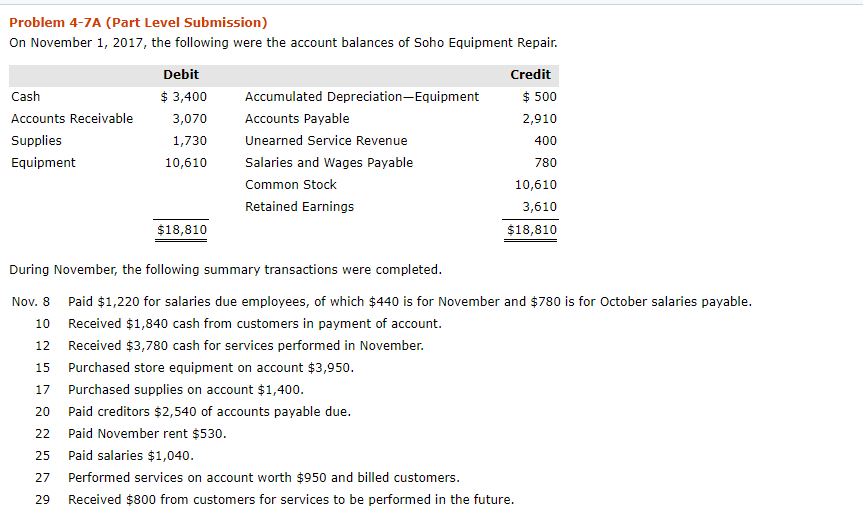

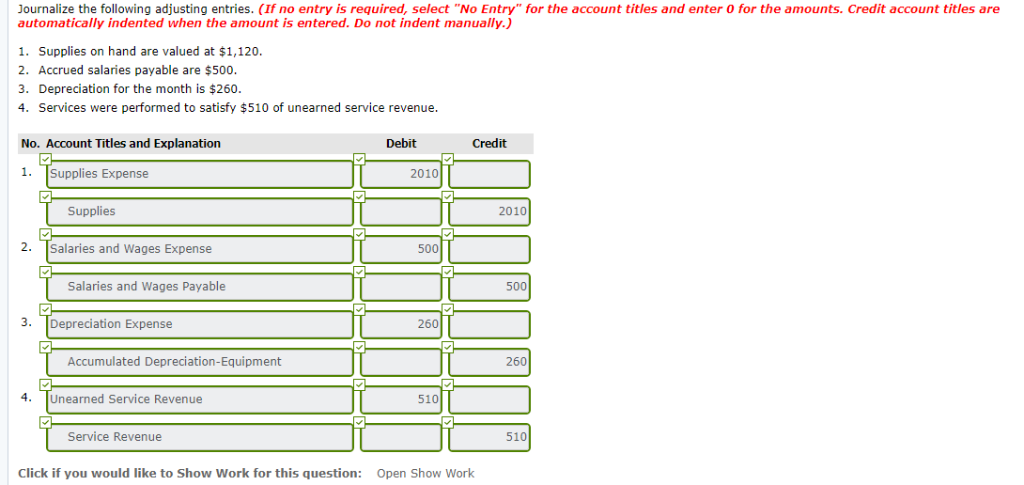

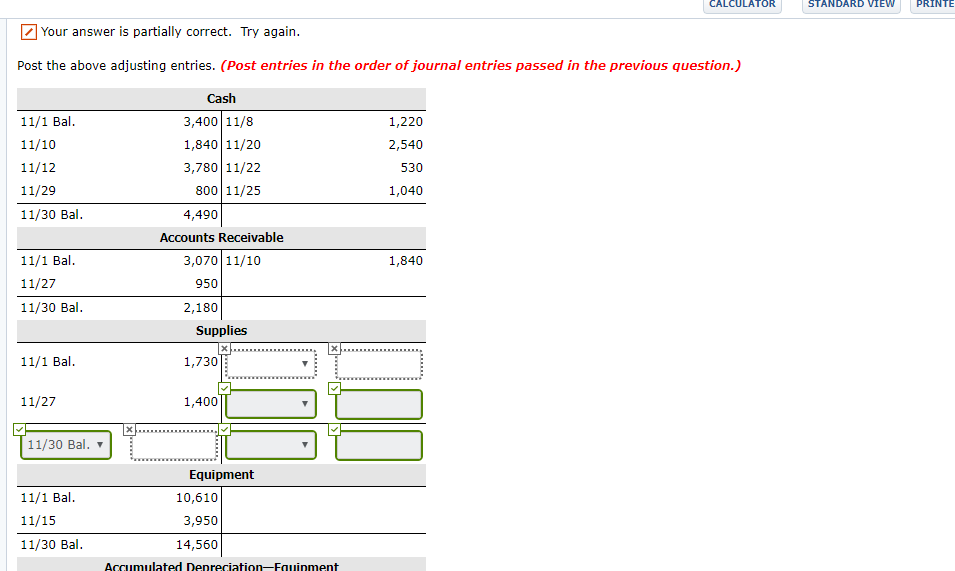

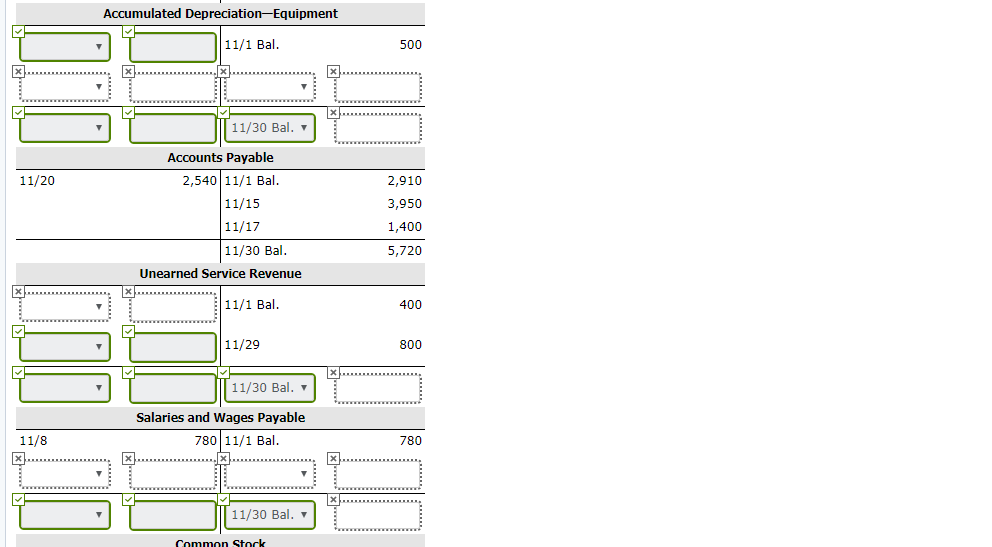

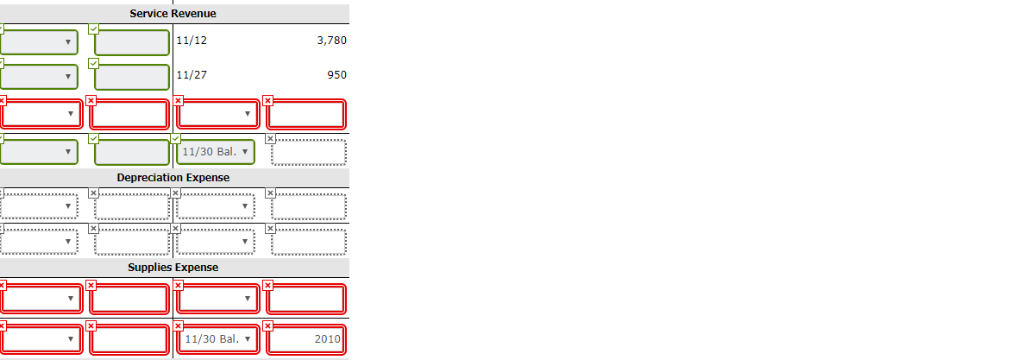

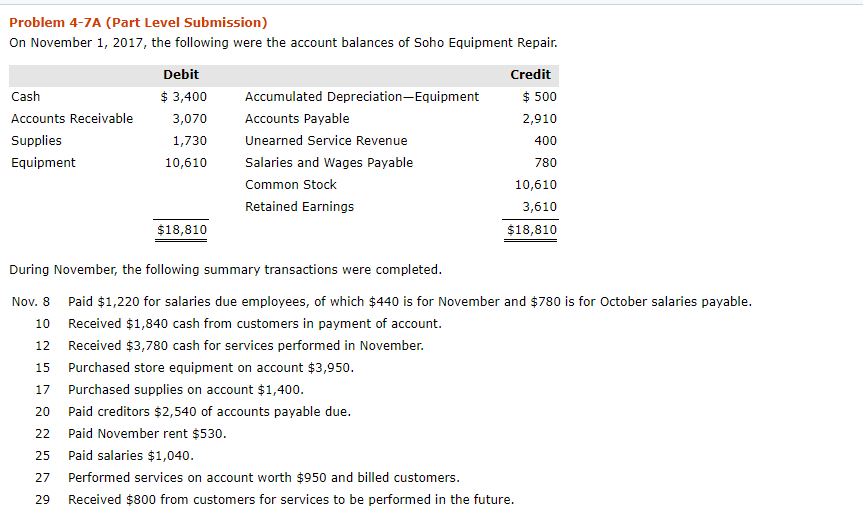

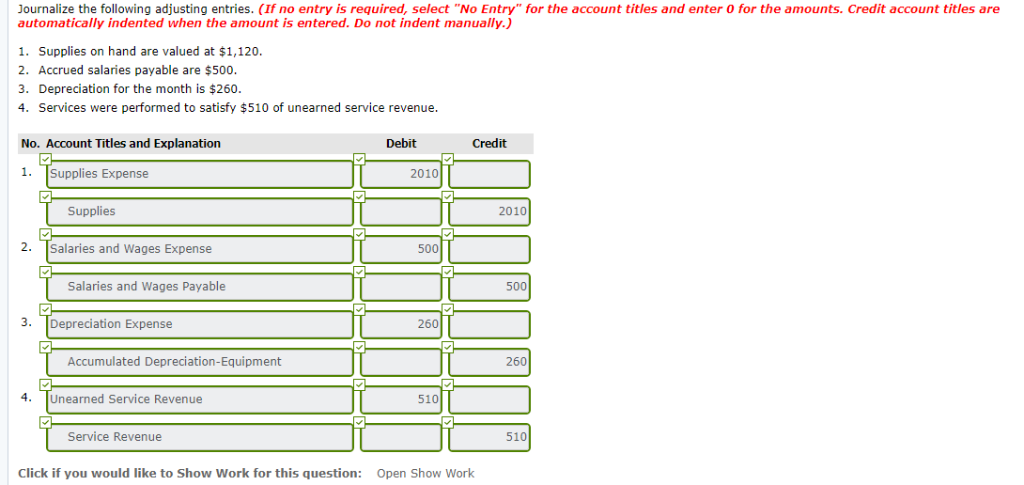

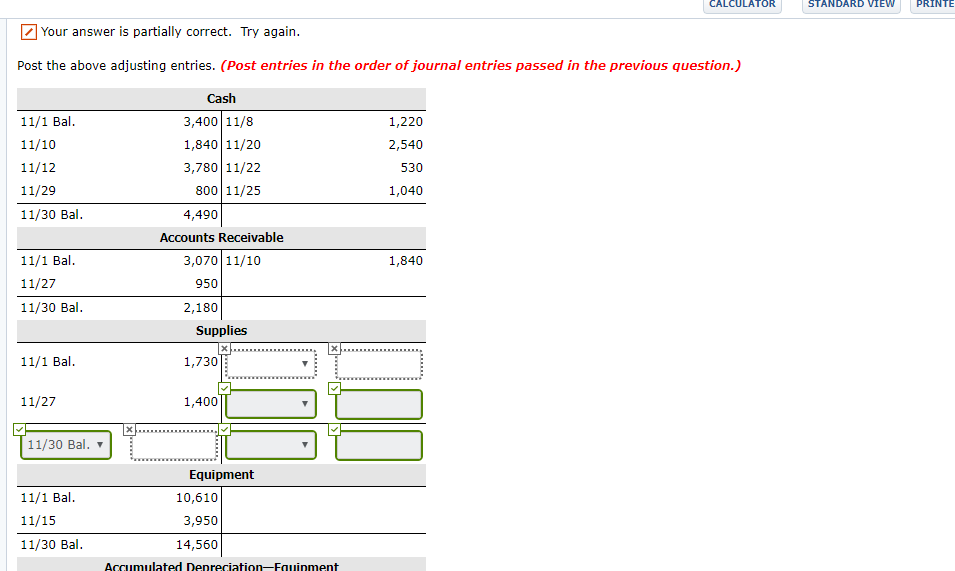

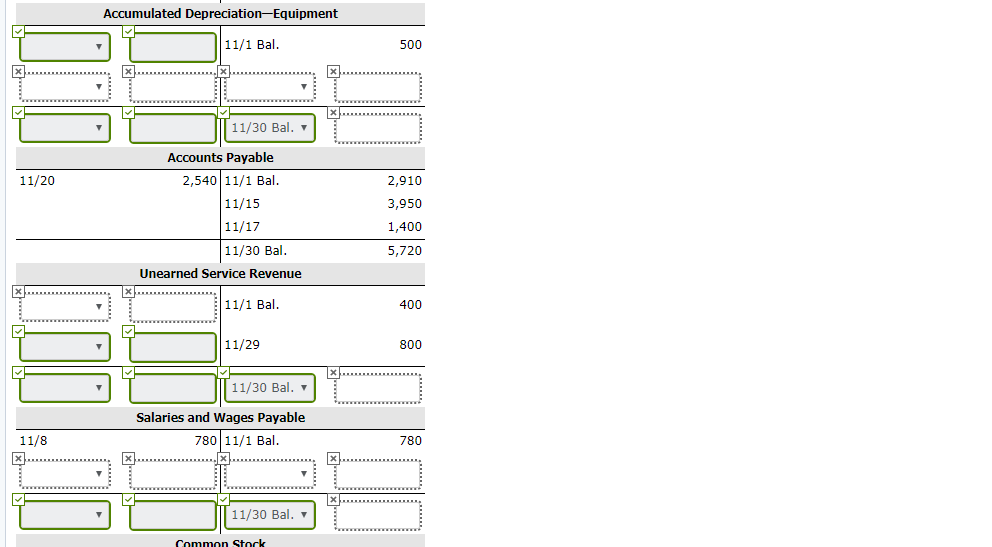

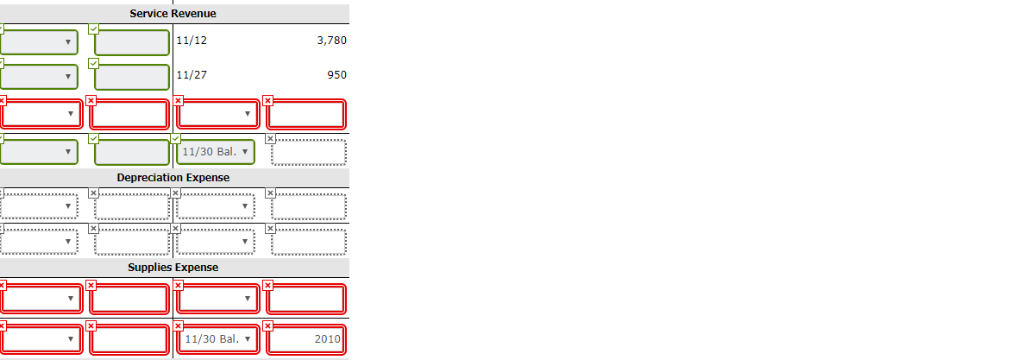

Problem 4-7A (Part Level Submission) On November 1, 2017, the following were the account balances of Soho Equipment Repair. Debit Credit 500 Cash 3,400 Accumulated Depreciation-Equipment Accounts Receivable Accounts Payable 3,070 2,910 Unearned Service Revenue Supplies 1,730 400 Equipment Salaries and Wages Payable 10,610 780 Common Stock 10,610 Retained Earnings 3,610 $18,810 $18,810 During November, the following summary transactions were completed Paid $1,220 for salaries due employees, of which $440 is for November and $780 is for October salaries payable. Nov. 8 Received $1,840 cash from customers in payment of account. 10 Received $3,780 cash for services performed in November. 12 Purchased store equipment on account $3,950 15 Purchased supplies on account $1,400 17 Paid creditors $2,540 of accounts payable due. 20 Paid November rent $530. 22 Paid salaries $1,040. 25 Performed services on account worth $950 and billed customers. 27 Received $800 from customers for services to be performed in the future. 29 Journalize the following adjusting entries. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 1. Supplies on hand are valued at $1,120. 2. Accrued salaries payable are $500. 3. Depreciation for the month is $260. 4. Services were performed to satisfy $510 of unearned service revenue. No. Account Titles and Explanation Debit Credit Supplies Expense 1. 2010 Supplies 2010 2. Salaries and Wages Expense 500l Salaries and Wages Payable 500 260 3. Depreciation Expense 260 Accumulated Depreciation- Equipment 510 4. Unearned Service Revenue Service Revenue 510 Click if you would like to Show Work for this question: Open Show Work CALCULATOR STANDARD VIEW PRINTE Your answer is partially correct. Try again Post the above adjusting entries. (Post entries in the order of journal entries passed in the previous question.) Cash 3,400 11/8 11/1 Bal 1,220 1,840 11/20 11/10 2,540 3,780 11/22 11/12 530 800 11/25 11/29 1,040 11/30 Bal 4,490 Accounts Receivable 3,070 11/10 11/1 Bal 1,840 11/27 950 11/30 Bal 2,180 Supplies 11/1 Bal 1,730 11/27 1,400 11/30 Bal. Equipment 11/1 Bal 10,610 11/15 3,950 11/30 Bal 14,560 Accumulated Depreciation-Fquipment Accumulated Depreciation Equipment 11/1 Bal 500 11/30 Bal Accounts Payable 2,540 11/1 Bal 11/20 2,910 11/15 3,950 11/17 1,400 11/30 Bal. 5,720 Unearned Service Revenue 11/1 Bal 400 11/29 800 11/30 Bal. Salaries and Wages Payable 780 11/1 Bal 11/8 780 11/30 Bal. Common Stock l .. Service Revenue 11/12 3,780 11/27 950 x 11/30 Bal. Depreciation Expense Supplies Expense 11/30 Bal, 2010 Supplies Expense Salaries and Wages Expense 440T 11/8 1,040| 11/25 11/30 Bal. Rent Expense 11/22 530 11/30 Bal. 530