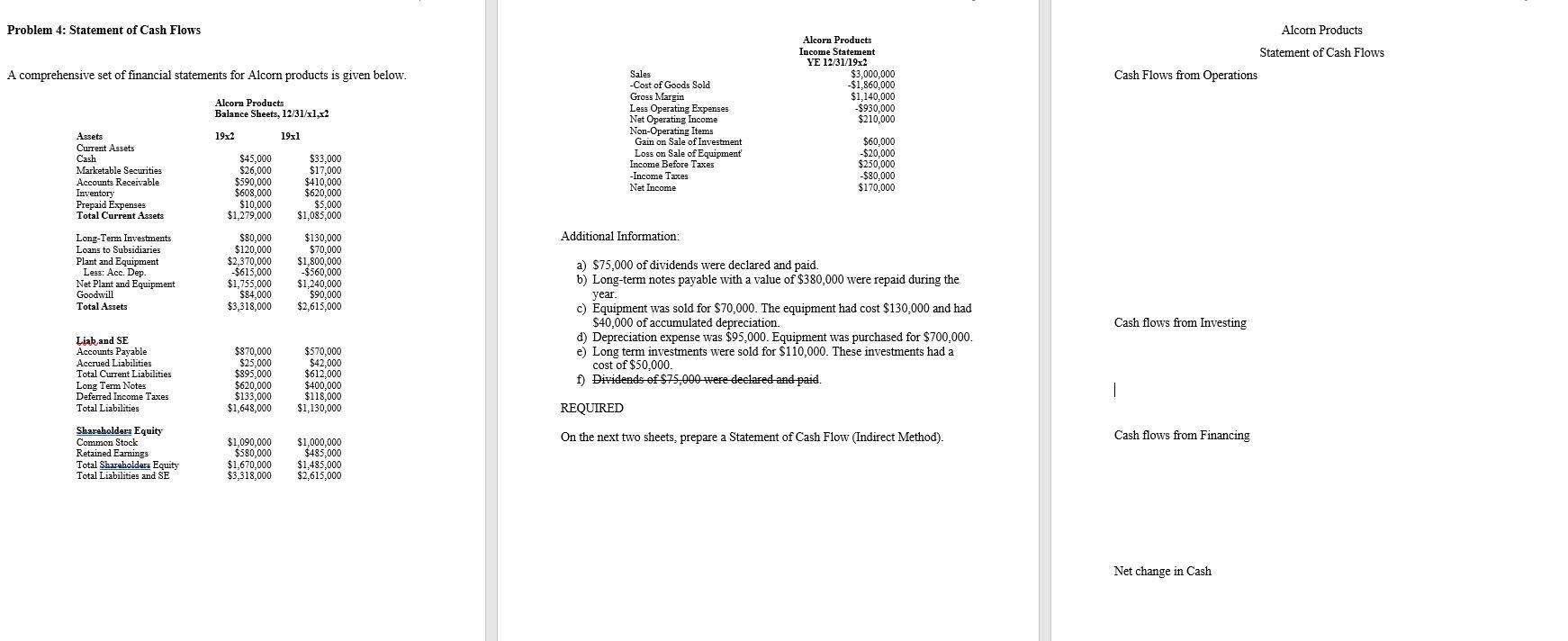

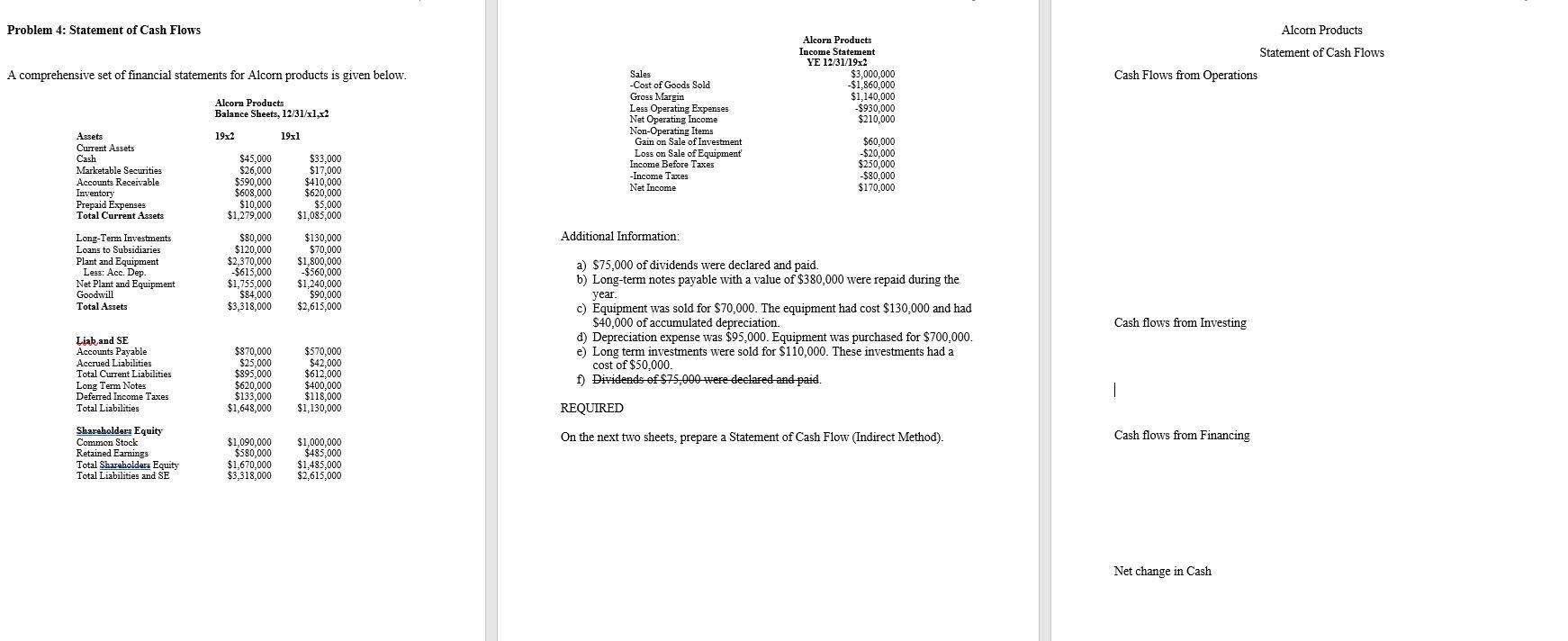

Problem 4: Statement of Cash Flows Alcorn Products Statement of Cash Flows A comprehensive set of financial statements for Alcorn products is given below. Alcorn Products Income Statement YE 12/31/19x2 $3,000,000 -$1,860,000 $1,140,000 $930,000 $210,000 Cash Flows from Operations Alcorn Products Balance Sheets, 12/31/x1,x? 19x2 19x1 Sales -Cost of Goods Sold Gross Margin Less Operating Expenses Net Operating Income Non-Operating Items Gain on Sale of Investment Loss on Sale of Equipment Income Before Taxes -Income Tates Net Income Assets Current Assets Cash Marketable Securities Accounts Receivable Inventory Prepaid Expenses Total Current Assets $33,000 $45,000 $26,000 $590,000 $608,000 $10,000 $1,279,000 $17,000 $410,000 $620,000 $5,000 $1,085,000 $60,000 -$20,000 $250,000 -$80,000 $170,000 Additional Information: Long-Term Investments Loans to Subsidiaries Plant and Equipment Less: Acc. Dep. Net Plant and Equipment Goodwill Total Assets $80,000 $120,000 $2,370,000 -$615,000 $1,755,000 $84,000 $3,318,000 $130,000 $70,000 $1,800,000 $560,000 $1,240,000 $90,000 $2,615,000 a) $75,000 of dividends were declared and paid. b) Long-term notes payable with a value of $380,000 were repaid during the year. c) Equipment was sold for $70,000. The equipment had cost $130,000 and had $40,000 of accumulated depreciation. d) Depreciation expense was $95,000. Equipment was purchased for $700.000. e) Long term investments were sold for $110,000. These investments had a cost of $50,000. f) Dividends of $75,000 were declared and paid. Cash flows from Investing Liab and SE Accounts Payable Accrued Liabilities Total Current Liabilities Long Term Notes Deferred Income Taxes Total Liabilities $870,000 $25,000 $895,000 $620,000 $133,000 $1,648,000 $570,000 $42.000 $612,000 $400,000 $118,000 $1,130,000 | REQUIRED On the next two sheets, prepare a Statement of Cash Flow (Indirect Method). Cash flows from Financing Shareholders Equity Common Stock Retained Earnings Total Shareholders Equity Total Liabilities and SE $1.090.000 $580,000 $1,670,000 $3,318,000 $1,000,000 $485.000 $1,485,000 $2,615,000 Net change in Cash