Question: Problem 4-20 Sales Mix; Multi-Product Break-Even Analysis [LO9] Smithen Company, a wholesale distributor, has been operating for only a few months. The company sells three

![Problem 4-20 Sales Mix; Multi-Product Break-Even Analysis [LO9] Smithen Company, a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbe6dcdd64a_66866fbe6dc7ed7a.jpg)

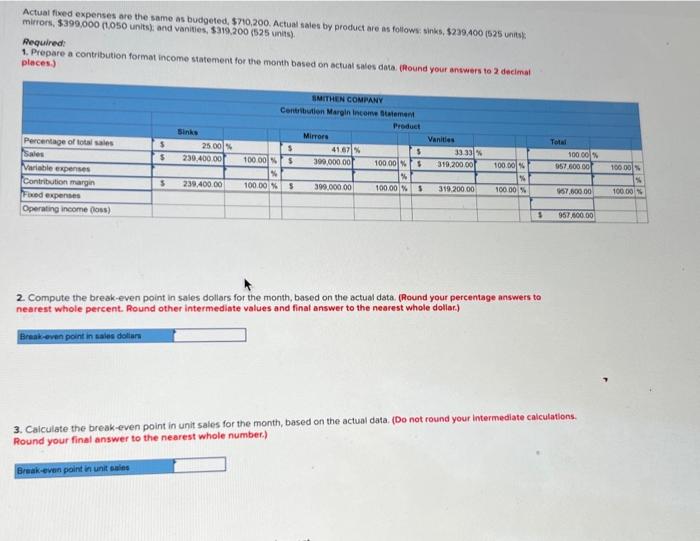

Problem 4-20 Sales Mix; Multi-Product Break-Even Analysis (LO9) mirrors, and vanities. Eixtgeted sales by product and in total for the coning month are shewn below based on planned usit sales as folows. As shown by these data, operating income is budgeted at $45,400 for the month, break-even sales dolars at $892.97953, and brewkeven una sales at 194575 . Assume that actuat sales for the manth fotal $957,600 (2100 units), with the CM ratio and per unt anounts the same as budoeted. Actual fixed expenses are the same as budgeted, $710,200. Actual sales by peoduct are as follows: sinks, $239.400 ( 525 unts): mirrors, $399,000 (1,050 unas); and vanities, $319,200 (525 uncs) Required: 1. Prepare a contribution format income statement for the month based on actual saies data. (Round your answers to 2 decinal places) Actual fixed expenses are the same as budgeted, $7n0,200. Actual sales by product are as follows: sinks, $239,400 (525 units) mirrors, $399,000 (1,050 units), and vanities, $319,200 (525 unis). Aequired: 1. Prepare a contribution format income statement for the month based on sctual salos data. (flound your anwwers to 2 decimat places.) 2. Compute the break-even point in sales dollars for the month, based on the actual data. (Round your percentage answers to nearest whole percent. Round other intermediate values and final answer to the nearest whole dollar.) 3. Caiculate the break-even point in unit sales for the month, based on the actual data. (Do not round your intermediate calculations. Round your final answer to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts