Answered step by step

Verified Expert Solution

Question

1 Approved Answer

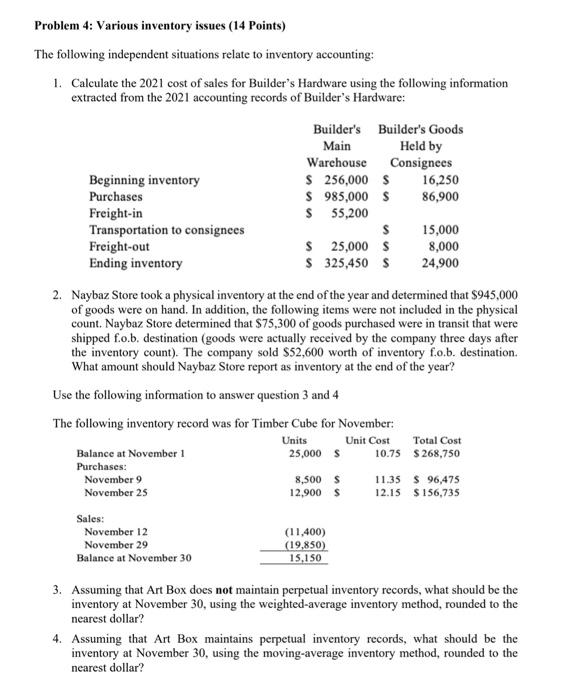

Problem 4: Various inventory issues (14 Points) The following independent situations relate to inventory accounting: 1. Calculate the 2021 cost of sales for Builder's

Problem 4: Various inventory issues (14 Points) The following independent situations relate to inventory accounting: 1. Calculate the 2021 cost of sales for Builder's Hardware using the following information extracted from the 2021 accounting records of Builder's Hardware: Beginning inventory Purchases Freight-in Transportation to consignees Freight-out Ending inventory Balance at November 1 Purchases: November 9 November 25 Sales: November 12 November 29 Balance at November 30 Builder's Main Warehouse S 256,000 S $ 985,000 $ $ 55,200 2. Naybaz Store took a physical inventory at the end of the year and determined that $945,000 of goods were on hand. In addition, the following items were not included in the physical count. Naybaz Store determined that $75,300 of goods purchased were in transit that were shipped f.o.b. destination (goods were actually received by the company three days after the inventory count). The company sold $52,600 worth of inventory fo.b. destination. What amount should Naybaz Store report as inventory at the end of the year? Use the following information to answer question 3 and 4 The following inventory record was for Timber Cube for November: Units Unit Cost S $ 25,000 S $ 325,450 S Builder's Goods Held by Consignees 25,000 S 8,500 $ 12,900 S (11,400) (19,850) 15,150 16,250 86,900 15,000 8,000 24,900 Total Cost 10.75 $268,750 11.35 $ 96,475 12.15 $156,735 3. Assuming that Art Box does not maintain perpetual inventory records, what should be the inventory at November 30, using the weighted-average inventory method, rounded to the nearest dollar? 4. Assuming that Art Box maintains perpetual inventory records, what should be the inventory at November 30, using the moving-average inventory method, rounded to the nearest dollar?

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started