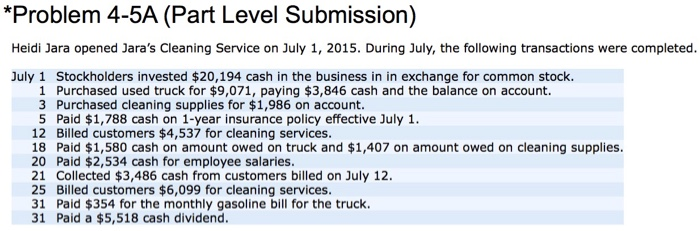

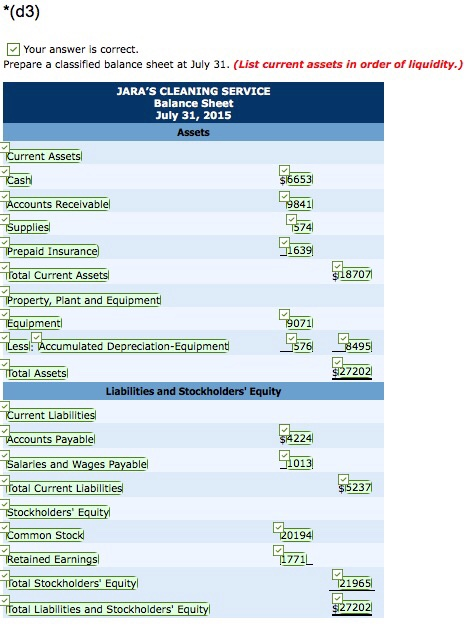

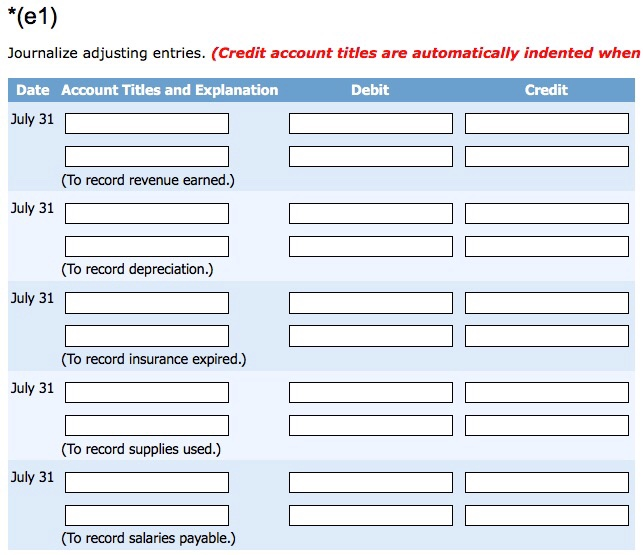

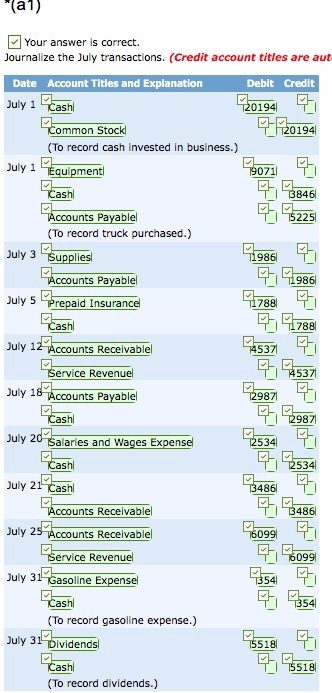

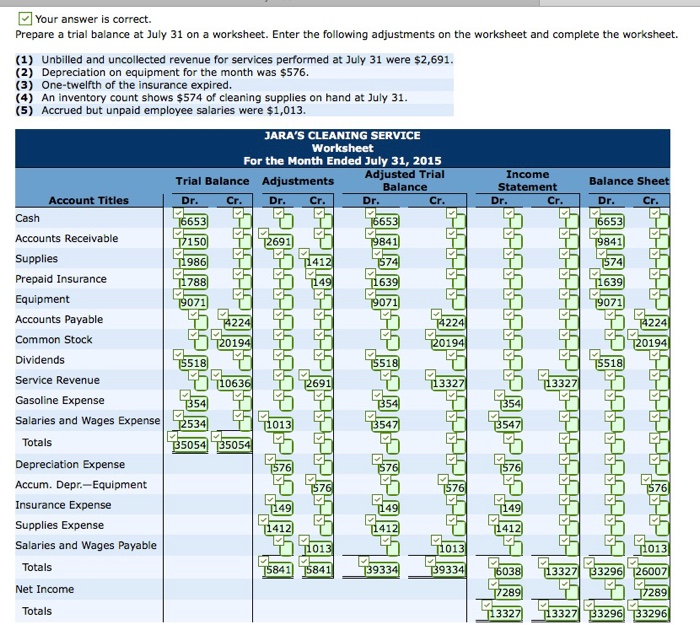

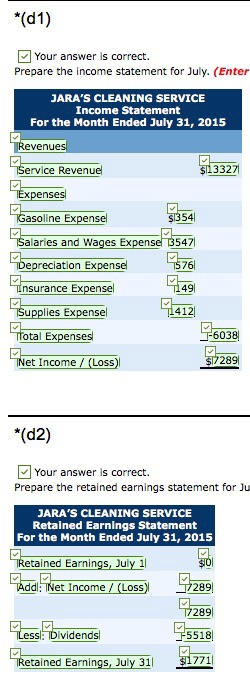

"Problem 4-5A (Part Level Submission) Heidi Jara opened Jara's Cleaning Service on July 1, 2015. During July, the following transactions were completed. July 1 Stockholders invested $20,194 cash in the business in in exchange for common stock. 3 1 Purchased used truck for $9,071, paying $3,846 cash and the balance on account. 3 Purchased cleaning supplies for $1,986 on account. 5 Paid $1,788 cash on 1-year insurance policy effective July 1. 12 Billed customers $4,537 for cleaning services 18 Paid $1,580 cash on amount owed on truck and $1,407 on amount owed on cleaning supplies. 20 Paid $2,534 cash for employee salaries. 21 Collected $3,486 cash from customers billed on July 12 25 Billed customers $6,099 for cleaning services 31 Paid $354 for the monthly gasoline bill for the truck. 31 Paid a $5,518 cash dividend. *(d3) ] Your answer is correct. Prepare a classified balance sheet at July 31. (List current assets in order of liquidity.) ARA'S CLEANING SERVICE Balance Sheet July 31, 2015 Assets urrent Assets 653 841 574 639 ash unts Recelvable paid Insurance tal Current Assets 18707 Plant and Equipment uipment 071/ ess: Accumulated Depreciation-Equipment 8495 27202 tal Assets Liabilities and Stockholders' Equi urrent Liabilitles nts Payable 224 013 laries and Wages Payable 237 tal Current Liabilitles tockholders Equit ommon Stock etained Earnings otal Stockholders' Equit 0194 771L 1965 27202 tal Liabilitles and Stockholders' Equi "(e1) Journalize adjusting entries. (Credit account titles are automatically indented when Date Account Titles and Explanation July 31 Debit Credit (To record revenue earned.) July 31 (To record depreciation.) July 31 (To record insurance expired.) July 31 (To record supplies used.) July 31 (To record salaries payable.) (at) Your answer is correct. Journalize the July transactions. (Credit account titles are aut Date Account Titles and Explanation Debit Credit 20194 % 20194 July 1 Cash Common Stock (To record cash invested in business.) July 1 Equipmentl 071 Cash 846 225 ccounts Payablel (To record truck purchased.) 7986 % Duly 3 Supplies ccounts Payablel 1986 7788 -I July 5 Prepaid insurance T788 as uly 12 ACcounts Receivablel 5371 ervice Revenuel July 18 TAccounts Payable 9871 fashi 12987 July 20 salaries and Wages Expensel as 486 % July 21 Cash 486 ccounts Receivable 486 July 25 Accounts Receivablel 099 ervice Revenue 6099 54 % Duly 31 Gasoline Expense 54 as (To record gasoline expense.) 15518/ uly 31 Dividends 518 as (To record dividends.) Your answer is correct. Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilled and uncollected revenue for services performed at July 31 were $2,691. (2) Depreciation on equipment for the month was $576 (3) One-twelfth of the insurance expired. (4) An inventory count shows $574 of cleaning supplies on hand at July 31 (5) Accrued but unpaid employee salaries were $1,013. JARA'S CLEANING SERVICE Worksheet For the Month Ended July 31, 2015 Adjusted Trial Income Statement Trial Balance Adjustments Balance Sheet Balance Dr Account Titles Dr Cr Dr. Cr. Cr Dr Cr Dr. 65 841 Cr Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Common Stock Dividends Service Revenue Gasoline Expense Salaries and Wages Expense2534 653 150 986 788 071 841 74 63 071 691 74 163 071 224 224 0194 20194 518 51 5518 0636 691 3327 332 54 013 Totals Depreciation Expense Accum. Depr.-Equipment Insurance Expense Supplies Expense Salaries and Wages Payable 5054 35054 76 412 412 41 01 013 038 3327 33296 26007 7289 3327 33296 133296 Totals 841 5841 9334 9334 Net Income Totals (d1) Your answer is correct. Prepare the income statement for July. (Enter JARA'S CLEANING SERVICE Income Statement For the Month Ended July 31, 2015 evenu 913327 ervice Revenue penses Gasoline Exoense alanes and Wages Expense 5471 76 49 412 Depreciation Expense nsurance Expensel Supplies Expense total Expenses 6038 37289 et Income/ (Loss) *(d2) Your answer is correct. Prepare the retained earnings statement for Ju ARA'S CLEANING SERVICE Retained Earnings Statement For the Month Ended July 31, 2015 Retained Earnings, July 1 ddl: Net Income/ (Loss) 289 ined Earnings, July 31