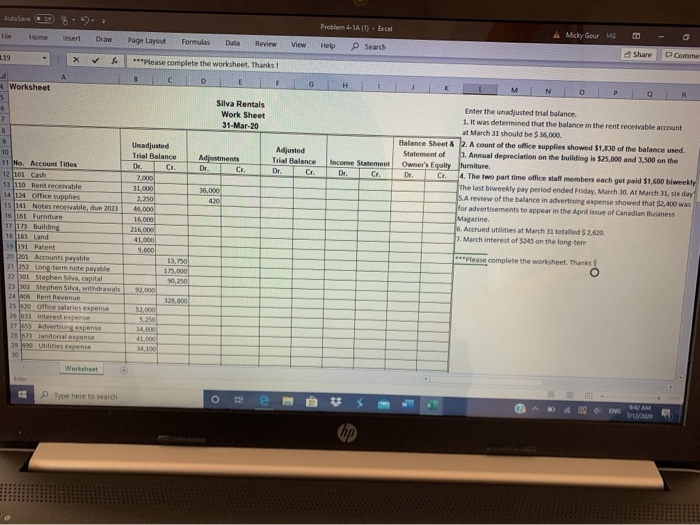

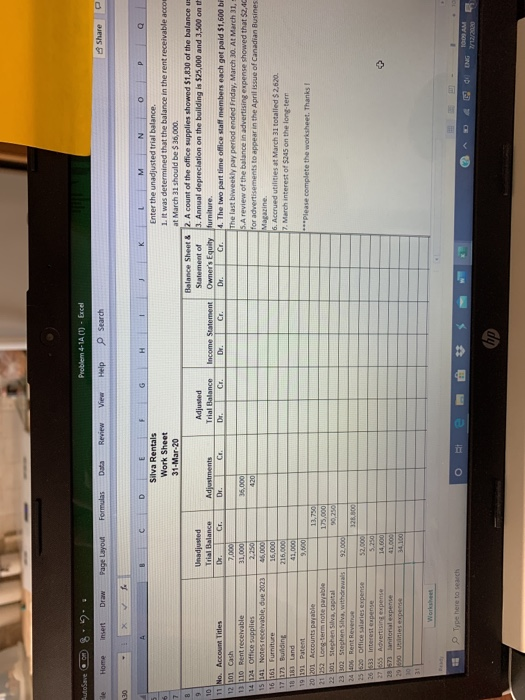

Problem 4-1A (1) - Excel File Home Insert Draw Page Layout A Micky Gour MC Formulas Das Review View Help Search 119 Share pCornume X ***Please complete the worksheet. Thanks! C 4 Worksheet G H O R 6 7 Silva Rentals Work Sheet 31-Mar-20 Adjustments Dr. Cr, Adjusted Trial Balance Dr. Cr. Income Statement Dr. CE 36,000 420 8 9 10 11 No. Account Titles 12 101 Cash 13110 Rent receivable 14 124 Office supplies 15 141 Notes receivable, due 2023 16 161 Furniture 17 173 Building 13 13 Land 19191 Patent 20 201 Accounts payable 21352 Long term note payable 22101 Stephen Silva, capital 23302 Stephen Silva, withdrawal 24406 Rent Revenue 25520 Office salaries expense Unadjusted Trial Balance Dr. CA 7.000 31,000 2,250 46,000 16.000 216.000 41.000 9,000 11.750 175.000 90,250 22.000 32,300 52,000 5,250 14.500 41.000 34,100 Enter the unadjusted trial balance. 1. It was determined that the balance in the rent receivable account at March 31 should be $1,000 Balance Sheet & 2. A count of the office supplies showed 51,830 of the balance used. Statement of Annual depreciation on the building is $25,000 and 3.500 on the Owner's Equity furniture De CH, 4. The two part time office staff members each get paid $1,600 biweekly The last biweekly pay period ended Friday, March 30, At March 31, six day S. A review of the balance in advertising expense showed that $2,400 was for advertisements to appear in the April issue of Canadian Business Magazine 6. Accrued utilities at March 31 totalled $2.620. 7. March interest of 245 on the long-ter please complete the worksheet. Thanks O 27-55 Advertispense 2016 Janitorial sense 299 Utilities expense 30 Worksheet Type here to search O BCAM hop AutoSave Problem 4-1A (0) - Excel Home Insert Draw Page Layout Formulas Review View Share Help Search 30 A D H 6 Silva Rentals Work Sheet 31-Mar-20 7 8 9 Adjustments Dr. C. Adjusted Trial Balance Dr. Cr. Income Statement Dr. Cr. K M N Q Enter the unadjusted trial balance. 1. It was determined that the balance in the rent receivable accom at March 31 should be $ 36,000. Balance Sheet & 2. A count of the office supplies showed $1,830 of the balance u Statement of 3. Annual depreciation on the building is $25,000 and 3,500 onth Owner's Equity furniture. Dr. 4. The two part time office staff members each get paid $1,600 bp The last biweekly pay period ended Friday, March 30. At March 31, S. A review of the balance in advertising expense showed that $2,40 for advertisements to appear in the April issue of Canadian Busines Magazine 6. Accrued utilities at March 31 totalled $ 2,620 7. March interest of $245 on the long-term 35,000 420 10 11 No. Account Titles 12 101 Cash 13110 Rent receivable 14 124 Office supplies 15 141 Notes receivable, due 2023 16 161 Furniture 17 173 Building 1813 Land 19 191 Patent 20 201 Accounts payable 21 252 Long term note payable 22301 Stephens.capital 23302 Stephen Sily, withdrawals 24 406 Rent Revenue 25 520 Office salaries expense 26 931 interest expense 27655 Advertising expense 28 ) lateral expense 299 Unisex Unadjusted Trial Balance Dr. 7,000 31,000 2,250 45,000 16,000 216.000 41,000 9,600 13.750 175.000 90,250 92.000 125,000 52.000 5.250 14.000 11.000 34,100 Please complete the worksheet. Thanks! 31 Worksheet Type here to search O BE + 100AM ING