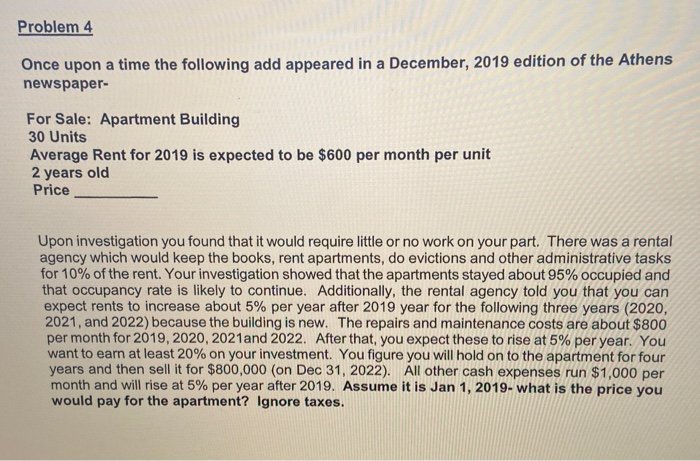

Problem 4 Once upon a time the following add appeared in a December, 2019 edition of the Athens newspaper- For Sale: Apartment Building 30 Units Average Rent for 2019 is expected to be $600 per month per unit 2 years old Price Upon investigation you found that it would require little or no work on your part. There was a rental agency which would keep the books, rent apartments, do evictions and other administrative tasks for 10% of the rent. Your investigation showed that the apartments stayed about 95% occupied and that occupancy rate is likely to continue. Additionally, the rental agency told you that you can expect rents to increase about 5% per year after 2019 year for the following three years (2020, 2021, and 2022) because the building is new. The repairs and maintenance costs are about $800 per month for 2019, 2020, 2021and 2022. After that, you expect these to rise at 5% per year. You want to earn at least 20% on your investment. You figure you will hold on to the apartment for four years and then sell it for $800,000 (on Dec 31, 2022). All other cash expenses run $1,000 per month and will rise at 5% per year after 2019. Assume it is Jan 1, 2019- what is the price you would pay for the apartment? Ignore taxes. The quantity demanded x (in units of a hundred) of the Mikado miniature cameras per week is related to the unit price p (in dollars) by p=-0.222 +100 and the quantity (in units of a hundred) that the supplier is willing to make available in the market is related to the unit price p (in dollars) by p=0.12.2x + 50. If the market price is set at the equilibrium price, find the consumers' surplus and the producers' surplus. (Round your answers to the nearest dollar.) consumer's surplus producer's surplus $ Problem 4 Once upon a time the following add appeared in a December, 2019 edition of the Athens newspaper- For Sale: Apartment Building 30 Units Average Rent for 2019 is expected to be $600 per month per unit 2 years old Price Upon investigation you found that it would require little or no work on your part. There was a rental agency which would keep the books, rent apartments, do evictions and other administrative tasks for 10% of the rent. Your investigation showed that the apartments stayed about 95% occupied and that occupancy rate is likely to continue. Additionally, the rental agency told you that you can expect rents to increase about 5% per year after 2019 year for the following three years (2020, 2021, and 2022) because the building is new. The repairs and maintenance costs are about $800 per month for 2019, 2020, 2021and 2022. After that, you expect these to rise at 5% per year. You want to earn at least 20% on your investment. You figure you will hold on to the apartment for four years and then sell it for $800,000 (on Dec 31, 2022). All other cash expenses run $1,000 per month and will rise at 5% per year after 2019. Assume it is Jan 1, 2019- what is the price you would pay for the apartment? Ignore taxes. The quantity demanded x (in units of a hundred) of the Mikado miniature cameras per week is related to the unit price p (in dollars) by p=-0.222 +100 and the quantity (in units of a hundred) that the supplier is willing to make available in the market is related to the unit price p (in dollars) by p=0.12.2x + 50. If the market price is set at the equilibrium price, find the consumers' surplus and the producers' surplus. (Round your answers to the nearest dollar.) consumer's surplus producer's surplus $