Answered step by step

Verified Expert Solution

Question

1 Approved Answer

178 Problem 4 yes capital prep Introduction to Federal Income Tax definition of a small business corporation. He invested $100,000 in common shares and

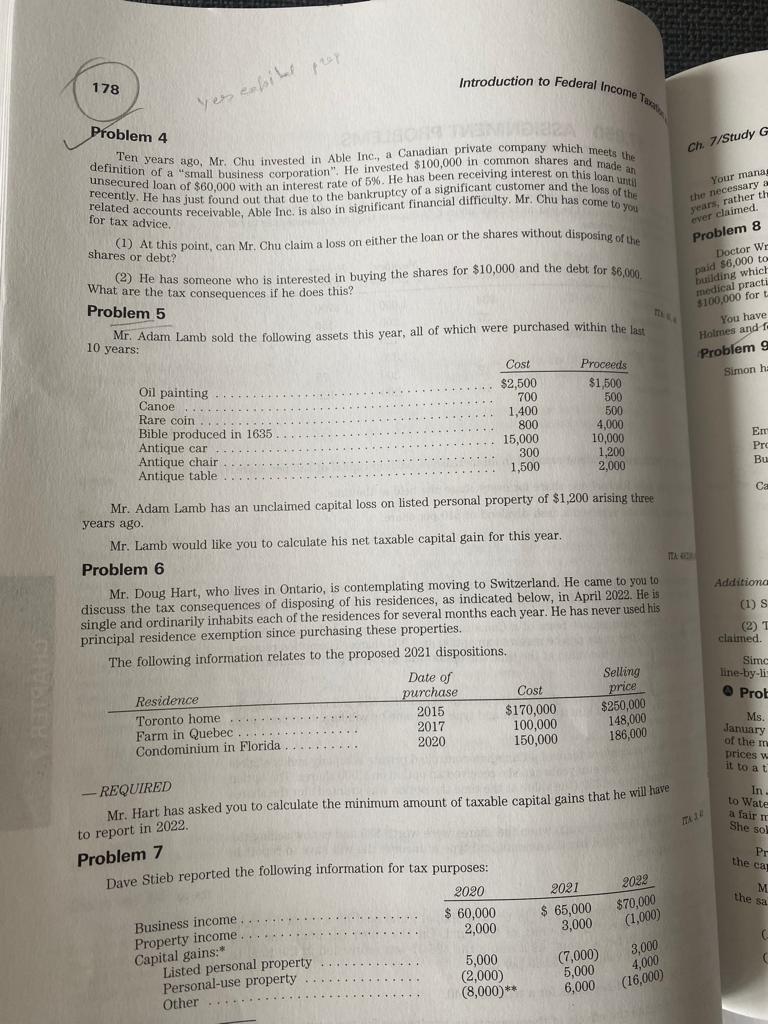

178 Problem 4 yes capital prep Introduction to Federal Income Tax definition of a "small business corporation". He invested $100,000 in common shares and made an Ten years ago, Mr. Chu invested in Able Inc., a Canadian private company which meets the unsecured loan of $60,000 with an interest rate of 5%. He has been receiving interest on this loan until recently. He has just found out that due to the bankruptcy of a significant customer and the loss of the related accounts receivable, Able Inc. is also in significant financial difficulty. Mr. Chu has come to you for tax advice. (1) At this point, can Mr. Chu claim a loss on either the loan or the shares without disposing of the shares or debt? What are the tax consequences if he does this? (2) He has someone who is interested in buying the shares for $10,000 and the debt for $6,000 Problem 5 Mr. Adam Lamb sold the following assets this year, all of which were purchased within the last 10 years: Ch. 7/Study G Your manag the necessary a years, rather th ever claimed. Problem 8 Doctor Wr paid $6,000 to building which medical practi $100,000 for t You have Holmes and f Problem 9 Simon ha Oil painting Canoe Rare coin Bible produced in 1635 Antique car Antique chair Antique table Cost Proceeds $2,500 700 1,400 $1,500 500 500 800 4,000 15,000 10,000 300 1,200 1,500 2,000 Em Pro Bu Ca Mr. Adam Lamb has an unclaimed capital loss on listed personal property of $1,200 arising three years ago. Mr. Lamb would like you to calculate his net taxable capital gain for this year. Problem 6 Mr. Doug Hart, who lives in Ontario, is contemplating moving to Switzerland. He came to you to discuss the tax consequences of disposing of his residences, as indicated below, in April 2022. He is single and ordinarily inhabits each of the residences for several months each year. He has never used his principal residence exemption since purchasing these properties. TEA Additiona (1) S (2) T claimed. Date of Selling Simc line-by-lin purchase Cost price 2015 $170,000 $250,000 Prob 2017 100,000 148,000 2020 150,000 186,000 The following information relates to the proposed 2021 dispositions. Residence Toronto home Farm in Quebec. Condominium in Florida - - REQUIRED Mr. Hart has asked you to calculate the minimum amount of taxable capital gains that he will have to report in 2022. Problem 7 Dave Stieb reported the following information for tax purposes: Business income Property income Capital gains:* Listed personal property Personal-use property Other 2020 2021 2022 $ 60,000 $ 65,000 2,000 3,000 $70,000 (1,000) 5,000 (7,000) 3,000 (2,000) 5,000 4,000 (8,000)** 6,000 (16,000) Ms. January of the m prices w it to a t In- to Wate a fair m She sol Pr the cap M the sa C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets address each problem step by step Problem 4 1 Can Mr Chu claim a loss on the loan or the shares without disposing of them Under Canadian tax law ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started