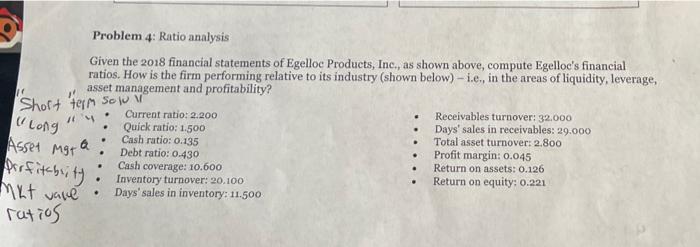

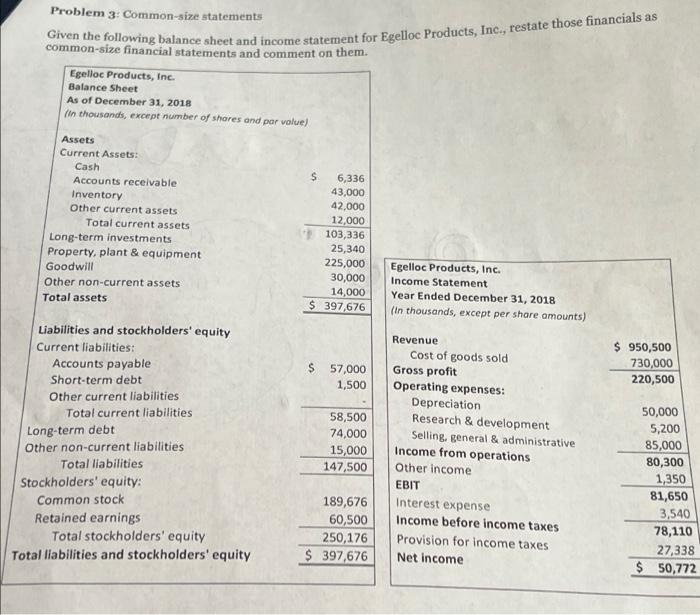

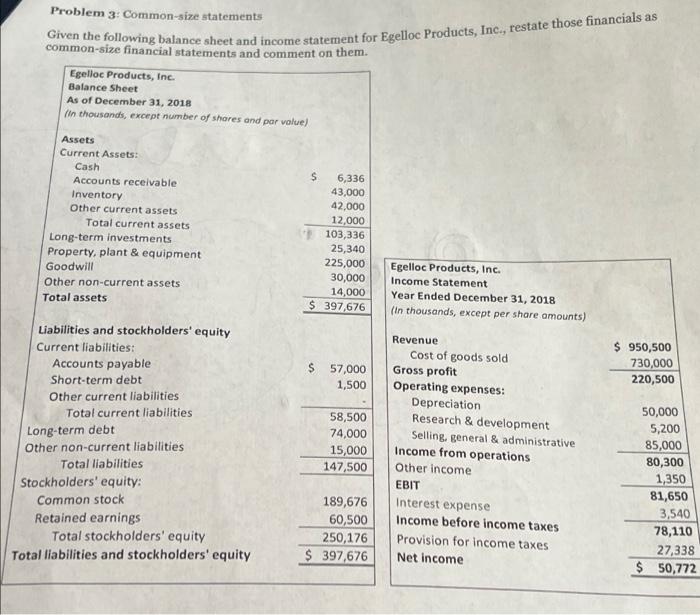

Problem 4: Ratio analysis Given the 2018 financial statements of Egelloc Products, Inc., as shown above, compute Egelloc's financial ratios. How is the firm performing relative to its industry (shown below) - i.e., in the areas of liquidity, leverage, asset management and profitability? . Current ratio: 2.200 Receivables turnover: 32.000 Days' sales in receivables: 29.000 Total asset turnover: 2.800 . Quick ratio: 1.500 Cash ratio: 0.135 Profit margin: 0.045 Debt ratio: 0.430 Cash coverage: 10.600 Return on assets: 0.126 Inventory turnover: 20.100 Return on equity: 0.221 Days' sales in inventory: 11.500 10 Short term Sol V 114 Long Asset Mgt Q Parfitablity Mut vare ratios . . . . . . Problem 3: Common-size statements Given the following balance sheet and income statement for Egelloc Products, Inc., restate those financials as common-size financial statements and comment on them. Egelloc Products, Inc. Balance Sheet As of December 31, 2018 (In thousands, except number of shares and par value) Assets Current Assets: Cash 6,336 Accounts receivable 43,000 Inventory 42,000 Other current assets 12,000 Total current assets 103,336 Long-term investments. 25,340 Property, plant & equipment 225,000 Goodwill 30,000 Other non-current assets Total assets 14,000 $ 397,676 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 57,000 Short-term debt 1,500 Other current liabilities 58,500 74,000 15,000 147,500 189,676 60,500 250,176 $ 397,676 Total current liabilities Long-term debt Other non-current liabilities Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Egelloc Products, Inc. Income Statement Year Ended December 31, 2018 (In thousands, except per share amounts) Revenue Cost of goods sold Gross profit Operating expenses: Depreciation Research & development Selling, general & administrative Income from operations Other income EBIT Interest expense Income before income taxes Provision for income taxes Net income $ 950,500 730,000 220,500 50,000 5,200 85,000 80,300 1,350 81,650 3,540 78,110 27,338 $ 50,772 Problem 3: Common-size statements Given the following balance sheet and income statement for Egelloc Products, Inc., restate those financials as common-size financial statements and comment on them. Egelloc Products, Inc. Balance Sheet As of December 31, 2018 (In thousands, except number of shares and par value) Assets Current Assets: Cash 6,336 Accounts receivable 43,000 Inventory 42,000 Other current assets 12,000 Total current assets 103,336 Long-term investments. 25,340 Property, plant & equipment 225,000 Goodwill 30,000 Other non-current assets Total assets 14,000 $ 397,676 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 57,000 Short-term debt 1,500 Other current liabilities 58,500 74,000 15,000 147,500 189,676 60,500 250,176 $ 397,676 Total current liabilities Long-term debt Other non-current liabilities Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Egelloc Products, Inc. Income Statement Year Ended December 31, 2018 (In thousands, except per share amounts) Revenue Cost of goods sold Gross profit Operating expenses: Depreciation Research & development Selling, general & administrative Income from operations Other income EBIT Interest expense Income before income taxes Provision for income taxes Net income $ 950,500 730,000 220,500 50,000 5,200 85,000 80,300 1,350 81,650 3,540 78,110 27,338 $ 50,772