Question

Problem #4 Project Evaluation Micas firm is choosing from two different projects that both require $40,000 investment today. The firm can only manage one project.

Problem #4 Project Evaluation

Micas firm is choosing from two different projects that both require $40,000 investment today. The firm can only manage one project.

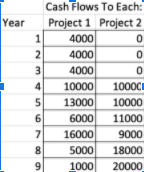

Micas manager is leaning towards Project 1, observing that its cash flows give the firm back all the money it must invest in under 6 years while Project 2 has an 8-year payback period. The firms other projects are similar to this and the firms weighted average cost of capital is 10%.

Make an argument for which project would be the best financial choice. You should use computations and concepts to convince the manager.

Criticize or defend the metric the manager is suggesting.

Year 1 2 3 4 5 6 7 Cash Flows To Each: Project 1 Project 2 4000 0 4000 0 4000 0 10000 1000C 13000 10000 6000 11000 16000 9000 5000 18000 1000 20000 8 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started