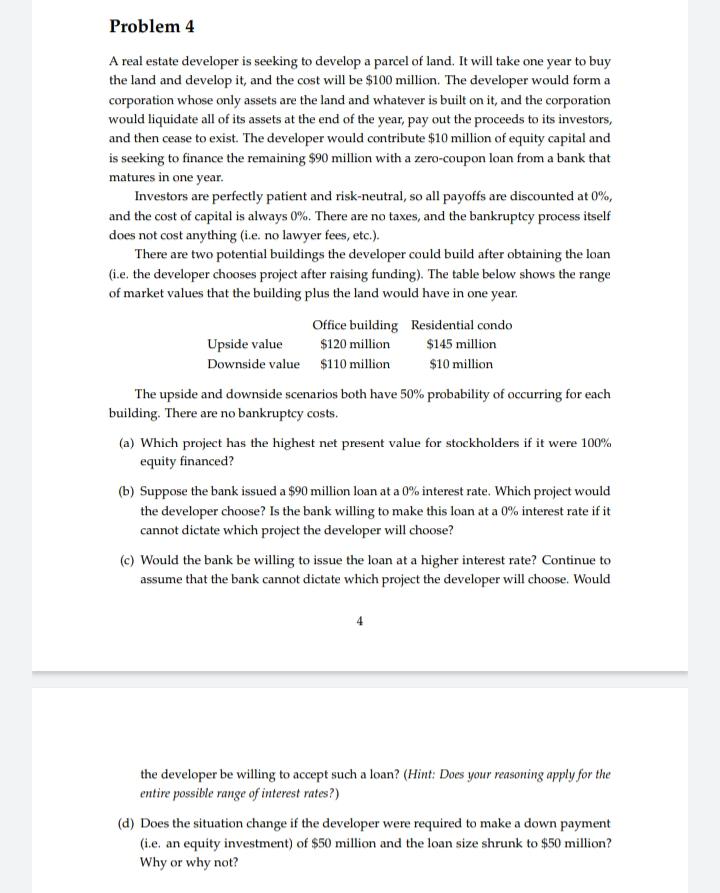

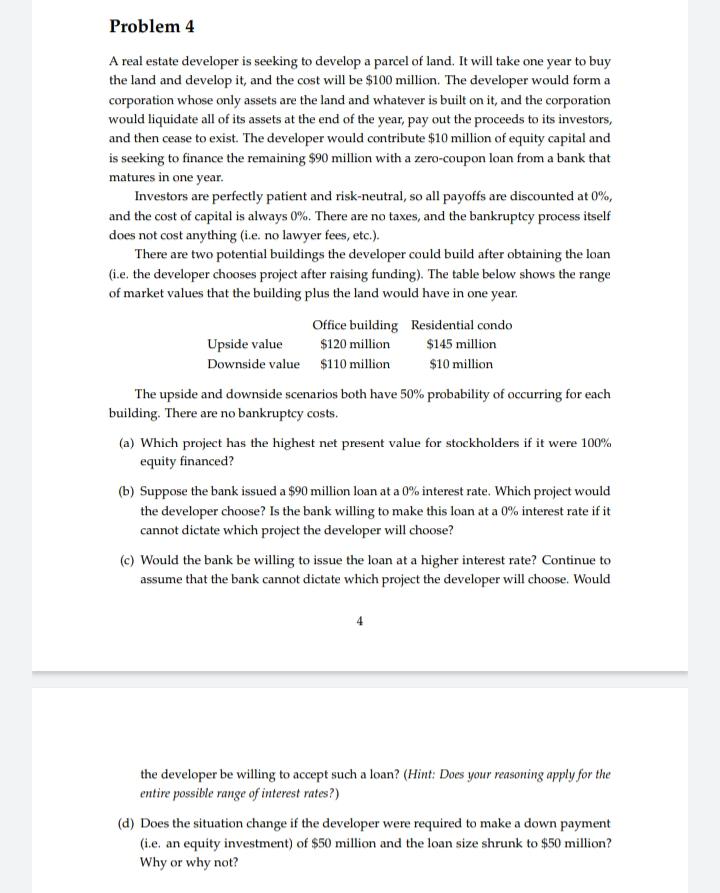

Problem 4 A real estate developer is seeking to develop a parcel of land. It will take one year to buy the land and develop it, and the cost will be $100 million. The developer would form a corporation whose only assets are the land and whatever is built on it, and the corporation would liquidate all of its assets at the end of the year, pay out the proceeds to its investors, and then cease to exist. The developer would contribute $10 million of equity capital and is seeking to finance the remaining $90 million with a zero-coupon loan from a bank that matures in one year. Investors are perfectly patient and risk-neutral, so all payoffs are discounted at 0%, and the cost of capital is always 0%. There are no taxes, and the bankruptcy process itself does not cost anything (ie, no lawyer fees, etc.). There are two potential buildings the developer could build after obtaining the loan (i.e. the developer chooses project after raising funding). The table below shows the range of market values that the building plus the land would have in one year. Office building Residential condo Upside value $120 million $145 million Downside value $110 million $10 million The upside and downside scenarios both have 50% probability of occurring for each building. There are no bankruptcy costs. (a) Which project has the highest net present value for stockholders if it were 100% equity financed? (b) Suppose the bank issued a $90 million loan at a 0% interest rate. Which project would the developer choose? Is the bank willing to make this loan at a 0% interest rate if it cannot dictate which project the developer will choose? (c) Would the bank be willing to issue the loan at a higher interest rate? Continue to assume that the bank cannot dictate which project the developer will choose. Would 4 the developer be willing to accept such a loan? (Hint: Does your reasoning apply for the entire possible range of interest rates?) (d) Does the situation change if the developer were required to make a down payment (i.e. an equity investment) of $50 million and the loan size shrunk to $50 million? Why or why not? Problem 4 A real estate developer is seeking to develop a parcel of land. It will take one year to buy the land and develop it, and the cost will be $100 million. The developer would form a corporation whose only assets are the land and whatever is built on it, and the corporation would liquidate all of its assets at the end of the year, pay out the proceeds to its investors, and then cease to exist. The developer would contribute $10 million of equity capital and is seeking to finance the remaining $90 million with a zero-coupon loan from a bank that matures in one year. Investors are perfectly patient and risk-neutral, so all payoffs are discounted at 0%, and the cost of capital is always 0%. There are no taxes, and the bankruptcy process itself does not cost anything (ie, no lawyer fees, etc.). There are two potential buildings the developer could build after obtaining the loan (i.e. the developer chooses project after raising funding). The table below shows the range of market values that the building plus the land would have in one year. Office building Residential condo Upside value $120 million $145 million Downside value $110 million $10 million The upside and downside scenarios both have 50% probability of occurring for each building. There are no bankruptcy costs. (a) Which project has the highest net present value for stockholders if it were 100% equity financed? (b) Suppose the bank issued a $90 million loan at a 0% interest rate. Which project would the developer choose? Is the bank willing to make this loan at a 0% interest rate if it cannot dictate which project the developer will choose? (c) Would the bank be willing to issue the loan at a higher interest rate? Continue to assume that the bank cannot dictate which project the developer will choose. Would 4 the developer be willing to accept such a loan? (Hint: Does your reasoning apply for the entire possible range of interest rates?) (d) Does the situation change if the developer were required to make a down payment (i.e. an equity investment) of $50 million and the loan size shrunk to $50 million? Why or why not