Answered step by step

Verified Expert Solution

Question

1 Approved Answer

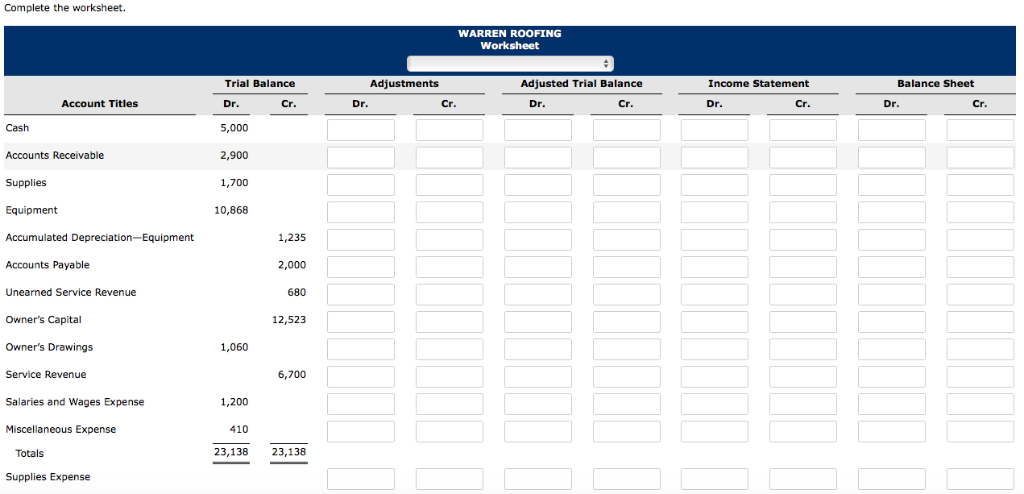

Problem 4-1A The trial balance columns of the worksheet for Warren Roofing at March 31, 2017, are as follows. WARREN ROOFING Worksheet For the Month

Problem 4-1A

The trial balance columns of the worksheet for Warren Roofing at March 31, 2017, are as follows.

| WARREN ROOFING Worksheet For the Month Ended March 31, 2017 | ||||

| Trial Balance | ||||

| Account Titles | Dr. | Cr. | ||

| Cash | 5,000 | |||

| Accounts Receivable | 2,900 | |||

| Supplies | 1,700 | |||

| Equipment | 10,868 | |||

| Accumulated DepreciationEquipment | 1,235 | |||

| Accounts Payable | 2,000 | |||

| Unearned Service Revenue | 680 | |||

| Owners Capital | 12,523 | |||

| Owners Drawings | 1,060 | |||

| Service Revenue | 6,700 | |||

| Salaries and Wages Expense | 1,200 | |||

| Miscellaneous Expense | 410 | |||

| 23,138 | 23,138 | |||

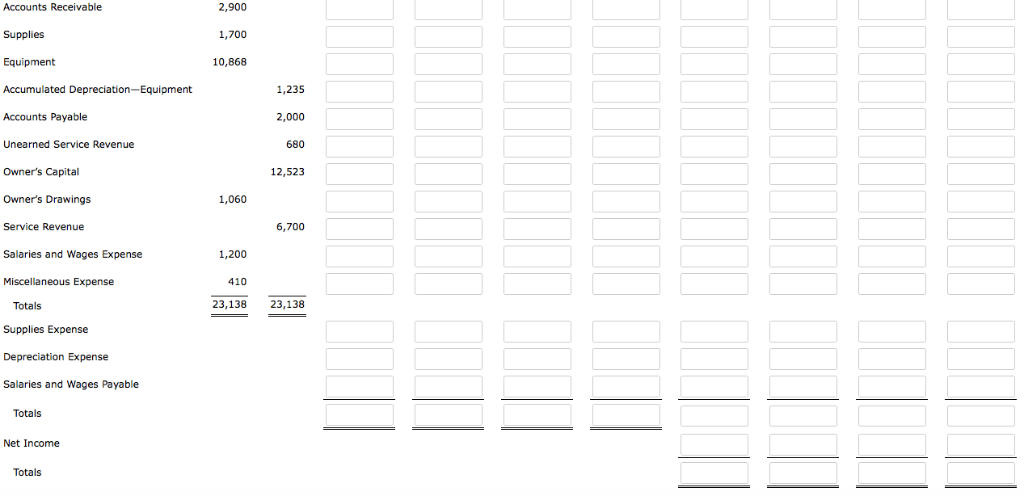

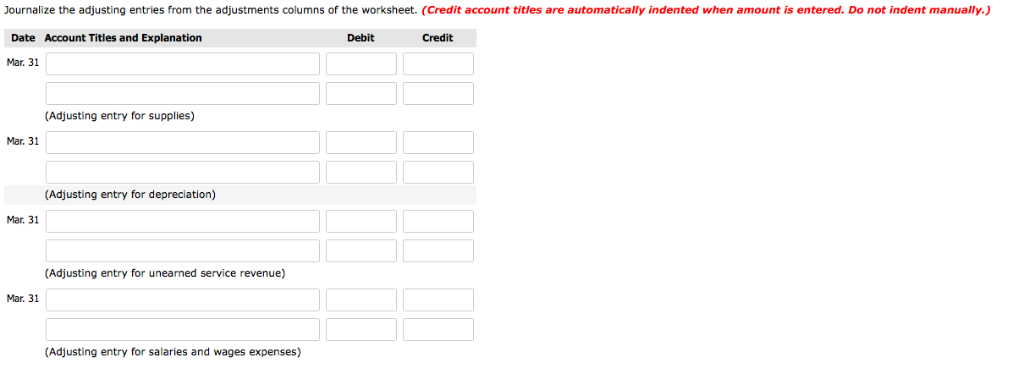

Other data:

| 1. | A physical count reveals only $500 of roofing supplies on hand. | |

| 2. | Depreciation for March is $247. | |

| 3. | Unearned revenue amounted to $240 at March 31. | |

| 4. | Accrued salaries are $800. |

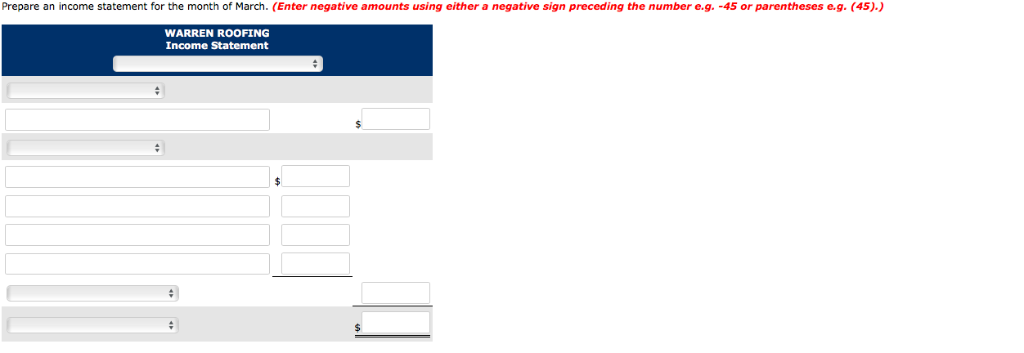

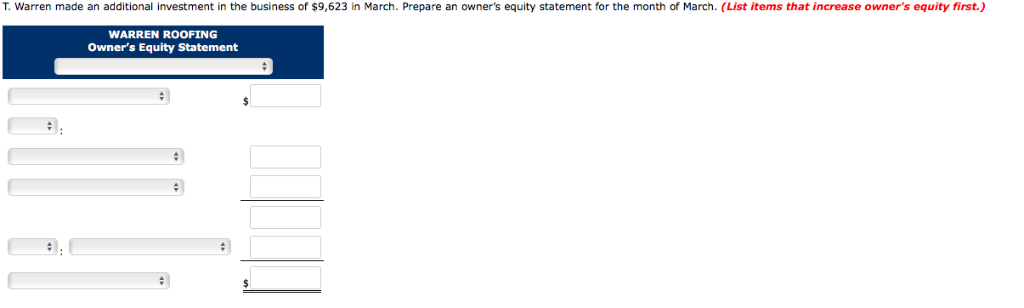

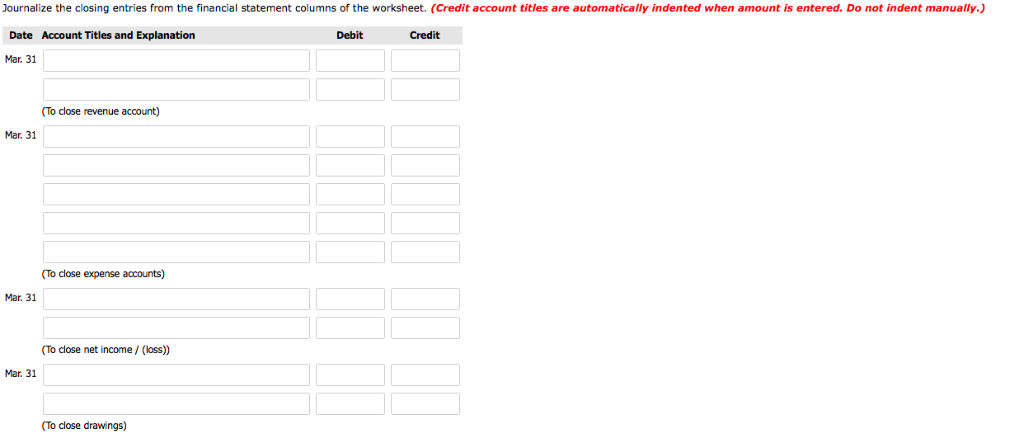

Prepare a classified balance sheet at March 31. (List Current Assets in order of liquidity.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started