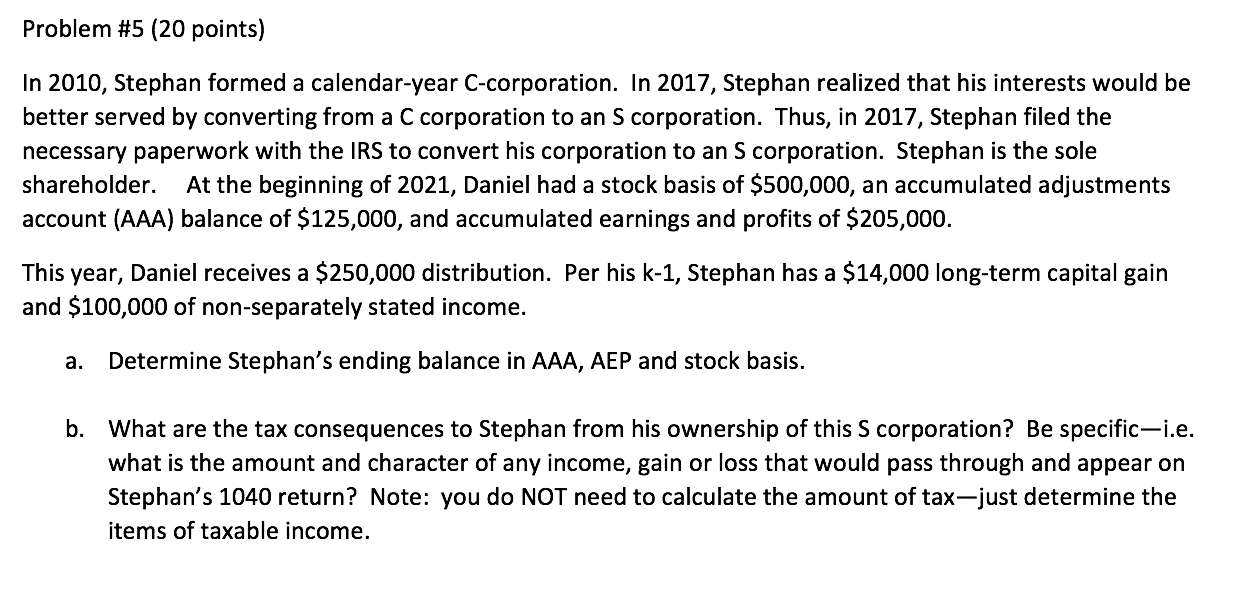

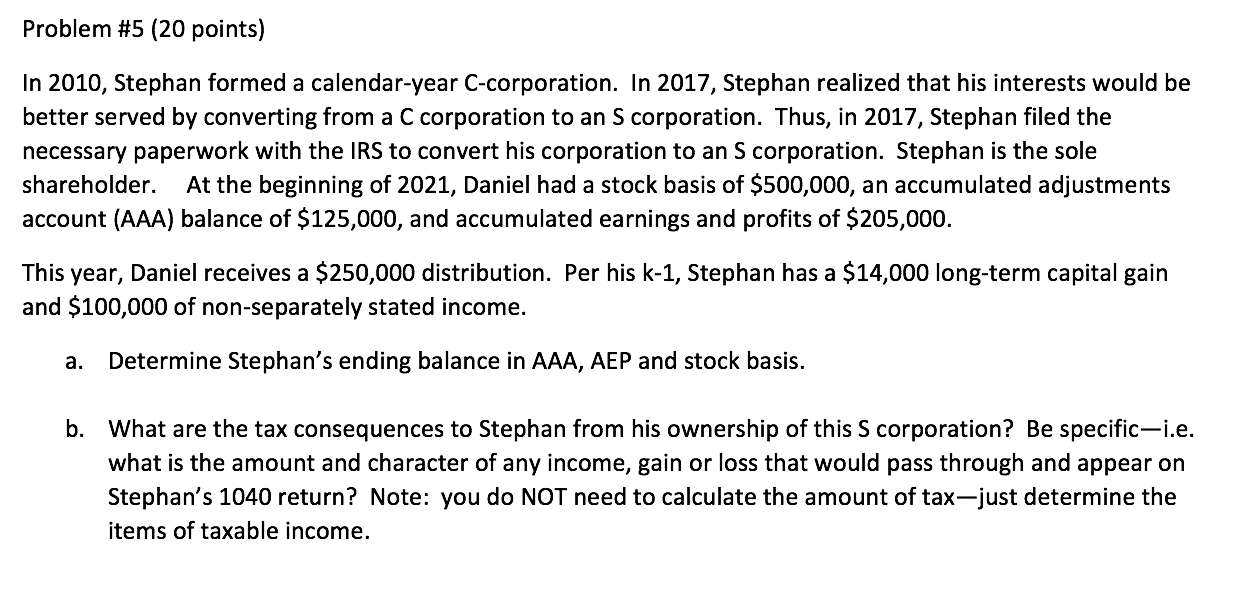

Problem #5 (20 points) In 2010, Stephan formed a calendar-year C-corporation. In 2017, Stephan realized that his interests would be better served by converting from a C corporation to an S corporation. Thus, in 2017, Stephan filed the necessary paperwork with the IRS to convert his corporation to an S corporation. Stephan is the sole shareholder. At the beginning of 2021, Daniel had a stock basis of $500,000, an accumulated adjustments account (AAA) balance of $125,000, and accumulated earnings and profits of $205,000. This year, Daniel receives a $250,000 distribution. Per his k-1, Stephan has a $14,000 long-term capital gain and $100,000 of non-separately stated income. a. Determine Stephan's ending balance in AAA, AEP and stock basis. b. What are the tax consequences to Stephan from his ownership of this S corporation? Be specific-i.e. what is the amount and character of any income, gain or loss that would pass through and appear on Stephan's 1040 return? Note: you do NOT need to calculate the amount of tax-just determine the items of taxable income. Problem #5 (20 points) In 2010, Stephan formed a calendar-year C-corporation. In 2017, Stephan realized that his interests would be better served by converting from a C corporation to an S corporation. Thus, in 2017, Stephan filed the necessary paperwork with the IRS to convert his corporation to an S corporation. Stephan is the sole shareholder. At the beginning of 2021, Daniel had a stock basis of $500,000, an accumulated adjustments account (AAA) balance of $125,000, and accumulated earnings and profits of $205,000. This year, Daniel receives a $250,000 distribution. Per his k-1, Stephan has a $14,000 long-term capital gain and $100,000 of non-separately stated income. a. Determine Stephan's ending balance in AAA, AEP and stock basis. b. What are the tax consequences to Stephan from his ownership of this S corporation? Be specific-i.e. what is the amount and character of any income, gain or loss that would pass through and appear on Stephan's 1040 return? Note: you do NOT need to calculate the amount of tax-just determine the items of taxable income