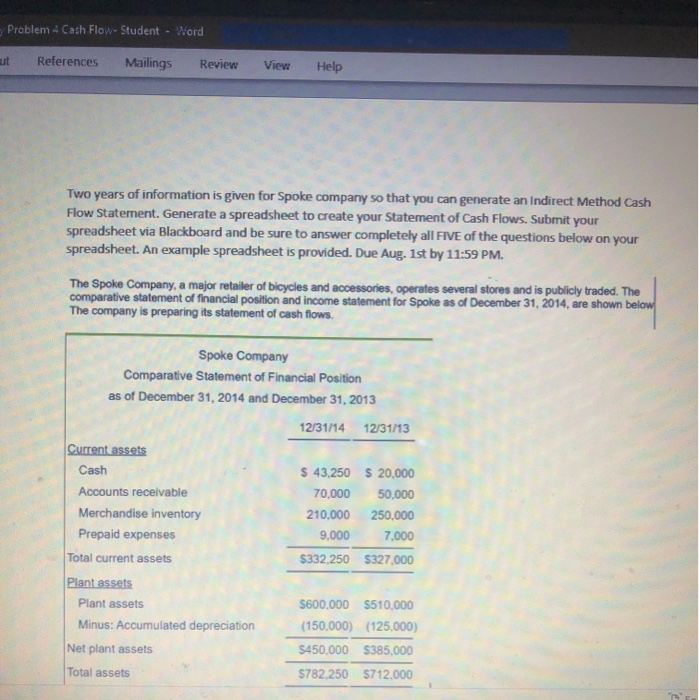

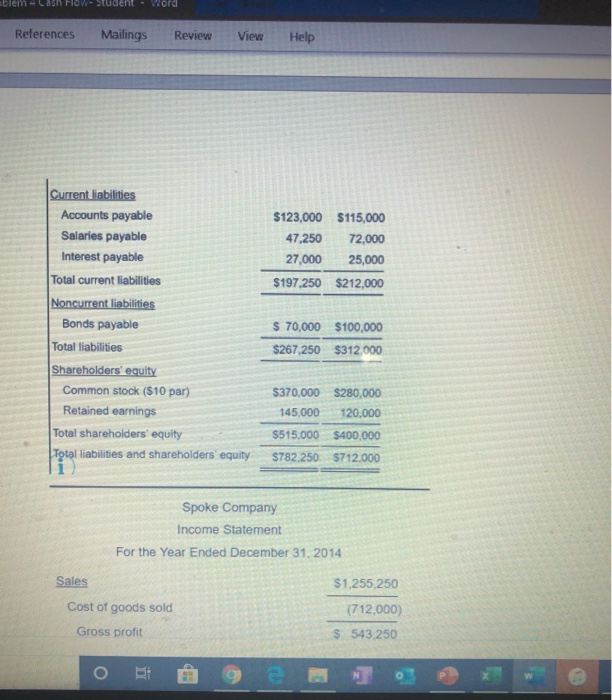

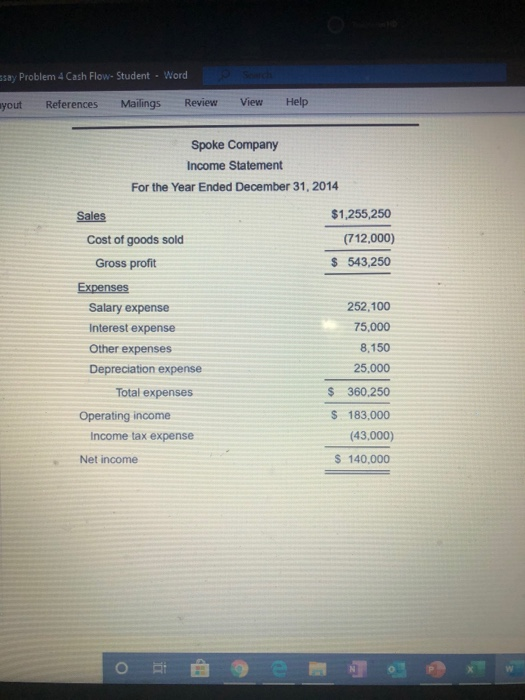

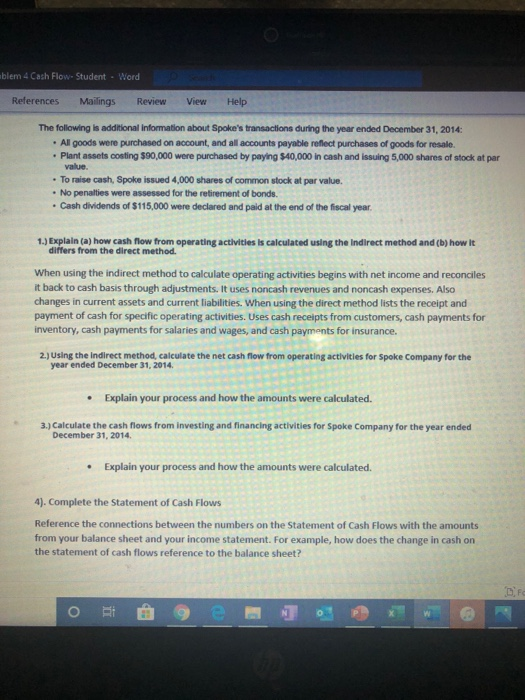

Problem 4 Cash Flow - Student - Word ut References Mailings Review View Help Two years of information is given for Spoke company so that you can generate an Indirect Method Cash Flow Statement. Generate a spreadsheet to create your Statement of Cash Flows. Submit your spreadsheet via Blackboard and be sure to answer completely all FIVE of the questions below on your spreadsheet. An example spreadsheet is provided. Due Aug. 1st by 11:59 PM. The Spoke Company, a major retailer of bicycles and accessories, operates several stores and is publicly traded. The comparative statement of financial position and income statement for Spoke as of December 31, 2014, are shown below The company is preparing its statement of cash flows. Spoke Company Comparative Statement of Financial Position as of December 31, 2014 and December 31, 2013 12/31/14 12/31/13 Current assets Cash $ 43,250 $ 20,000 Accounts receivable 70,000 50,000 Merchandise inventory 210,000 250.000 Prepaid expenses 9,000 7,000 Total current assets $332,250 $327.000 Plant assets Plant assets S600.000 S510,000 Minus: Accumulated depreciation (150.000) (125.000) Net plant assets $450,000 $385,000 Total assets $782,250 $712.000 blem Loan Fio Student word References Mailings Review View Help $123,000 $115,000 47,250 72,000 27,000 25,000 $197,250 $212,000 Current liabilities Accounts payable Salaries payable Interest payable Total current liabilities Noncurrent liabilities Bonds payable Total liabilities Shareholders' equity Common stock (510 par) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 70,000 $100,000 $267.250 $312.000 $370,000 $280,000 145,000 120,000 $515.000 $400,000 $782.250 $712.000 Spoke Company Income Statement For the Year Ended December 31, 2014 Sales $1,255,250 Cost of goods sold (712,000) Gross profit $ 543.250 ssay Problem 4 Cash Flow - Student - Word ayout References Mailings Review View Help Spoke Company Income Statement For the Year Ended December 31, 2014 $1,255,250 (712,000) $ 543,250 Sales Cost of goods sold Gross profit Expenses Salary expense Interest expense Other expenses Depreciation expense Total expenses Operating income Income tax expense 252,100 75,000 8.150 25,000 $360,250 $ 183,000 (43,000) Net income $ 140,000 mblem 4 Cash Flow. Student - Word View References Mailings Review Help The following is additional Information about Spoke's transactions during the year ended December 31, 2014: . All goods were purchased on account, and all accounts payable reflect purchases of goods for resale. Plant assets costing $90,000 were purchased by paying $10,000 in cash and issuing 5,000 shares of stock at par value. To raise cash, Spoke issued 4,000 shares of common stock at par value. No penalties were assessed for the retirement of bonds. Cash dividends of $115,000 were declared and paid at the end of the fiscal year. 1.) Explain (a) how cash flow from operating activities is calculated using the Indirect method and (b) how it differs from the direct method. When using the indirect method to calculate operating activities begins with net income and reconciles it back to cash basis through adjustments. It uses noncash revenues and noncash expenses. Also changes in current assets and current liabilities. When using the direct method lists the receipt and payment of cash for specific operating activities. Uses cash receipts from customers, cash payments for inventory, cash payments for salaries and wages, and cash payments for insurance. 2.) Using the Indirect method, calculate the net cash flow from operating activities for Spoke Company for the year ended December 31, 2014 Explain your process and how the amounts were calculated. 3.) Calculate the cash flows from investing and financing activities for Spoke Company for the year ended December 31, 2014 Explain your process and how the amounts were calculated. 4). Complete the Statement of Cash Flows Reference the connections between the numbers on the Statement of Cash Flows with the amounts from your balance sheet and your income statement. For example, how does the change in cash on the statement of cash flows reference to the balance sheet? O . Explain your process and how the amounts were calculated. 4). Complete the Statement of Cash Flows Reference the connections between the numbers on the Statement of Cash Flows with the amounts from your balance sheet and your income statement. For example, how does the change in cash on the statement of cash flows reference to the balance sheet? 5). Analyze the Cash How Information: Companies and analysts tend to use income statement and balance sheet information to evaluate financial performance. In fact, financial results presented to the investing public typically focus on earnings per share. However, analysis of cash flow information is becoming increasingly important to managers, auditors, and outside analysis. The three measures commonly used to evaluate performance related to cash flows are: 1) Operating Cash Flow Ratio. 2) Capital Expenditure Ratio. 3) Free Cash Flow. Give an explanation of each common measure by giving the equation for each of the three common measures and explain what does each ratio tell us? 'se the information for Spoke Company in your explanation and be sure to calculate each measure for Spoke Company. D Focus o BI