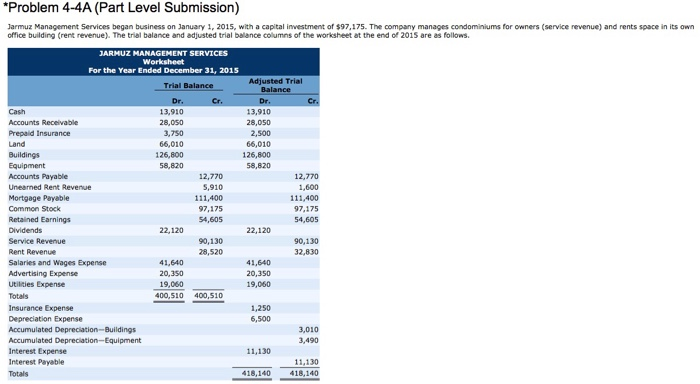

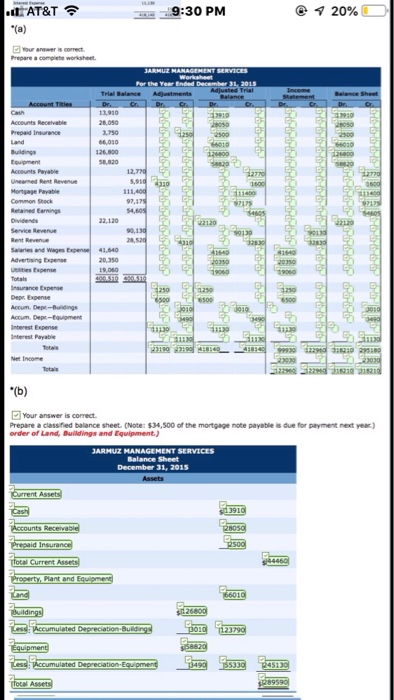

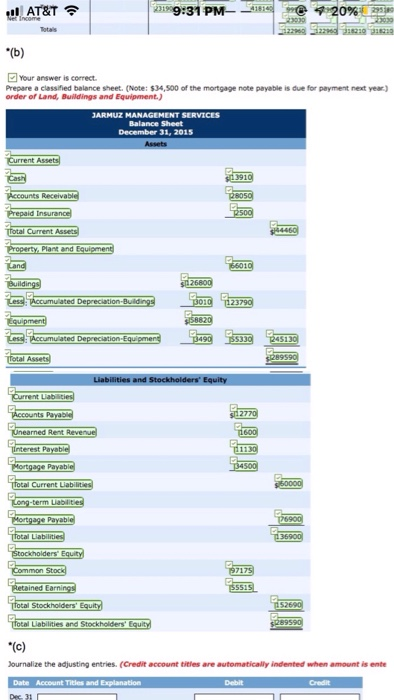

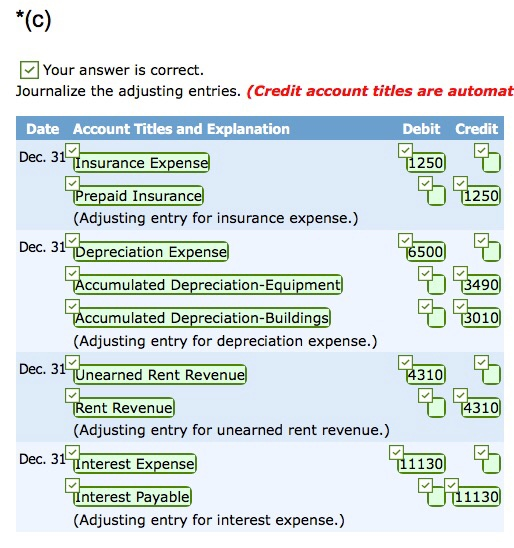

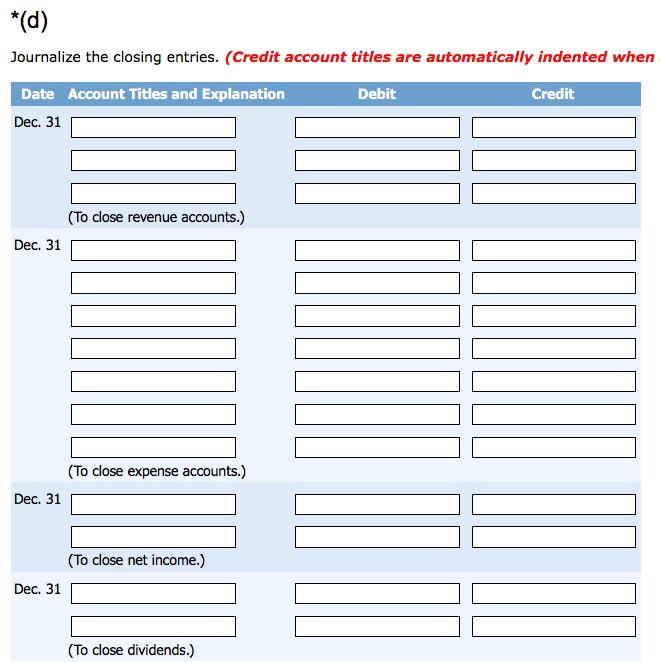

Problem 4-4A (Part Level Submission) Jarmuz Management Services began business on January 1, 2015, wth a capital investment of $97,175. The company manages condominiums for owners (service revenue) and rents space in its own office building (rent revenue). The trial balance and adjusted trial balance columns of the worksheet at the end of 2015 are as follows. JARMUZ MANAGEM ENT SERVICES For the Year Ended December 31, 2015 Adjusted Trial 13,910 28,050 3,750 13,910 28,050 Accounts Receivabke Prepaid Insurance 66,010 26,800 58,820 58,820 Accounts Payable Unearned Rent Revenue Mortgage Payable Common Stock Retained Earnings 12,770 5,910 111,400 97,175 111,400 22,120 22,120 90,130 Service Revenue Rent Revenue Salaries and Wages Expense 41,640 20,350 19,060 Utilties Expense 400519,060 Insurance Expense 6,500 Interest Expense Interest Payable 418,140 418,140 AT&T 9:30 PM Prepare a complete worksheet 13,910 Accounts Recelvable Prepaid Insurance Land 124800 Accounts Payable unewned Rent Revenue Mortgage Payable 111,400 Retained Earnings 22,120 a120 Salanies and Wages Expens Advertising Expense uelities Expense 41,640 20,350 nsurance Expense Oepr. Expense nberest Payable Your answer is correct. Prepare a classified balance sheet. (Note: $34,500 of the mortgage note payable is due for payment next year) order of Land, Buildings and Equipment) ARMUZ HANAGEMENT Salance Sheet December 31, 20S ated Deprecia nis 9:31 PM am r@20%)m AT&T Your answer is correct Prepare a classified balance sheet. (Note: $34,500 of the mortgage note payable is due for payment next year) 28059 roperty, Plant and Equipm 2770 "Bud holder Em 551 Journalize the adjusting entries. (Credit account tities are automatically indented when amount is ente | Your answer is correct. Journalize the adjusting entries. (Credit account titles are automat Date Account Titles and Explanation Dec. 31 Debit Credit 250 nsurance ExpenS Prepaid Insurance (Adjusting entry for insurance expense.) Dec. 31 epreciation Expense ccumulated Depreciation-Equipment ccumulated Depreciation-Buildings 490 3010 73101 % (Adjusting entry for depreciation expense.) Dec. 31 Unearned Rent Revenu ent Revenue (Adjusting entry for unearned rent revenue.) 11130 Dec. 31 nterest Expense nterest Payable 1130 (Adjusting entry for interest expense.) Journalize the closing entries. (Credit account titles are automatically indented when Date Account Titles and Explanation Dec. 31 Debit Credit (To close revenue accounts.) Dec. 31 (To close expense accounts.) Dec. 31 (To close net income.) Dec. 31 (To close dividends.)