Answered step by step

Verified Expert Solution

Question

1 Approved Answer

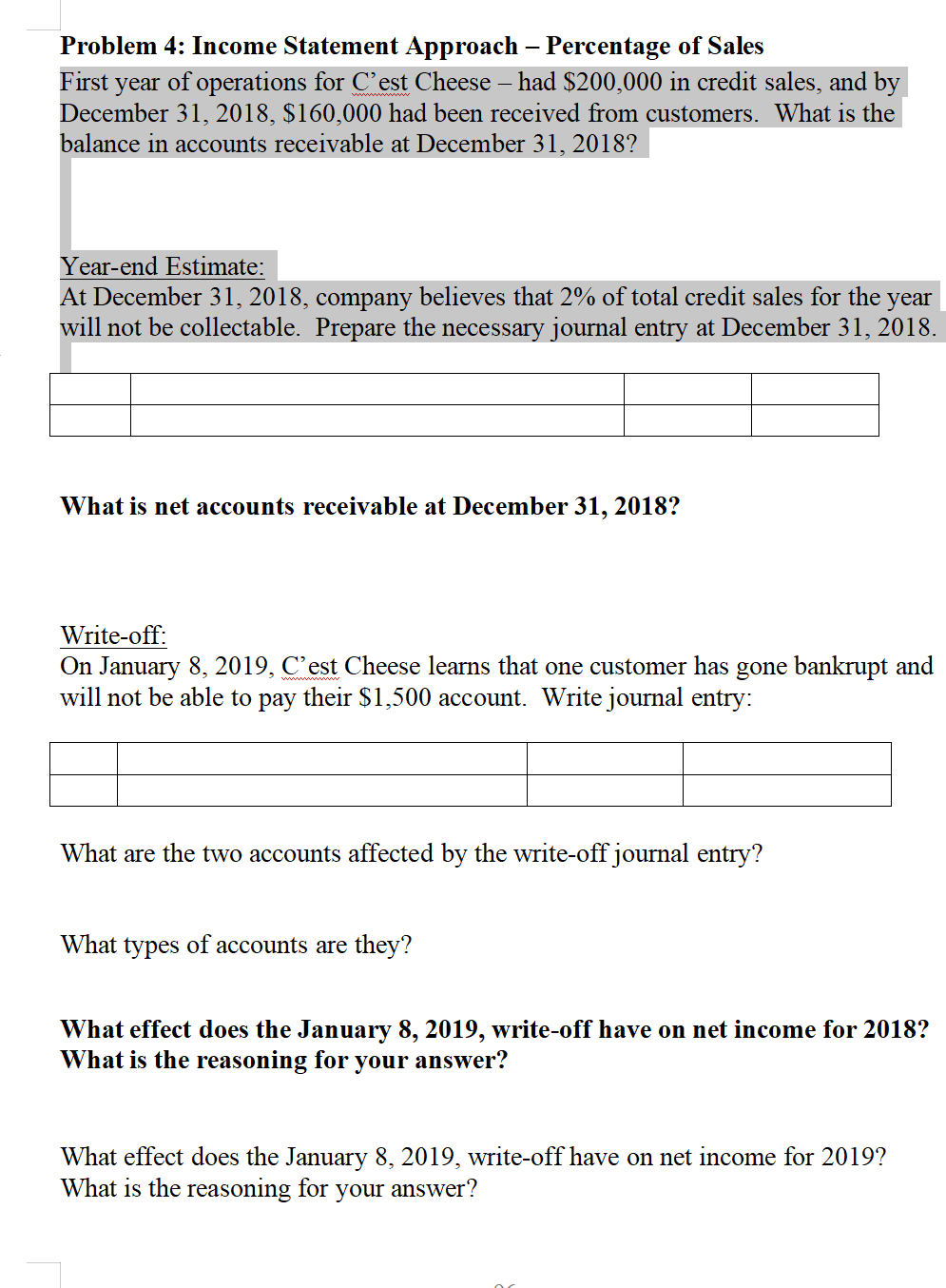

Problem 4: Income Statement Approach Percentage of Sales year of operations for C'est Cheese had $200,000 in credit sales, and by December 31, 2018,

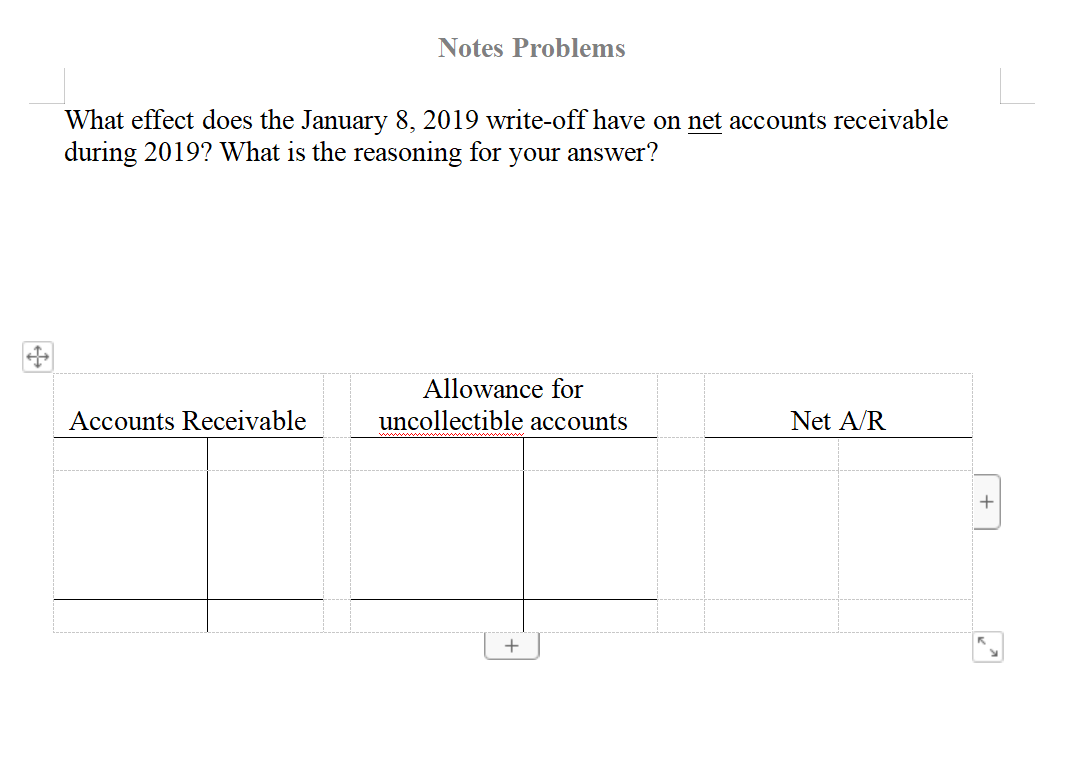

Problem 4: Income Statement Approach Percentage of Sales year of operations for C'est Cheese had $200,000 in credit sales, and by December 31, 2018, $160,000 had been received from customers. What is the balance in accounts receivable at December 31, 2018? First Year-end Estimate: At December 31, 2018, company believes that 2% of total credit sales for the year will not be collectable. Prepare the necessary journal entry at December 31, 2018. What is net accounts receivable at December 31, 2018? Write-off: On January 8, 2019, C'est Cheese learns that one customer has gone bankrupt and will not be able to pay their $1,500 account. Write journal entry: What are the two accounts affected by the write-off journal entry? What types of accounts are they? What effect does the January 8, 2019, write-off have on net income for 2018? What is the reasoning for your answer? What effect does the January 8, 2019, write-off have on net income for 2019? What is the reasoning for your answer? Notes Problems What effect does the January 8, 2019 write-off have on net accounts receivable during 2019? What is the reasoning for your answer? Allowance for Accounts Receivable uncollectible accounts Net A/R + +

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Balance in account receivable on Dec 31 st Credit sales collection from customers 200000160000 40000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started