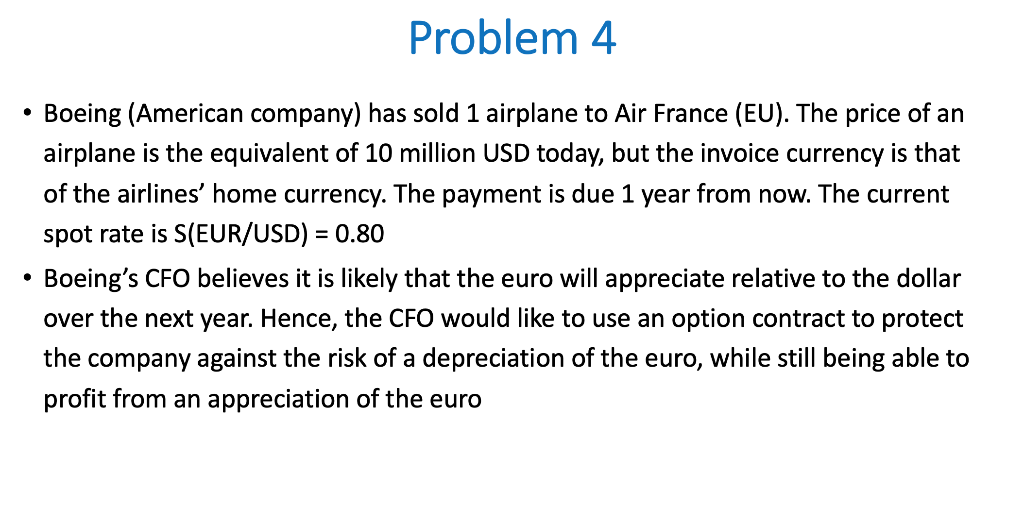

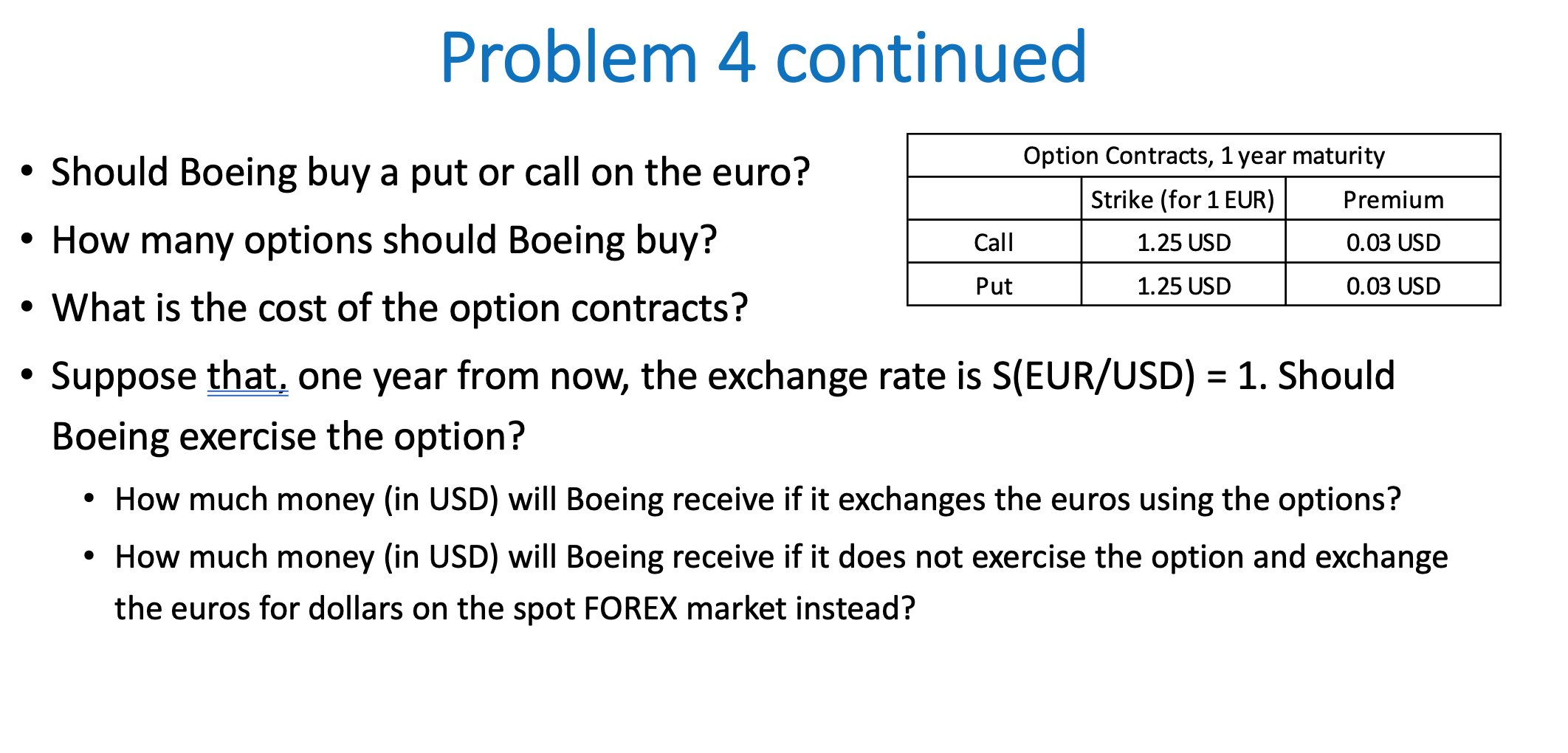

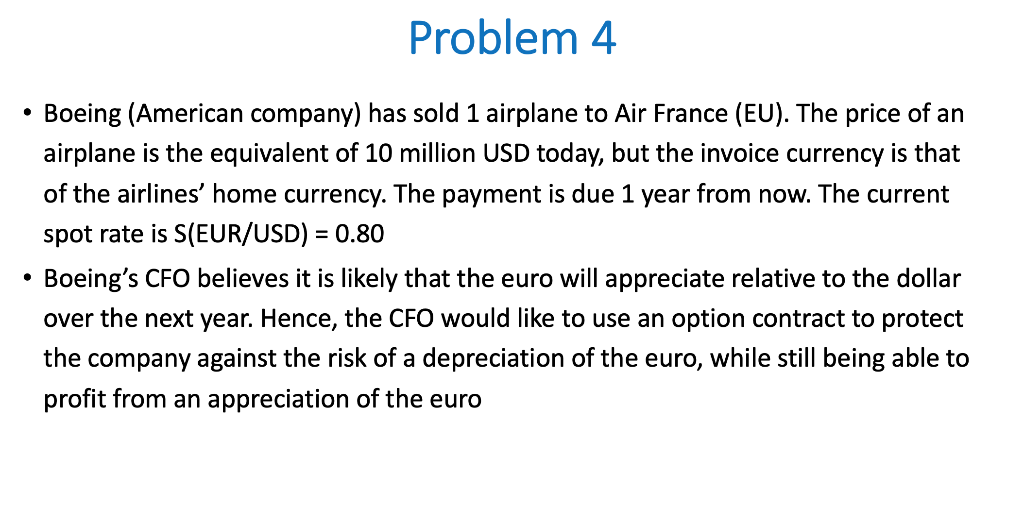

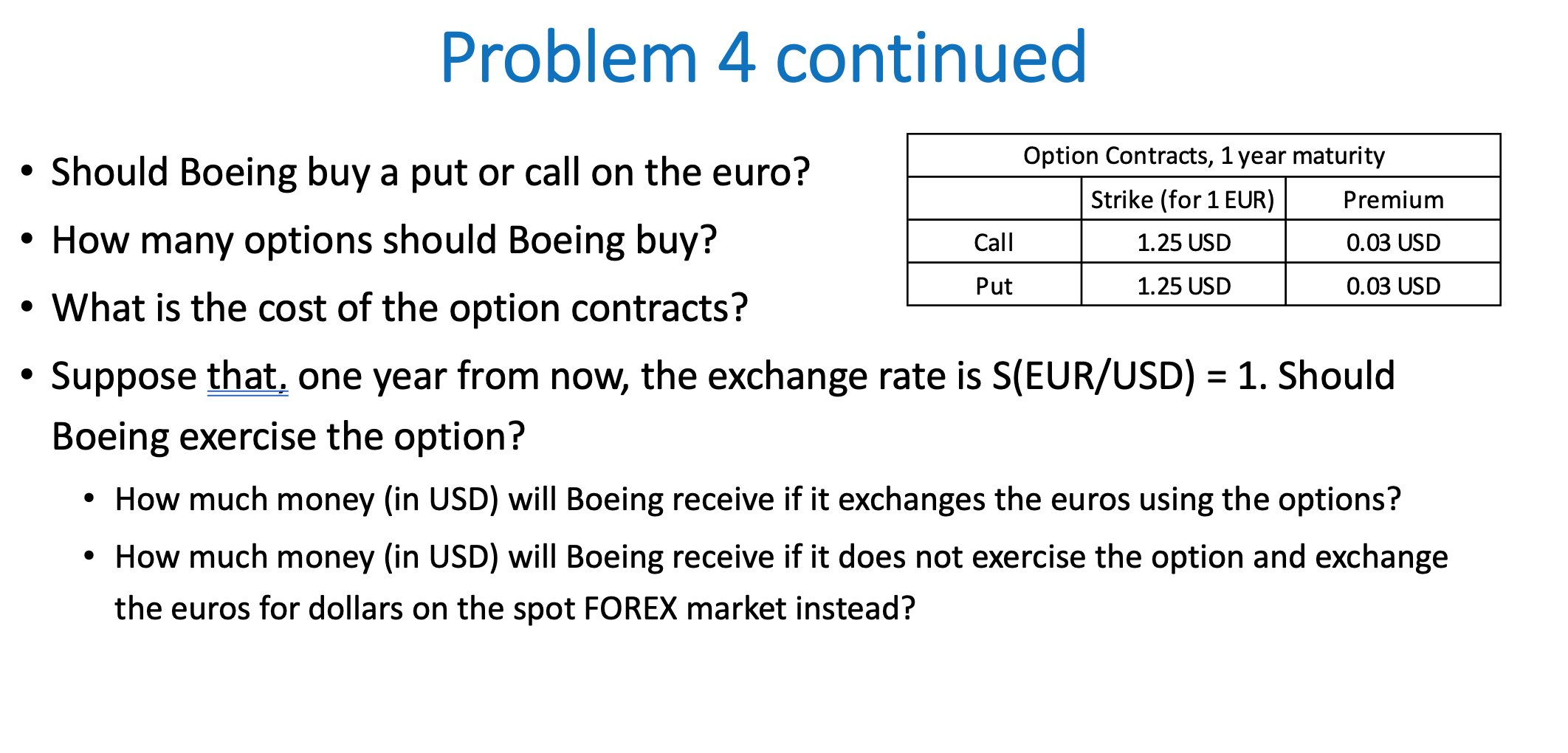

Problem 4 . Boeing (American company) has sold 1 airplane to Air France (EU). The price of an airplane is the equivalent of 10 million USD today, but the invoice currency is that of the airlines' home currency. The payment is due 1 year from now. The current spot rate is S(EUR/USD) = 0.80 Boeing's CFO believes it is likely that the euro will appreciate relative to the dollar over the next year. Hence, the CFO would like to use an option contract to protect the company against the risk of a depreciation of the euro, while still being able to profit from an appreciation of the euro . Problem 4 continued Call 1.25 USD 0.03 USD Put 1.25 USD 0.03 USD . = Option Contracts, 1 year maturity Should Boeing buy a put or call on the euro? Strike (for 1 EUR) Premium How many options should Boeing buy? What is the cost of the option contracts? Suppose that, one year from now, the exchange rate is S(EUR/USD) = 1. Should Boeing exercise the option? How much money in USD) will Boeing receive if it exchanges the euros using the options? How much money in USD) will Boeing receive if it does not exercise the option and exchange the euros for dollars on the spot FOREX market instead? . Problem 4 . Boeing (American company) has sold 1 airplane to Air France (EU). The price of an airplane is the equivalent of 10 million USD today, but the invoice currency is that of the airlines' home currency. The payment is due 1 year from now. The current spot rate is S(EUR/USD) = 0.80 Boeing's CFO believes it is likely that the euro will appreciate relative to the dollar over the next year. Hence, the CFO would like to use an option contract to protect the company against the risk of a depreciation of the euro, while still being able to profit from an appreciation of the euro . Problem 4 continued Call 1.25 USD 0.03 USD Put 1.25 USD 0.03 USD . = Option Contracts, 1 year maturity Should Boeing buy a put or call on the euro? Strike (for 1 EUR) Premium How many options should Boeing buy? What is the cost of the option contracts? Suppose that, one year from now, the exchange rate is S(EUR/USD) = 1. Should Boeing exercise the option? How much money in USD) will Boeing receive if it exchanges the euros using the options? How much money in USD) will Boeing receive if it does not exercise the option and exchange the euros for dollars on the spot FOREX market instead