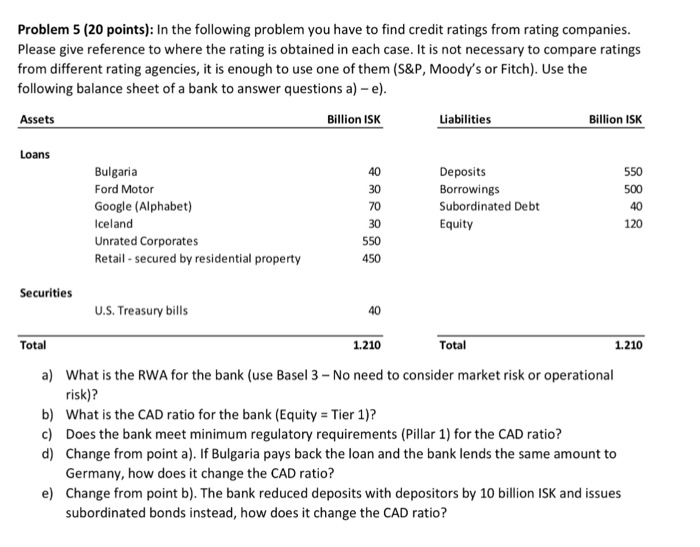

Problem 5 (20 points): In the following problem you have to find credit ratings from rating companies Please give reference to where the rating is obtained in each case. It is not necessary to compare ratings from different rating agencies, it is enough to use one of them (S&P, Moody's or Fitch). Use the following balance sheet of a bank to answer questions a)-e) Assets Billion ISK Liabilities Billion ISK Loans Bulgaria Ford Motor Google (Alphabet) Iceland Unrated Corporates Retail secured by residential property 40 30 70 30 550 450 Deposits Borrowings Subordinated Debt Equity 550 500 40 120 Securities U.S. Treasury bills 40 Total 1.210 Total 1.210 a) What is the RWA for the bank (use Basel 3- No need to consider market risk or operational risk)? b) What is the CAD ratio for the bank (Equity Tier 1)? c) Does the bank meet minimum regulatory requirements (Pillar 1) for the CAD ratio? d) Change from point a). If Bulgaria pays back the loan and the bank lends the same amount to Germany, how does it change the CAD ratio? Change from point b). The bank reduced deposits with depositors by 10 billion ISK and issues subordinated bonds instead, how does it change the CAD ratio? e) Problem 5 (20 points): In the following problem you have to find credit ratings from rating companies Please give reference to where the rating is obtained in each case. It is not necessary to compare ratings from different rating agencies, it is enough to use one of them (S&P, Moody's or Fitch). Use the following balance sheet of a bank to answer questions a)-e) Assets Billion ISK Liabilities Billion ISK Loans Bulgaria Ford Motor Google (Alphabet) Iceland Unrated Corporates Retail secured by residential property 40 30 70 30 550 450 Deposits Borrowings Subordinated Debt Equity 550 500 40 120 Securities U.S. Treasury bills 40 Total 1.210 Total 1.210 a) What is the RWA for the bank (use Basel 3- No need to consider market risk or operational risk)? b) What is the CAD ratio for the bank (Equity Tier 1)? c) Does the bank meet minimum regulatory requirements (Pillar 1) for the CAD ratio? d) Change from point a). If Bulgaria pays back the loan and the bank lends the same amount to Germany, how does it change the CAD ratio? Change from point b). The bank reduced deposits with depositors by 10 billion ISK and issues subordinated bonds instead, how does it change the CAD ratio? e)