Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4: Identifying where disclosures are made in a CAFR The financial section of a CAFR includes the auditor's opinion, management's discussion and Analysis

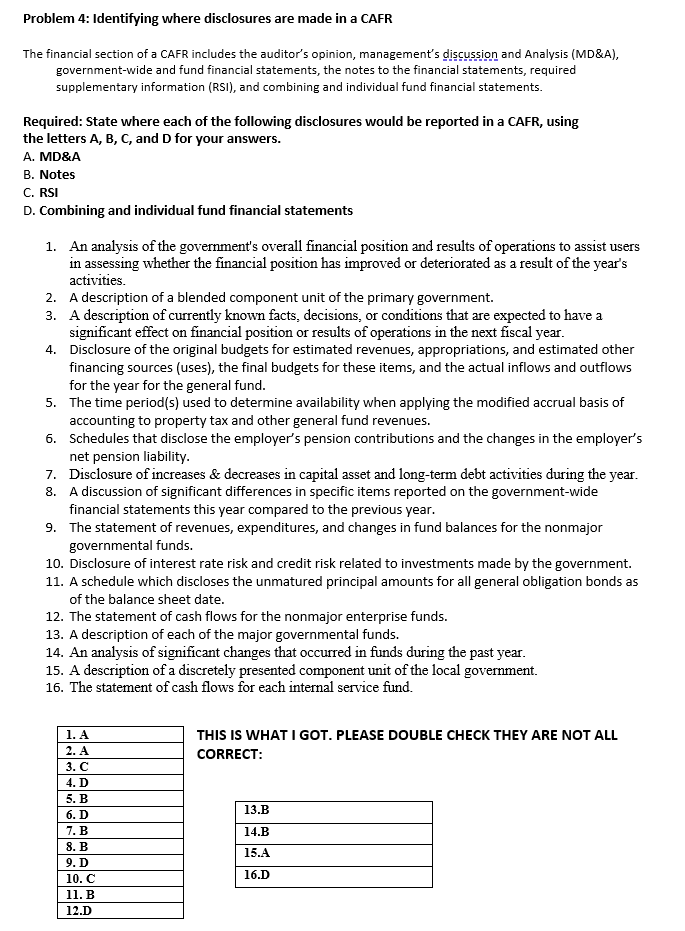

Problem 4: Identifying where disclosures are made in a CAFR The financial section of a CAFR includes the auditor's opinion, management's discussion and Analysis (MD&A), government-wide and fund financial statements, the notes to the financial statements, required supplementary information (RSI), and combining and individual fund financial statements. Required: State where each of the following disclosures would be reported in a CAFR, using the letters A, B, C, and D for your answers. A. MD&A B. Notes C. RSI D. Combining and individual fund financial statements 1. An analysis of the government's overall financial position and results of operations to assist users in assessing whether the financial position has improved or deteriorated as a result of the year's activities. 2. A description of a blended component unit of the primary government. 3. A description of currently known facts, decisions, or conditions that are expected to have a significant effect on financial position or results of operations in the next fiscal year. 4. Disclosure of the original budgets for estimated revenues, appropriations, and estimated other financing sources (uses), the final budgets for these items, and the actual inflows and outflows for the year for the general fund. 5. The time period(s) used to determine availability when applying the modified accrual basis of accounting to property tax and other general fund revenues. 6. Schedules that disclose the employer's pension contributions and the changes in the employer's net pension liability. 7. Disclosure of increases & decreases in capital asset and long-term debt activities during the year. 8. A discussion of significant differences in specific items reported on the government-wide financial statements this year compared to the previous year. 9. The statement of revenues, expenditures, and changes in fund balances for the nonmajor governmental funds. 10. Disclosure of interest rate risk and credit risk related to investments made by the government. 11. A schedule which discloses the unmatured principal amounts for all general obligation bonds as of the balance sheet date. 12. The statement of cash flows for the nonmajor enterprise funds. 13. A description of each of the major governmental funds. 14. An analysis of significant changes that occurred in funds during the past year. 15. A description of a discretely presented component unit of the local government. 16. The statement of cash flows for each internal service fund. THIS IS WHAT I GOT. PLEASE DOUBLE CHECK THEY ARE NOT ALL CORRECT: 1. A 2. A 3. C 4. D 5. B 6. D 7. B 13.B 14.B 8. B 15.A 9. D 16.D 10. C 11. B 12.D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started