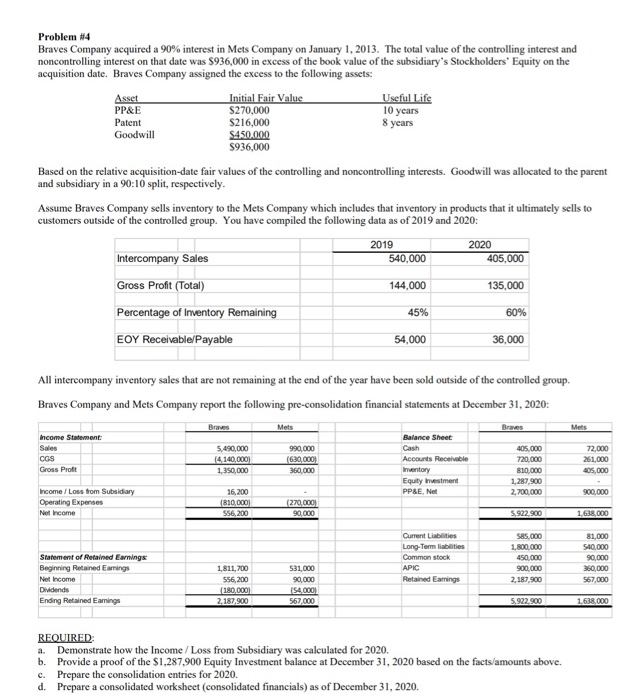

Problem #4 Braves Company acquired a 90% interest in Mets Company on January 1, 2013. The total value of the controlling interest and noncontrolling interest on that date was $936,000 in excess of the book value of the subsidiary's Stockholders' Equity on the acquisition date. Braves Company assigned the excess to the following assets: Asset PP&E Patent Goodwill Initial Fair Value $270,000 $216,000 $450.000 $936,000 Useful Life 10 years 8 years Based on the relative acquisition-date fair values of the controlling and noncontrolling interests. Goodwill was allocated to the parent and subsidiary in a 90:10 split, respectively. Assume Braves Company sells inventory to the Mets Company which includes that inventory in products that it ultimately sells to customers outside of the controlled group. You have compiled the following data as of 2019 and 2020: 2019 540,000 2020 405,000 Intercompany Sales Gross Profit (Total) 144,000 135,000 Percentage of Inventory Remaining 45% 60% EOY Receivable/Payable 54,000 36,000 All intercompany inventory sales that are not remaining at the end of the year have been sold outside of the controlled group. Braves Company and Mets Company report the following pre-consolidation financial statements at December 31, 2020: Mets Mets Income Statement: Sales 72,000 Balance Sheet Cash Accounts Receivable 5.490,000 14 140,000) 1,350,000 CGS Gross Profit 990,000 (610.000 350,000 405,000 720.000 810,000 1.287.900 2.700.000 261.000 405,000 Equity Westment PPSE, Net 900,000 Income / Loss from Subsidiary Operating Expenses Net Income 1810,000) 556,200 (270,000 90,000 5.922,900 1,638,000 Statement of Retained Earnings Beginning Retained Earnings Net Income Dividends Ending Retained Earnings Current Liabilities Long-Term liabilities Common stock APIC Retained Earrings SA5.000 1.800.000 450.000 900.000 2,187,900 81,000 540,000 90,000 360,000 567,000 531,000 90,000 1,811,200 556,200 (190.0001 2.187.900 567.000 5922900 1 638.000 REQUIRED a. Demonstrate how the Income / Loss from Subsidiary was calculated for 2020. b. Provide a proof of the $1,287.900 Equity Investment balance at December 31, 2020 based on the facts/amounts above. c. Prepare the consolidation entries for 2020. d. Prepare a consolidated worksheet (consolidated financials) as of December 31, 2020. Problem #4 Braves Company acquired a 90% interest in Mets Company on January 1, 2013. The total value of the controlling interest and noncontrolling interest on that date was $936,000 in excess of the book value of the subsidiary's Stockholders' Equity on the acquisition date. Braves Company assigned the excess to the following assets: Asset PP&E Patent Goodwill Initial Fair Value $270,000 $216,000 $450.000 $936,000 Useful Life 10 years 8 years Based on the relative acquisition-date fair values of the controlling and noncontrolling interests. Goodwill was allocated to the parent and subsidiary in a 90:10 split, respectively. Assume Braves Company sells inventory to the Mets Company which includes that inventory in products that it ultimately sells to customers outside of the controlled group. You have compiled the following data as of 2019 and 2020: 2019 540,000 2020 405,000 Intercompany Sales Gross Profit (Total) 144,000 135,000 Percentage of Inventory Remaining 45% 60% EOY Receivable/Payable 54,000 36,000 All intercompany inventory sales that are not remaining at the end of the year have been sold outside of the controlled group. Braves Company and Mets Company report the following pre-consolidation financial statements at December 31, 2020: Mets Mets Income Statement: Sales 72,000 Balance Sheet Cash Accounts Receivable 5.490,000 14 140,000) 1,350,000 CGS Gross Profit 990,000 (610.000 350,000 405,000 720.000 810,000 1.287.900 2.700.000 261.000 405,000 Equity Westment PPSE, Net 900,000 Income / Loss from Subsidiary Operating Expenses Net Income 1810,000) 556,200 (270,000 90,000 5.922,900 1,638,000 Statement of Retained Earnings Beginning Retained Earnings Net Income Dividends Ending Retained Earnings Current Liabilities Long-Term liabilities Common stock APIC Retained Earrings SA5.000 1.800.000 450.000 900.000 2,187,900 81,000 540,000 90,000 360,000 567,000 531,000 90,000 1,811,200 556,200 (190.0001 2.187.900 567.000 5922900 1 638.000 REQUIRED a. Demonstrate how the Income / Loss from Subsidiary was calculated for 2020. b. Provide a proof of the $1,287.900 Equity Investment balance at December 31, 2020 based on the facts/amounts above. c. Prepare the consolidation entries for 2020. d. Prepare a consolidated worksheet (consolidated financials) as of December 31, 2020