Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 4-18 and PROBLEM 4-19 Problem 4-18 (IAA) Newton Company is involved in litigation regarding a faulty product sold in a prior year. that the

PROBLEM 4-18 and PROBLEM 4-19

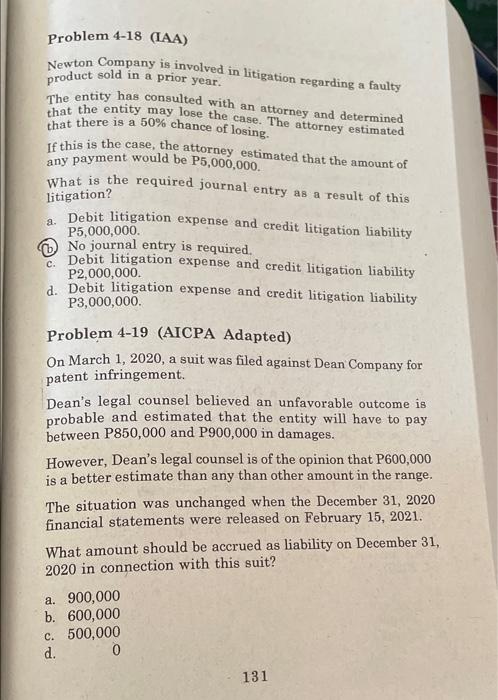

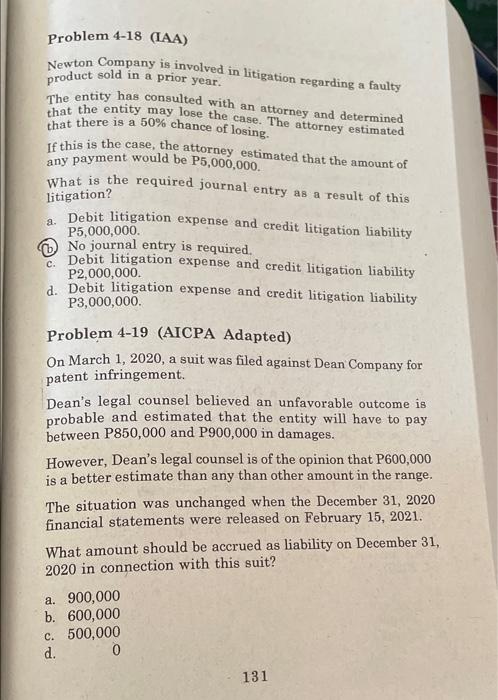

Problem 4-18 (IAA) Newton Company is involved in litigation regarding a faulty product sold in a prior year. that the entity may lose the case. The attorney estimated that there is a 50% chance of losing. litigation? any payment would be P5,000,000. that the amount of What is the required journal entry as a result of this a. Debit litigation expense and credit litigation liability No journal entry is required. C. Debit litigation expense and credit litigation liability d. Debit litigation expense and credit litigation liability P5,000,000 P2,000,000 P3,000,000 Problem 4-19 (AICPA Adapted) On March 1, 2020, a suit was filed against Dean Company for patent infringement. Dean's legal counsel believed an unfavorable outcome is probable and estimated that the entity will have to pay between P850,000 and P900,000 in damages. However, Dean's legal counsel is of the opinion that P600,000 is a better estimate than any than other amount in the range. The situation was unchanged when the December 31, 2020 financial statements were released on February 15, 2021. What amount should be accrued as liability on December 31, 2020 in connection with this suit? a. 900,000 b. 600,000 c. 500,000 d. 0 131

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started