Answered step by step

Verified Expert Solution

Question

1 Approved Answer

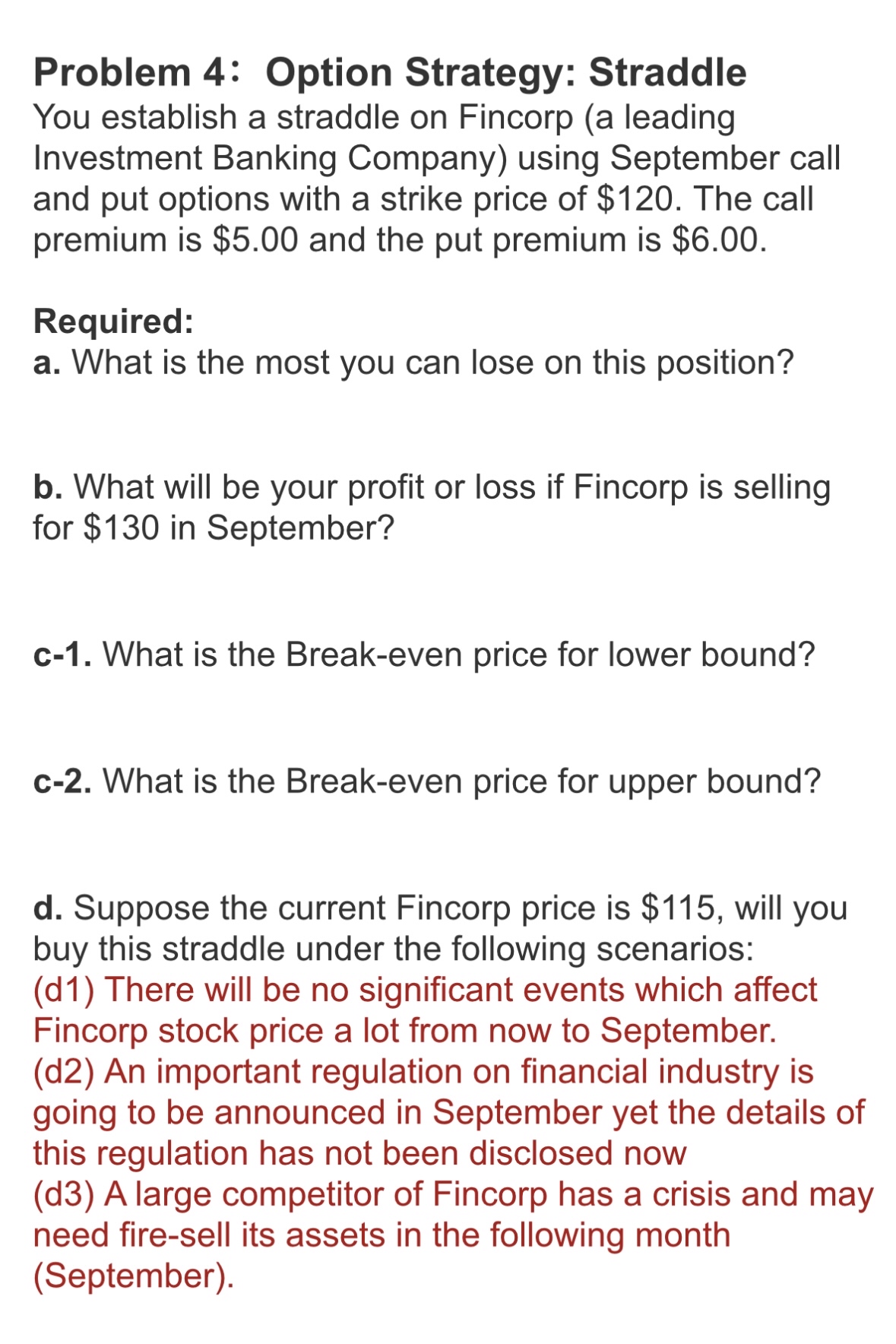

Problem 4 : Option Strategy: Straddle You establish a straddle on Fincorp ( a leading Investment Banking Company ) using September call and put options

Problem : Option Strategy: Straddle

You establish a straddle on Fincorp a leading Investment Banking Company using September call and put options with a strike price of $ The call premium is $ and the put premium is $

Required:

a What is the most you can lose on this position?

b What will be your profit or loss if Fincorp is selling for $ in September?

c What is the Breakeven price for lower bound?

c What is the Breakeven price for upper bound?

d Suppose the current Fincorp price is $ will you buy this straddle under the following scenarios:

d There will be no significant events which affect Fincorp stock price a lot from now to September.

d An important regulation on financial industry is going to be announced in September yet the details of this regulation has not been disclosed now d A large competitor of Fincorp has a crisis and may need firesell its assets in the following month September

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started