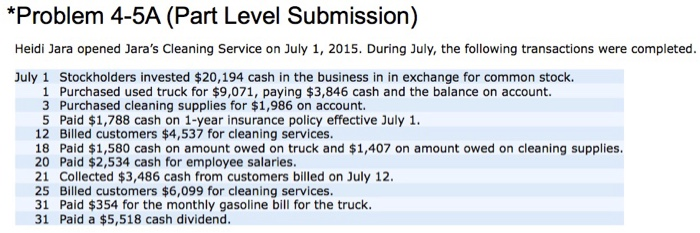

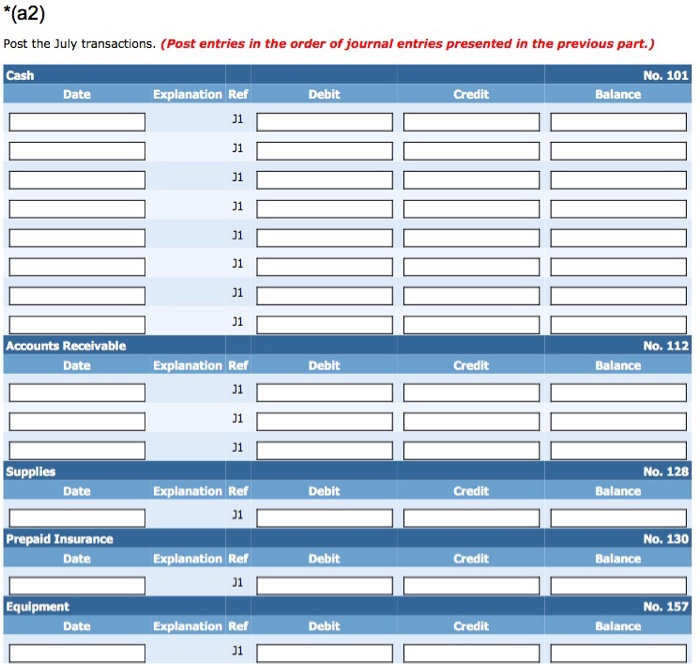

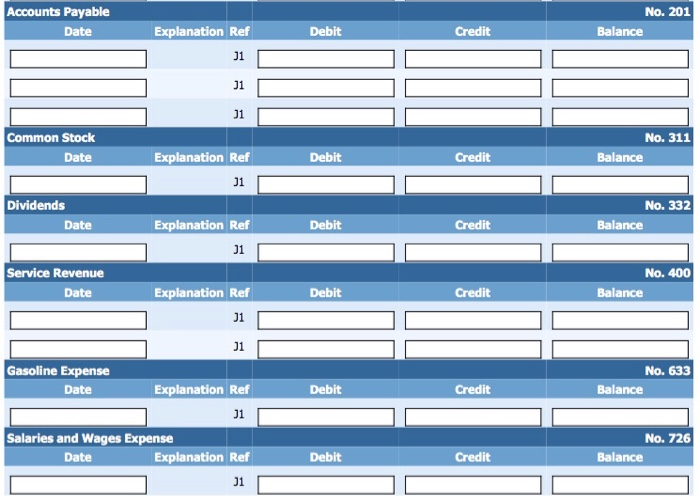

Problem 4-5A (Part Level Submission) Heidi Jara opened Jara's Cleaning Service on July 1, 2015. During July, the following transactions were completed. July 1 Stockholders invested $20,194 cash in the business in in exchange for common stock. 1 Purchased used truck for $9,071, paying $3,846 cash and the balance on account. 3 Purchased cleaning supplies for $1,986 on account. 5 Paid $1,788 cash on 1-year insurance policy effective July 1 12 Billed customers $4,537 for cleaning services. 18 Paid $1,580 cash on amount owed on truck and $1,407 on amount owed on cleaning supplies 20 Paid $2,534 cash for employee salaries 21 Collected $3,486 cash from customers billed on July 12 25 Billed customers $6,099 for cleaning services. 31 Paid $354 for the monthly gasoline bill for the truck. 31 Paid a $5,518 cash dividend. "(a1) Your answer is correct. Journalize the J July transactions. Credit account titles are automatically inder Date Account Titles and Explanation Debit Credit July 1 Cash 20194 T. T20194 mon Stock (To record cash invested in business.) July 1 quipment 071 3846 3235 7986 % 196 ble counts (To record truck purchased.) July 3 Supplies ounts Payable July Prepaid Insurance 788 1788 "As3 71 July 12 Accounts Receivablel 537 rvice Revenue July 1 987 E53.g July 20 Salaries and Wages Expense Cash July 21 Cash 534 486 3486 ounts Receivable counts Receivable ice July 31 Gasoline Expense 354 354 3518 (To record gasoline expense.) July 31 bividends 518 (To record dividends.) (a2) Post the July transactions. (Post entries in the order of journal entries presented in the previous part.) No. 101 Cash Debit Date Explanation Ref Balance Credit JI 01 Accounts Receivable No. 112 Explanation Ref Debit Credit Balance Date JI Supplies No. 128 Debit Explanation Ref Balance Date Credit Prepaid Insurance No. 130 Credit Date Explanation Ref Debit Balance Equipment No. 157 Debit Explanation Ref Credit Date Balance Accounts Payable No. 201 Explanation Ref Date Debit Credit Balance JI JI Common Stock No. 311 Balance Date Explanation Ref Debit Credit Dividends No. 332 Date Explanation Ref Debit Balance Credit Service Revenue No. 400 Debit Credit Date Explanation Ref Balance No. 633 Gasoline Expense Explanation Ref Debit Credit Date Balance JI Salaries and Wages Expense No. 726 Credit Date Explanation Ref Balance Debit JI