Answered step by step

Verified Expert Solution

Question

1 Approved Answer

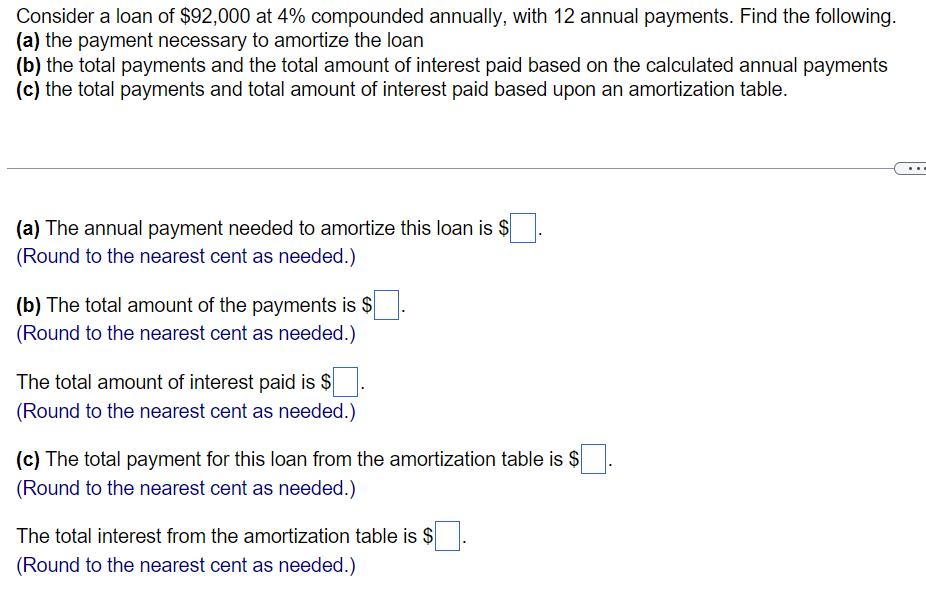

Consider a loan of $92,000 at 4% compounded annually, with 12 annual payments. Find the following. (a) the payment necessary to amortize the loan

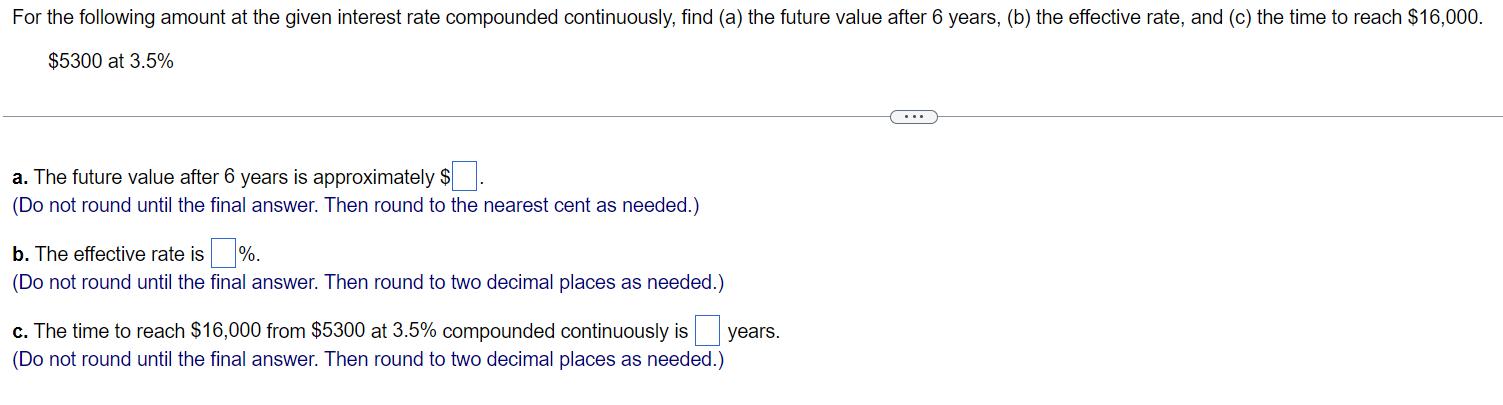

Consider a loan of $92,000 at 4% compounded annually, with 12 annual payments. Find the following. (a) the payment necessary to amortize the loan (b) the total payments and the total amount of interest paid based on the calculated annual payments (c) the total payments and total amount of interest paid based upon an amortization table. (a) The annual payment needed to amortize this loan is $ (Round to the nearest cent as needed.) (b) The total amount of the payments is $ (Round to the nearest cent as needed.) The total amount of interest paid is $. (Round to the nearest cent as needed.) (c) The total payment for this loan from the amortization table is $ (Round to the nearest cent as needed.) The total interest from the amortization table is $ (Round to the nearest cent as needed.) For the following amount at the given interest rate compounded continuously, find (a) the future value after 6 years, (b) the effective rate, and (c) the time to reach $16,000. $5300 at 3.5% ... a. The future value after 6 years is approximately $ (Do not round until the final answer. Then round to the nearest cent as needed.) b. The effective rate is %. (Do not round until the final answer. Then round to two decimal places as needed.) c. The time to reach $16,000 from $5300 at 3.5% compounded continuously is years. (Do not round until the final answer. Then round to two decimal places as needed.)

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Requirement A Amount Borrowed 92000 Interest Rate 400 Nu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started