Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4: Blacklist International Company is assessing its cost of capital under alternative financing arrangements. In consultation with investment managers and bankers, Blacklist International Company

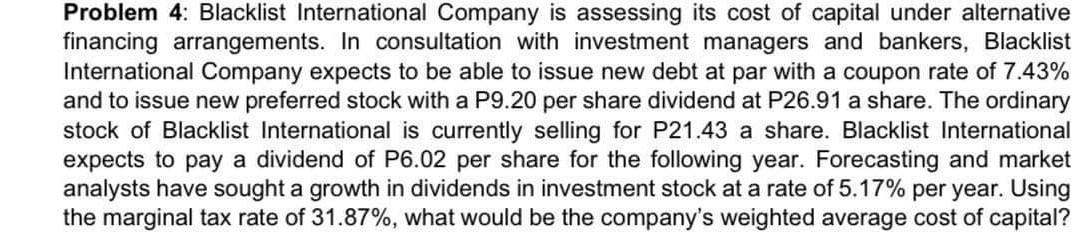

Problem 4: Blacklist International Company is assessing its cost of capital under alternative financing arrangements. In consultation with investment managers and bankers, Blacklist International Company expects to be able to issue new debt at par with a coupon rate of 7.43% and to issue new preferred stock with a P9.20 per share dividend at P26.91 a share. The ordinary stock of Blacklist International is currently selling for P21.43 a share. Blacklist International expects to pay a dividend of P6.02 per share for the following year. Forecasting and market analysts have sought a growth in dividends in investment stock at a rate of 5.17% per year. Using the marginal tax rate of 31.87%, what would be the company's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started