiving all payments, the remaining payments will be made

to her estate.

the payments are neither included in Nell's gross income nor deductible by Kirby since they are pursuant to a

divorce agreement reached after

c Nell is to have custody of their yearold son, Bobby. She is to receive $ per month until Bobby dies or attains age

whichever occurs first After either of these events occurs, Nell will receive only $ per month for the remainder of her life.

The monthly payments are considered

the payments are excluded from Nell's gross income

as they are received by her, and Kirby may not deduct the payments.

d How would the answer to part b change if the divorce had been finalized in

Even if the divorce were settled in the cash payments of $

per month

: as alimony because they

cease upon Nell's death. Therefore, the payments would still be excluded from Nell's gross income and

by Kirby.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started