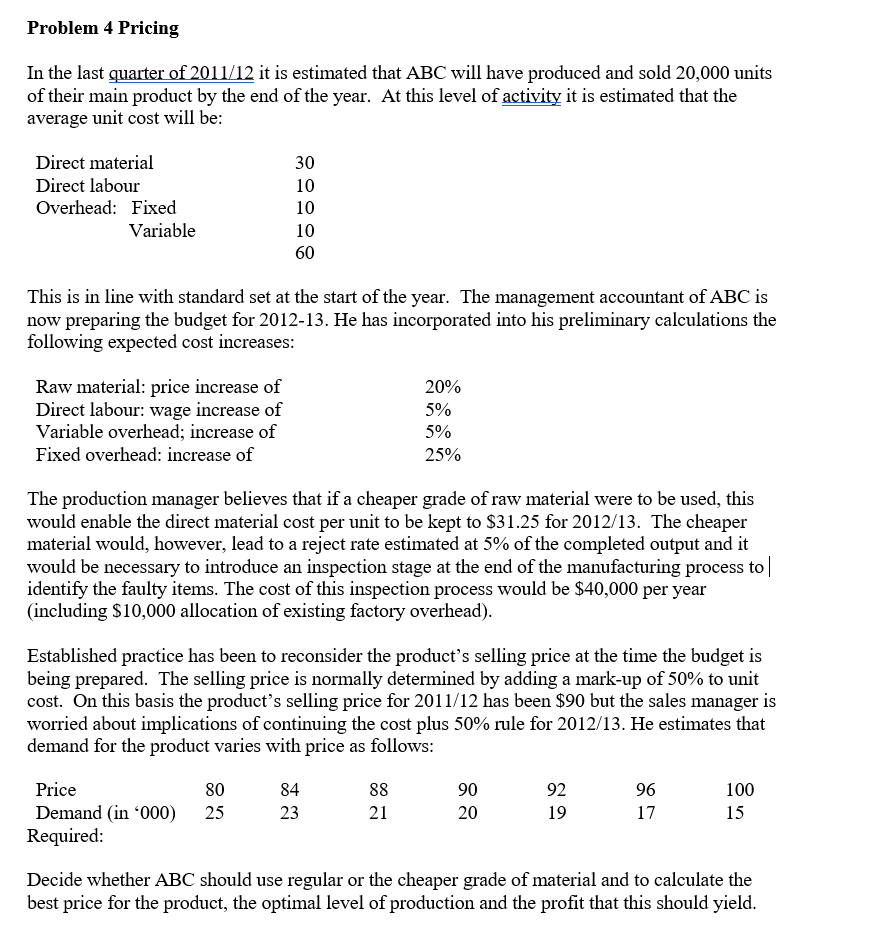

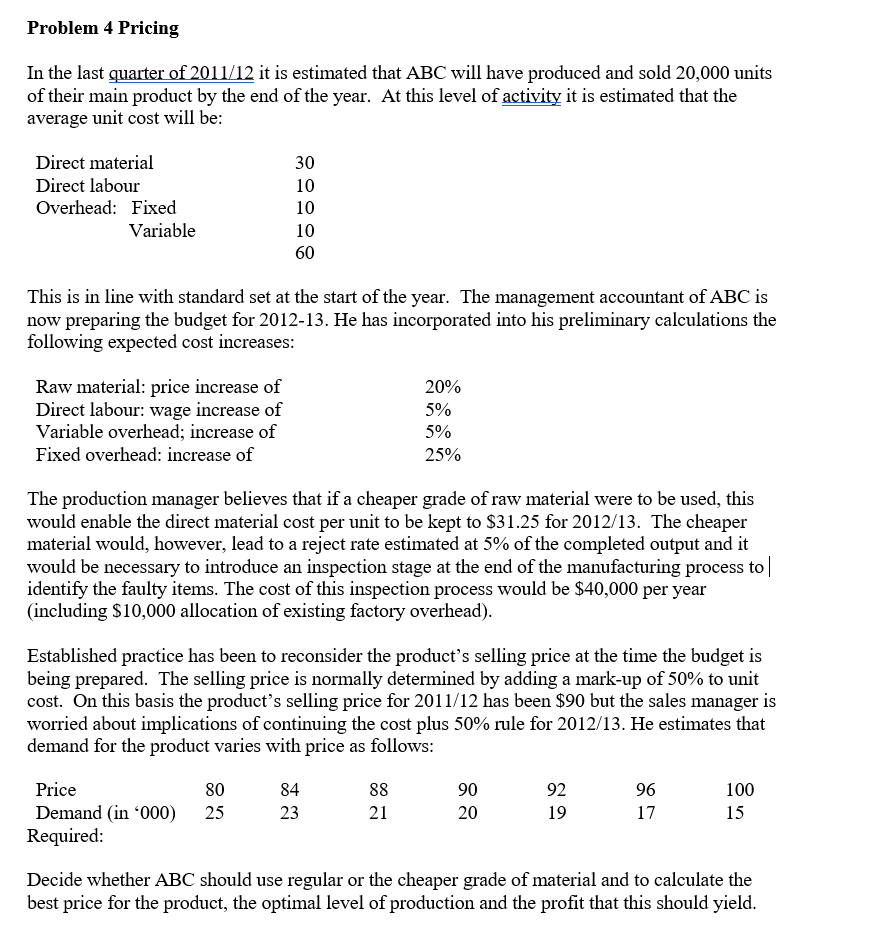

Problem 4 Pricing In the last quarter of 2011/12 it is estimated that ABC will have produced and sold 20,000 units of their main product by the end of the year. At this level of activity it is estimated that the average unit cost will be: 30 10 Direct material Direct labour Overhead: Fixed Variable 10 10 60 This is in line with standard set at the start of the year. The management accountant of ABC is now preparing the budget for 2012-13. He has incorporated into his preliminary calculations the following expected cost increases: Raw material: price increase of Direct labour: wage increase of Variable overhead; increase of Fixed overhead: increase of 20% 5% 5% 25% The production manager believes that if a cheaper grade of raw material were to be used, this would enable the direct material cost per unit to be kept to $31.25 for 2012/13. The cheaper material would, however, lead to a reject rate estimated at 5% of the completed output and it would be necessary to introduce an inspection stage at the end of the manufacturing process to identify the faulty items. The cost of this inspection process would be $40,000 per year (including $10,000 allocation of existing factory overhead). Established practice has been to reconsider the product's selling price at the time the budget is being prepared. The selling price is normally determined by adding a mark-up of 50% to unit cost. On this basis the product's selling price for 2011/12 has been $90 but the sales manager is worried about implications of continuing the cost plus 50% rule for 2012/13. He estimates that demand for the product varies with price as follows: Price Demand in '000) Required: 80 25 84 23 88 21 90 20 92 19 96 100 15 17 Decide whether ABC should use regular or the cheaper grade of material and to calculate the best price for the product, the optimal level of production and the profit that this should yield. Problem 4 Pricing In the last quarter of 2011/12 it is estimated that ABC will have produced and sold 20,000 units of their main product by the end of the year. At this level of activity it is estimated that the average unit cost will be: 30 10 Direct material Direct labour Overhead: Fixed Variable 10 10 60 This is in line with standard set at the start of the year. The management accountant of ABC is now preparing the budget for 2012-13. He has incorporated into his preliminary calculations the following expected cost increases: Raw material: price increase of Direct labour: wage increase of Variable overhead; increase of Fixed overhead: increase of 20% 5% 5% 25% The production manager believes that if a cheaper grade of raw material were to be used, this would enable the direct material cost per unit to be kept to $31.25 for 2012/13. The cheaper material would, however, lead to a reject rate estimated at 5% of the completed output and it would be necessary to introduce an inspection stage at the end of the manufacturing process to identify the faulty items. The cost of this inspection process would be $40,000 per year (including $10,000 allocation of existing factory overhead). Established practice has been to reconsider the product's selling price at the time the budget is being prepared. The selling price is normally determined by adding a mark-up of 50% to unit cost. On this basis the product's selling price for 2011/12 has been $90 but the sales manager is worried about implications of continuing the cost plus 50% rule for 2012/13. He estimates that demand for the product varies with price as follows: Price Demand in '000) Required: 80 25 84 23 88 21 90 20 92 19 96 100 15 17 Decide whether ABC should use regular or the cheaper grade of material and to calculate the best price for the product, the optimal level of production and the profit that this should yield