Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4 Nelson Co., a manufacturer of construction equipment, finished the construction of a unit of equipment at P10,000,000 on January 1, 2021. Nelson immediately

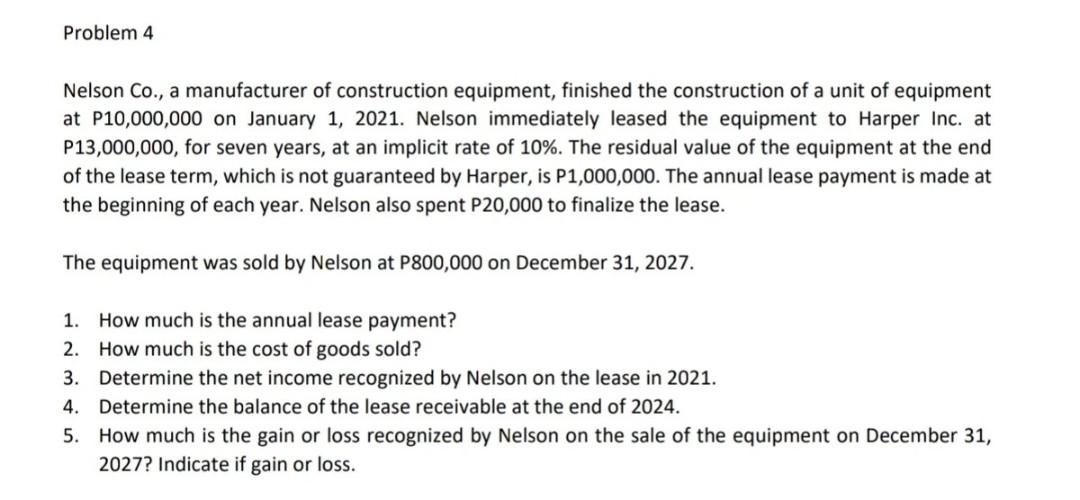

Problem 4 Nelson Co., a manufacturer of construction equipment, finished the construction of a unit of equipment at P10,000,000 on January 1, 2021. Nelson immediately leased the equipment to Harper Inc. at P13,000,000, for seven years, at an implicit rate of 10%. The residual value of the equipment at the end of the lease term, which is not guaranteed by Harper, is P1,000,000. The annual lease payment is made at the beginning of each year. Nelson also spent P20,000 to finalize the lease. The equipment was sold by Nelson at P800,000 on December 31, 2027. 1. How much is the annual lease payment? 2. How much is the cost of goods sold? 3. Determine the net income recognized by Nelson on the lease in 2021. 4. Determine the balance of the lease receivable at the end of 2024. 5. How much is the gain or loss recognized by Nelson on the sale of the equipment on December 31, 2027? Indicate if gain or loss. Problem 4 Nelson Co., a manufacturer of construction equipment, finished the construction of a unit of equipment at P10,000,000 on January 1, 2021. Nelson immediately leased the equipment to Harper Inc. at P13,000,000, for seven years, at an implicit rate of 10%. The residual value of the equipment at the end of the lease term, which is not guaranteed by Harper, is P1,000,000. The annual lease payment is made at the beginning of each year. Nelson also spent P20,000 to finalize the lease. The equipment was sold by Nelson at P800,000 on December 31, 2027. 1. How much is the annual lease payment? 2. How much is the cost of goods sold? 3. Determine the net income recognized by Nelson on the lease in 2021. 4. Determine the balance of the lease receivable at the end of 2024. 5. How much is the gain or loss recognized by Nelson on the sale of the equipment on December 31, 2027? Indicate if gain or loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started