Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4: Portfolio Optimization (25 pts) A technology company AFX is considering investing some of its savings in the stock market and has contacted a

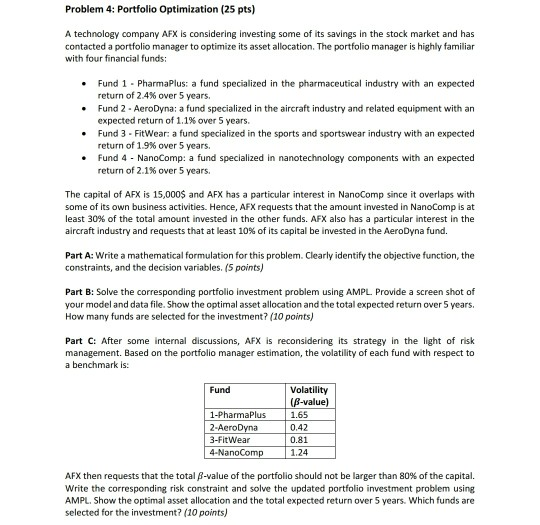

Problem 4: Portfolio Optimization (25 pts) A technology company AFX is considering investing some of its savings in the stock market and has contacted a portfolio manager to optimize its asset allocation. The portfolio manager is highly familiar with four financial funds: Fund 1 - PharmaPlus: a fund specialized in the pharmaceutical industry with an expected return of 2.4% over 5 years. Fund 2 - AeroDyna: a fund specialized in the aircraft industry and related equipment with an expected return of 1.1% over 5 years. Fund 3 - FitWear: a fund specialized in the sports and sportswear industry with an expected return of 1.9% over 5 years. Fund 4 - NanoComp: a fund specialized in nanotechnology components with an expected return of 2.1% over 5 years The capital of AFX is 15,000$ and AFX has a particular interest in NanoComp since it overlaps with some of its own business activities. Hence, AFX requests that the amount invested in NanoComp is at least 30% of the total amount invested in the other funds. AFX also has a particular interest in the aircraft Industry and requests that at least 10% of its capital be invested in the AeroDyna fund. Part A: Write a mathematical formulation for this problem. Clearly identify the objective function, the constraints, and the decision variables. (5 points) Part B: Solve the corresponding portfolio investment problem using AMPL. Provide a screen shot of your model and data file. Show the optimal asset allocation and the total expected return over 5 years. How many funds are selected for the investment? (10 points) Part C: After some internal discussions, AFX is reconsidering its strategy in the light of risk management. Based on the portfolio manager estimation, the volatility of each fund with respect to a benchmark is: Fund 1-PharmaPlus 2-AeroDyna 3-FitWear 4-NanoComp Volatility (B-value] 1.65 0.42 0.81 1.24 AFX then requests that the total B-value of the portfolio should not be larger than 80% of the capital Write the corresponding risk constraint and solve the updated portfolio investment problem using AMPL. Show the optimal asset allocation and the total expected return over 5 years. Which funds are selected for the investment? (10 points) Problem 4: Portfolio Optimization (25 pts) A technology company AFX is considering investing some of its savings in the stock market and has contacted a portfolio manager to optimize its asset allocation. The portfolio manager is highly familiar with four financial funds: Fund 1 - PharmaPlus: a fund specialized in the pharmaceutical industry with an expected return of 2.4% over 5 years. Fund 2 - AeroDyna: a fund specialized in the aircraft industry and related equipment with an expected return of 1.1% over 5 years. Fund 3 - FitWear: a fund specialized in the sports and sportswear industry with an expected return of 1.9% over 5 years. Fund 4 - NanoComp: a fund specialized in nanotechnology components with an expected return of 2.1% over 5 years The capital of AFX is 15,000$ and AFX has a particular interest in NanoComp since it overlaps with some of its own business activities. Hence, AFX requests that the amount invested in NanoComp is at least 30% of the total amount invested in the other funds. AFX also has a particular interest in the aircraft Industry and requests that at least 10% of its capital be invested in the AeroDyna fund. Part A: Write a mathematical formulation for this problem. Clearly identify the objective function, the constraints, and the decision variables. (5 points) Part B: Solve the corresponding portfolio investment problem using AMPL. Provide a screen shot of your model and data file. Show the optimal asset allocation and the total expected return over 5 years. How many funds are selected for the investment? (10 points) Part C: After some internal discussions, AFX is reconsidering its strategy in the light of risk management. Based on the portfolio manager estimation, the volatility of each fund with respect to a benchmark is: Fund 1-PharmaPlus 2-AeroDyna 3-FitWear 4-NanoComp Volatility (B-value] 1.65 0.42 0.81 1.24 AFX then requests that the total B-value of the portfolio should not be larger than 80% of the capital Write the corresponding risk constraint and solve the updated portfolio investment problem using AMPL. Show the optimal asset allocation and the total expected return over 5 years. Which funds are selected for the investment? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started