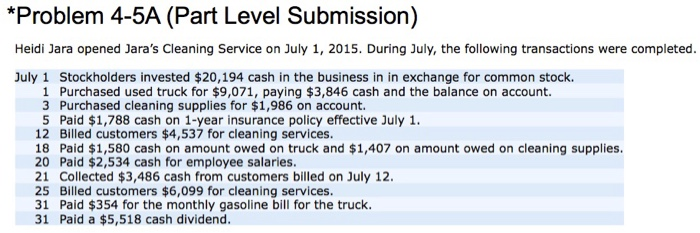

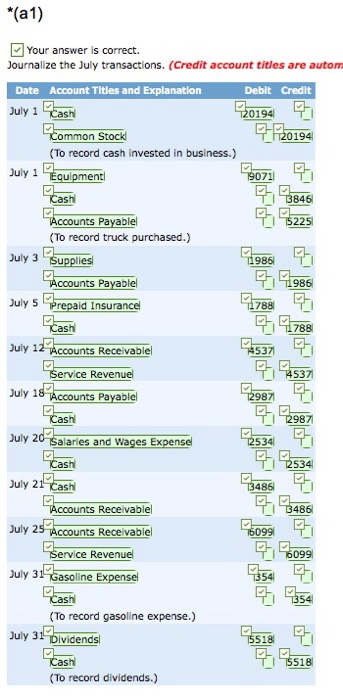

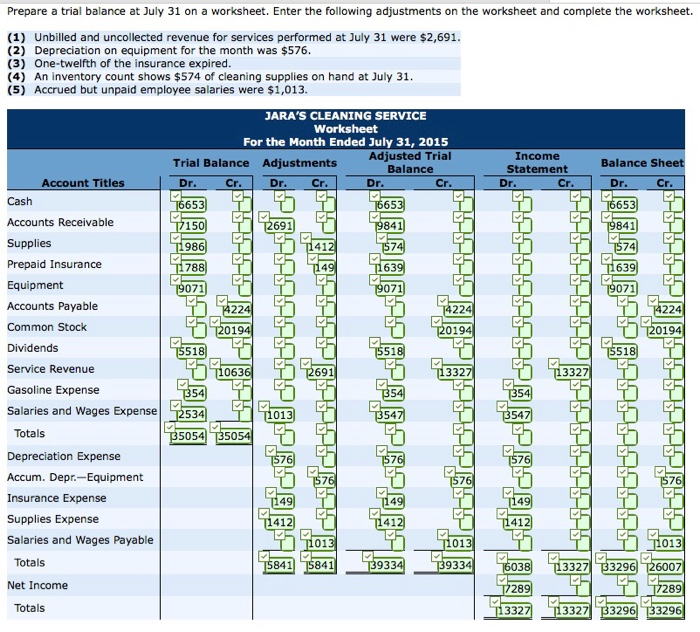

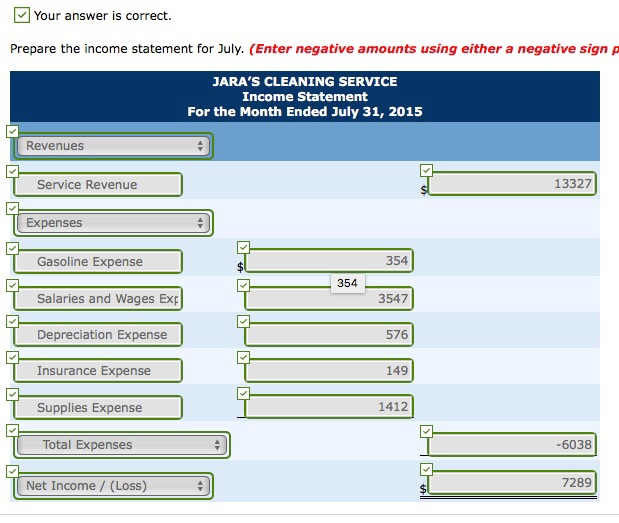

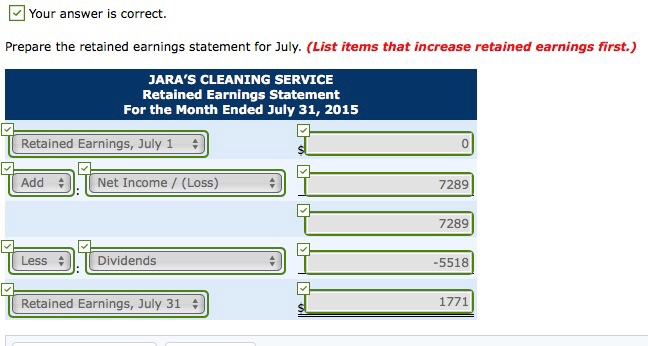

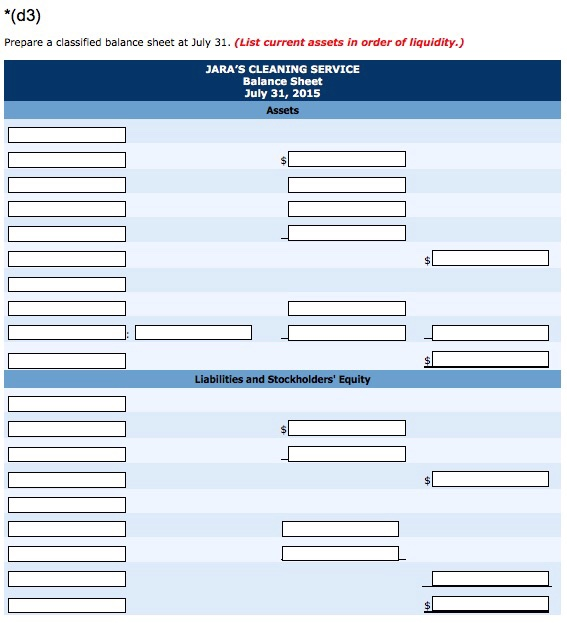

Problem 4-5A (Part Level Submission) Heidi Jara opened Jara's Cleaning Service on July 1, 2015. During July, the following transactions were completed. July 1 Stockholders invested $20,194 cash in the business in in exchange for common stock. 1 Purchased used truck for $9,071, paying $3,846 cash and the balance on account. 3 Purchased cleaning supplies for $1,986 on account. 5 Paid $1,788 cash on 1-year insurance policy effective July 1 12 Billed customers $4,537 for cleaning services. 18 Paid $1,580 cash on amount owed on truck and $1,407 on amount owed on cleaning supplies 20 Paid $2,534 cash for employee salaries 21 Collected $3,486 cash from customers billed on July 12 25 Billed customers $6,099 for cleaning services. 31 Paid $354 for the monthly gasoline bill for the truck. 31 Paid a $5,518 cash dividend. Your answer is correct. Journalize the July transactions. (Credit account titles are autom Debit Credit Date Account Titles and Explanation To record cash invested in business.) s Payablel To record truck purchased.) Payable id Insurance July 12 Accounts Receivablel ervice Revenue July 1 534-1 alanes and wages Expensel s Recelvablel Receivablel uly 3 31 Gasoline Expense To record gasoline expense.) (To record dividends.) Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilled and uncollected revenue for services performed at July 31 were $2,691. (2) Depreciation on equipment for the month was $576 (3) One-twelfth of the insurance expired. (4) An inventory count shows $574 of cleaning supplies on hand at July 31 (5) Accrued but unpaid employee salaries were $1,013. JARA'S CLEANING SERVICE Worksheet For the Month Ended July 31, 2015 Adjusted Trial Income Statement Trial Balance Adjustments Balance Sheet Balance Account Titles Dr Cr. Dr Ca Dr. Cr Dr Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Common Stock Dividends Service Revenue Gasoline Expense Salaries and Wages Expense 2534 653 653 65 691 841 841 788 63 071 071 071 224 224 20194 0194 0194 691 332 54 013 54 547 Totals Depreciation Expense Accum. Depr-Equipment Insurance Expense Supplies Expense Salaries and Wages Payable 5054 35054 49 412 013 013 Totals 13327 33296 T26007 289 841 5841 933 9334 Net Income 28 Totals 13327 33296 336 332 Ly Your answer is correct. Prepare the income statement for July. (Enter negative amounts using either a negative sign p JARA'S CLEANING SERVICE Income Statement For the Month Ended July 31, 2015 Revenues 13327 Service Revenue Expenses 354 Gasoline Expense Salaries and Wages Exp Depreciation Expense Insurance Expense Supplies Expense Total Expenses 3547 576 149 1412 -6038 7289 Net Income/ (Loss) Your answer is correct. Prepare the retained earnings statement for July. (List items that increase retained earnings first.) JARA'S CLEANING SERVICE Retained Earnings Statement For the Month Ended July 31, 2015 Retained Earnings, July 1 Add # L Net Income / (Loss) 7289 7289 Less Dividends -5518 Retained Earnings, July 31 "(d3) Prepare a classified balance sheet at July 31. (List current assets in order of liquidity.) JARA'S CLEANING SERVICE Balance Sheet July 31, 2015 Assets Liabilities and Stockholders' Equity