Question

Problem. 4. Scotsland Company had the following transactions relating to stock investments with insignificant influence during the year. Prepare the required journal entries for these

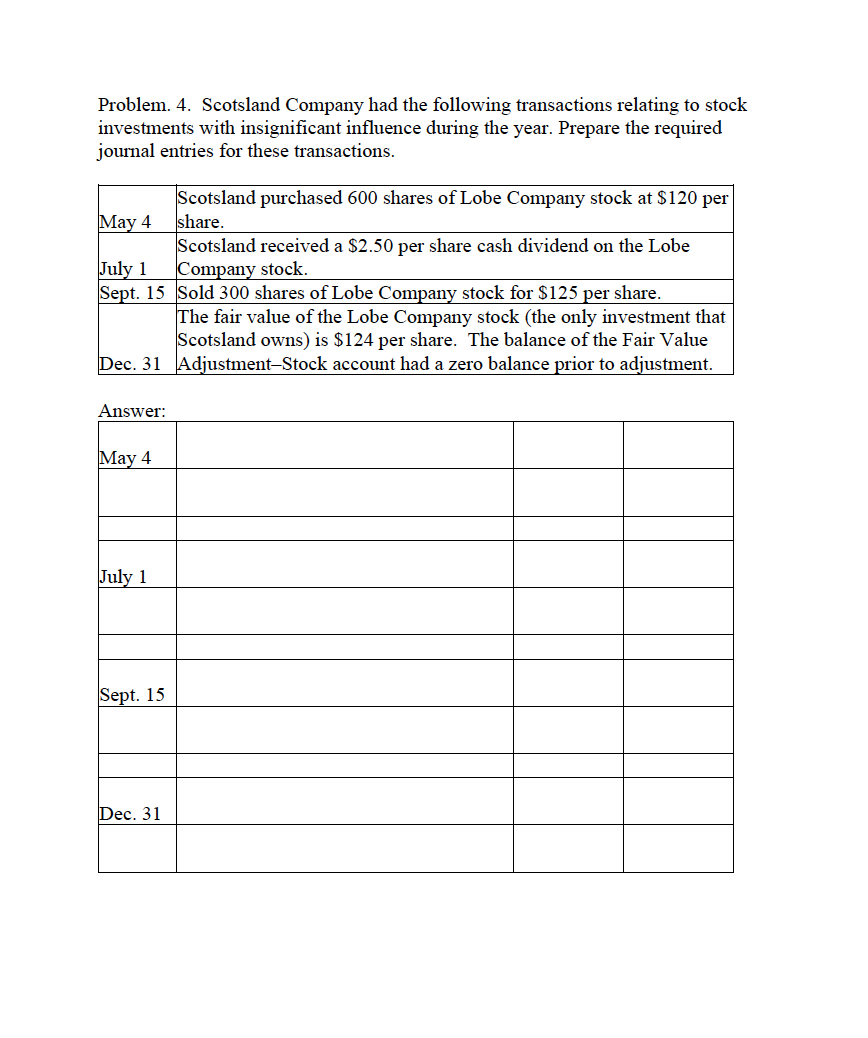

Problem. 4. Scotsland Company had the following transactions relating to stock investments with insignificant influence during the year. Prepare the required journal entries for these transactions.

May 4

Scotsland purchased 600 shares of Lobe Company stock at $120 per share.

July 1

Scotsland received a $2.50 per share cash dividend on the Lobe Company stock. Sept. 15 Sold 300 shares of Lobe Company stock for $125 per share.

Dec. 31

The fair value of the Lobe Company stock (the only investment that Scotsland owns) is $124 per share. The balance of the Fair Value AdjustmentStock account had a zero balance prior to adjustment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started