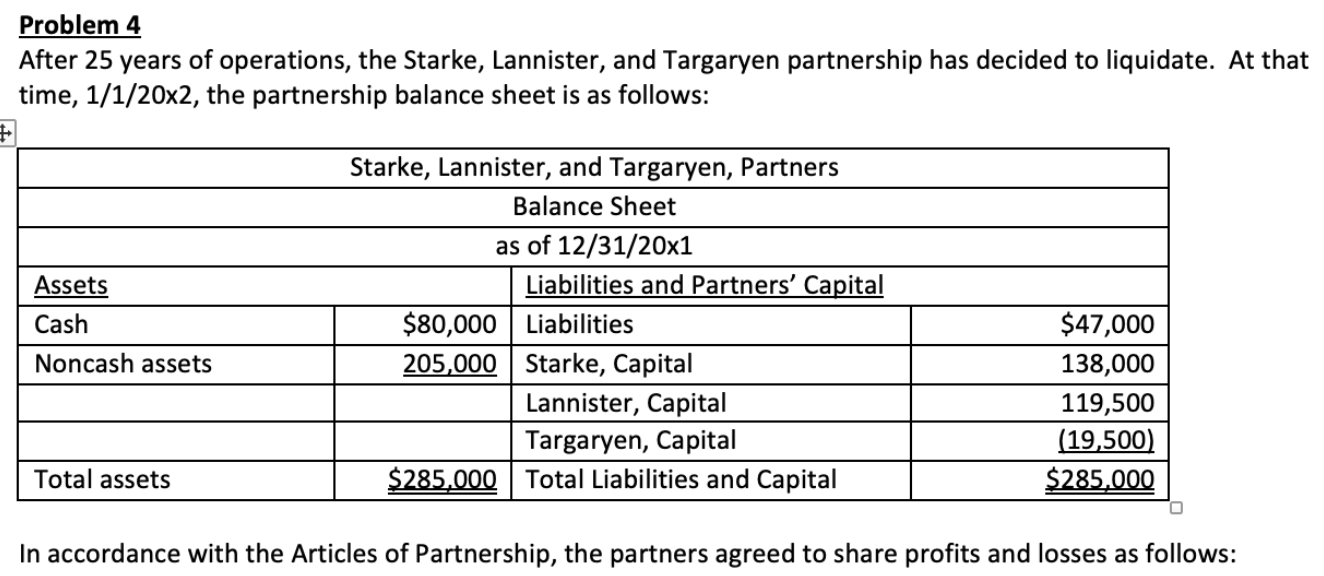

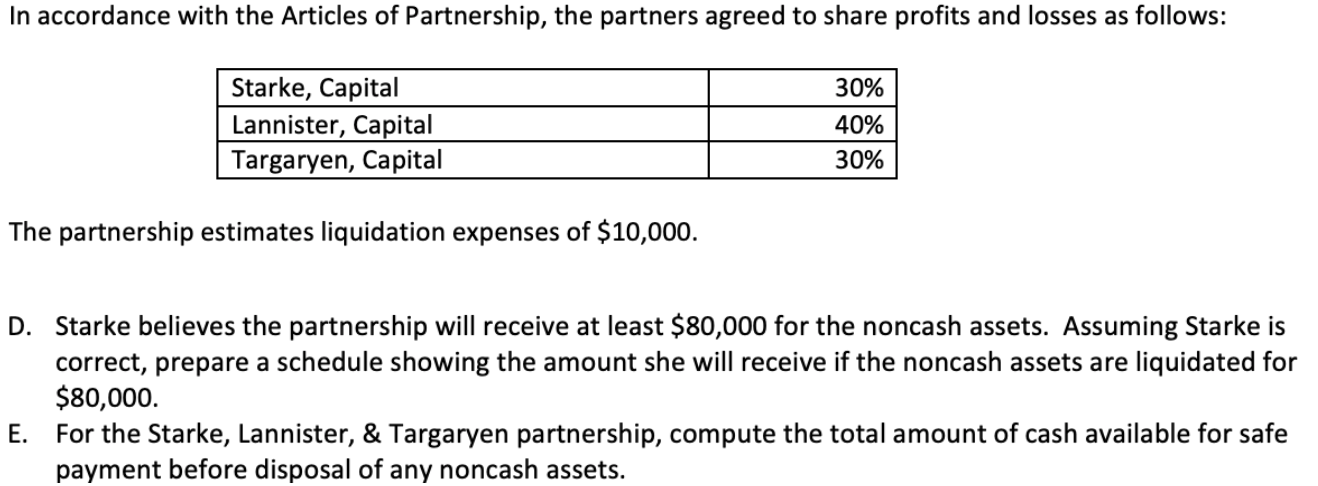

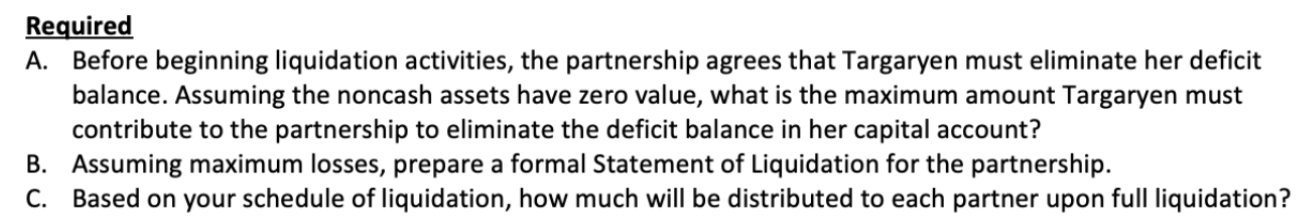

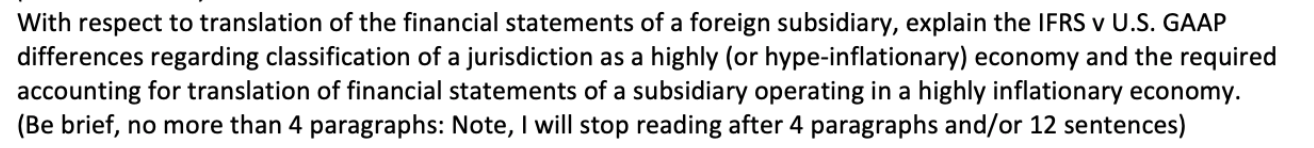

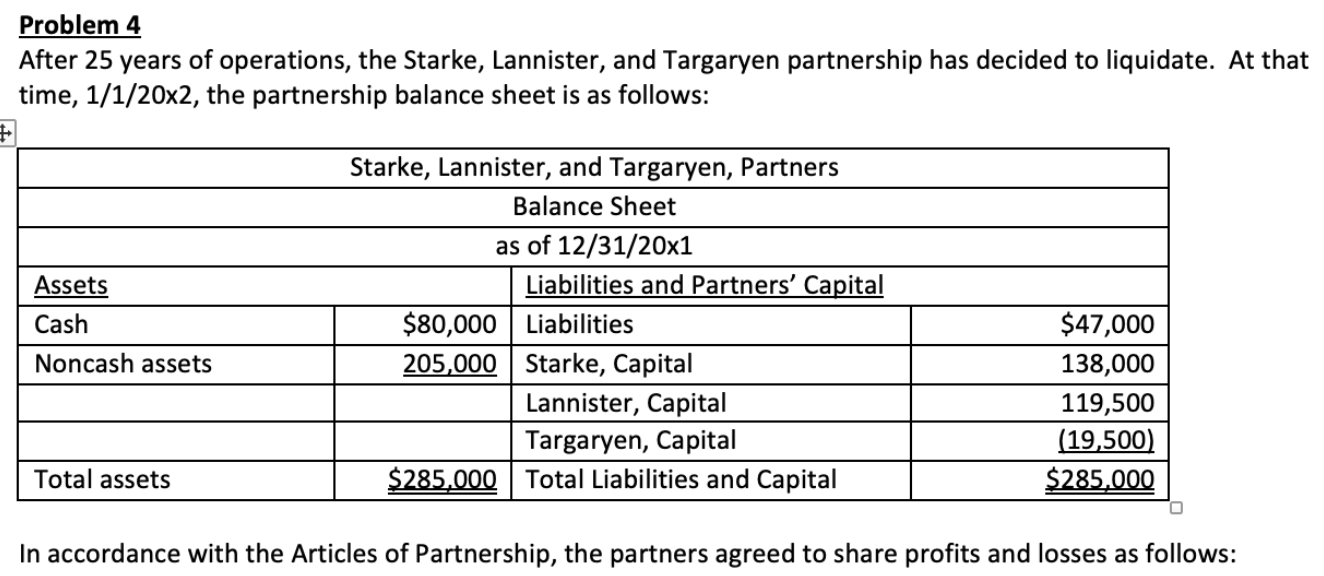

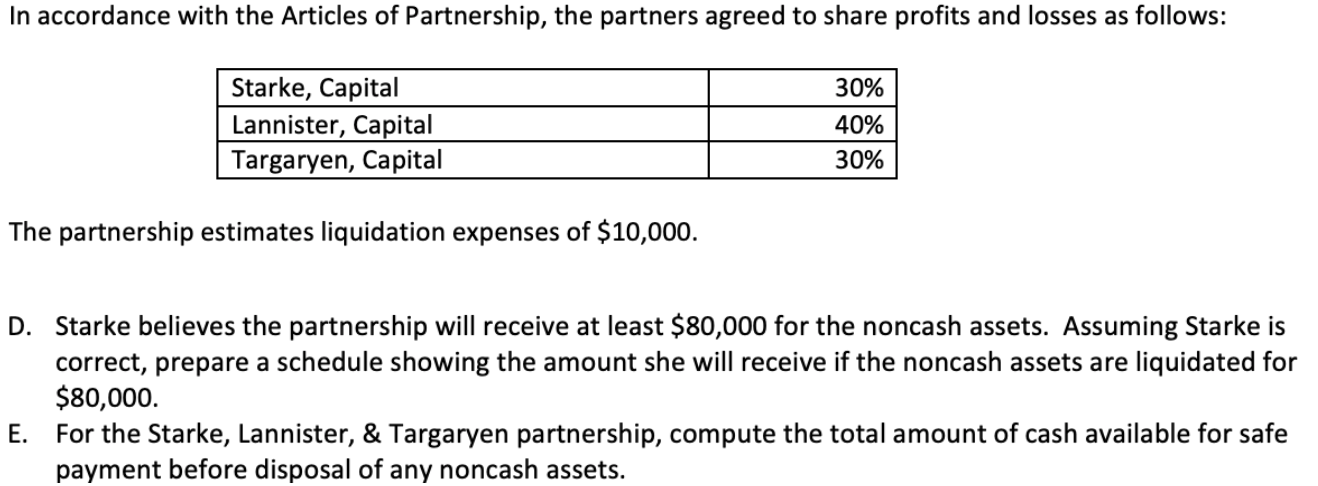

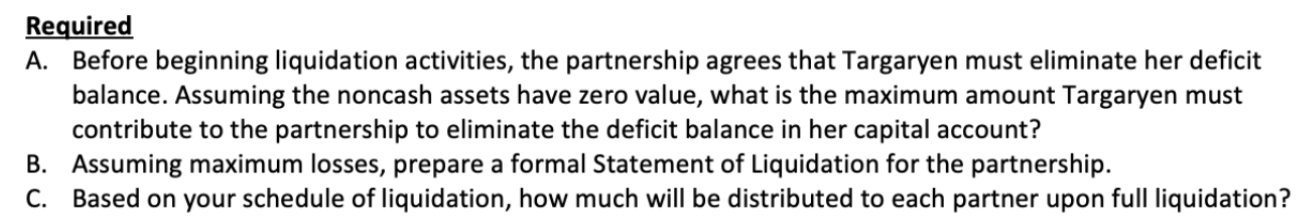

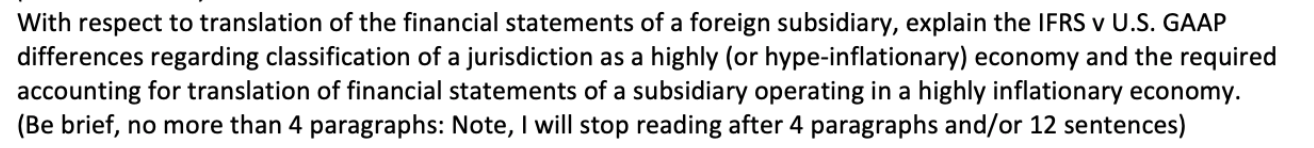

Problem 4 After 25 years of operations, the Starke, Lannister, and Targaryen partnership has decided to liquidate. At that time, 1/1/20x2, the partnership balance sheet is as follows: Assets Cash Starke, Lannister, and Targaryen, Partners Balance Sheet as of 12/31/20x1 Liabilities and Partners' Capital $80,000 Liabilities 205,000 Starke, Capital Lannister, Capital Targaryen, Capital $285.000 Total Liabilities and Capital Noncash assets $47,000 138,000 119,500 (19,500) $285.000 Total assets In accordance with the Articles of Partnership, the partners agreed to share profits and losses as follows: In accordance with the Articles of Partnership, the partners agreed to share profits and losses as follows: 30% Starke, Capital Lannister, Capital Targaryen, Capital 40% 30% The partnership estimates liquidation expenses of $10,000. D. Starke believes the partnership will receive at least $80,000 for the noncash assets. Assuming Starke is correct, prepare a schedule showing the amount she will receive if the noncash assets are liquidated for $80,000. E. For the Starke, Lannister, & Targaryen partnership, compute the total amount of cash available for safe payment before disposal of any noncash assets. Required A. Before beginning liquidation activities, the partnership agrees that Targaryen must eliminate her deficit balance. Assuming the noncash assets have zero value, what is the maximum amount Targaryen must contribute to the partnership to eliminate the deficit balance in her capital account? B. Assuming maximum losses, prepare a formal Statement of Liquidation for the partnership. C. Based on your schedule of liquidation, how much will be distributed to each partner upon full liquidation? With respect to translation of the financial statements of a foreign subsidiary, explain the IFRS v U.S. GAAP differences regarding classification of a jurisdiction as a highly (or hype-inflationary) economy and the required accounting for translation of financial statements of a subsidiary operating in a highly inflationary economy. (Be brief, no more than 4 paragraphs: Note, I will stop reading after 4 paragraphs and/or 12 sentences) Problem 4 After 25 years of operations, the Starke, Lannister, and Targaryen partnership has decided to liquidate. At that time, 1/1/20x2, the partnership balance sheet is as follows: Assets Cash Starke, Lannister, and Targaryen, Partners Balance Sheet as of 12/31/20x1 Liabilities and Partners' Capital $80,000 Liabilities 205,000 Starke, Capital Lannister, Capital Targaryen, Capital $285.000 Total Liabilities and Capital Noncash assets $47,000 138,000 119,500 (19,500) $285.000 Total assets In accordance with the Articles of Partnership, the partners agreed to share profits and losses as follows: In accordance with the Articles of Partnership, the partners agreed to share profits and losses as follows: 30% Starke, Capital Lannister, Capital Targaryen, Capital 40% 30% The partnership estimates liquidation expenses of $10,000. D. Starke believes the partnership will receive at least $80,000 for the noncash assets. Assuming Starke is correct, prepare a schedule showing the amount she will receive if the noncash assets are liquidated for $80,000. E. For the Starke, Lannister, & Targaryen partnership, compute the total amount of cash available for safe payment before disposal of any noncash assets. Required A. Before beginning liquidation activities, the partnership agrees that Targaryen must eliminate her deficit balance. Assuming the noncash assets have zero value, what is the maximum amount Targaryen must contribute to the partnership to eliminate the deficit balance in her capital account? B. Assuming maximum losses, prepare a formal Statement of Liquidation for the partnership. C. Based on your schedule of liquidation, how much will be distributed to each partner upon full liquidation? With respect to translation of the financial statements of a foreign subsidiary, explain the IFRS v U.S. GAAP differences regarding classification of a jurisdiction as a highly (or hype-inflationary) economy and the required accounting for translation of financial statements of a subsidiary operating in a highly inflationary economy. (Be brief, no more than 4 paragraphs: Note, I will stop reading after 4 paragraphs and/or 12 sentences)