Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4: Let us develop a savings plan for your retirement. We will assume that you will be finished with your schooling by age

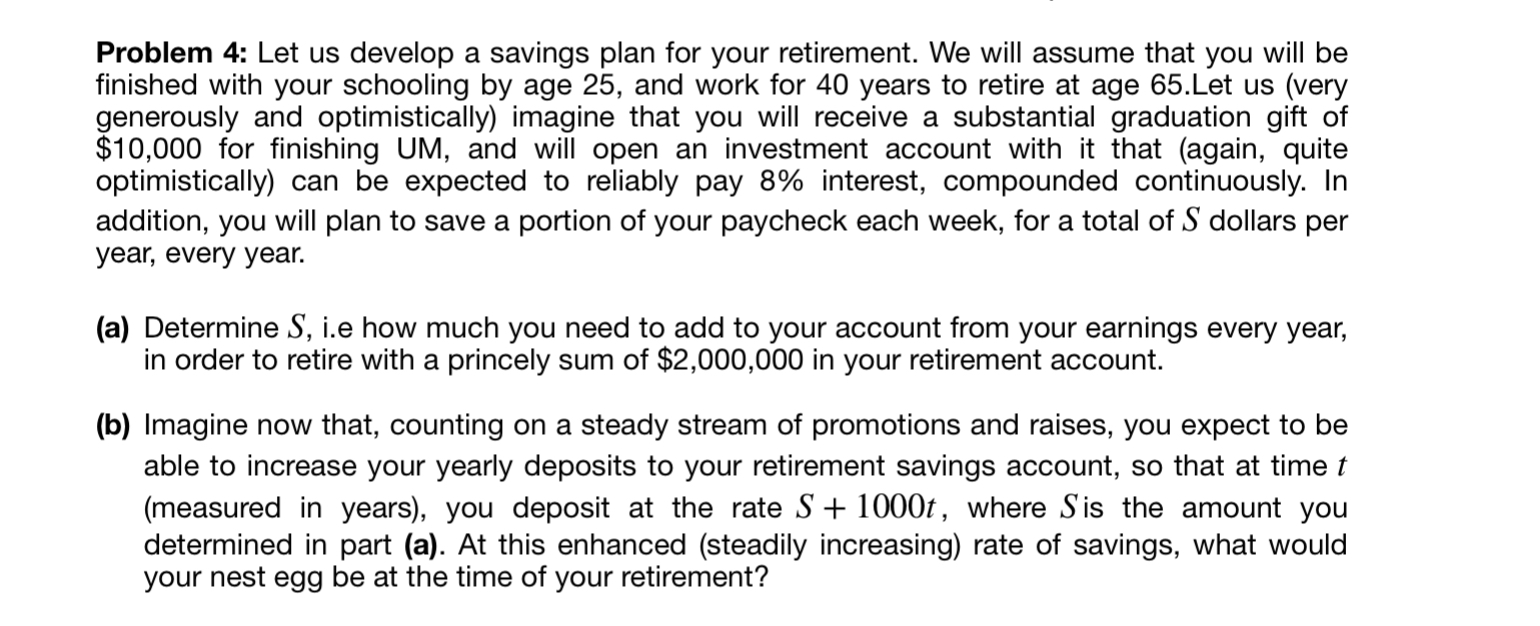

Problem 4: Let us develop a savings plan for your retirement. We will assume that you will be finished with your schooling by age 25, and work for 40 years to retire at age 65. Let us (very generously and optimistically) imagine that you will receive a substantial graduation gift of $10,000 for finishing UM, and will open an investment account with it that (again, quite optimistically) can be expected to reliably pay 8% interest, compounded continuously. In addition, you will plan to save a portion of your paycheck each week, for a total of S dollars per year, every year. (a) Determine S, i.e how much you need to add to your account from your earnings every year, in order to retire with a princely sum of $2,000,000 in your retirement account. (b) Imagine now that, counting on a steady stream of promotions and raises, you expect to be able to increase your yearly deposits to your retirement savings account, so that at time t (measured in years), you deposit at the rate S + 1000t, where Sis the amount you determined in part (a). At this enhanced (steadily increasing) rate of savings, what would your nest egg be at the time of your retirement?

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the annual savings amount S needed to retire with a retirement account balance of 2000000 we can use the formula for compound interest A P ert Where A is the amount of money accumulated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started