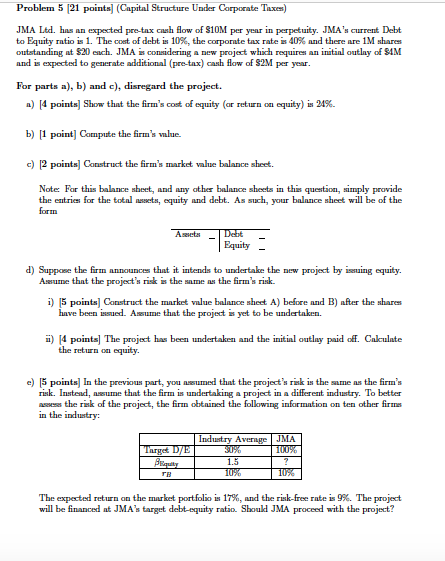

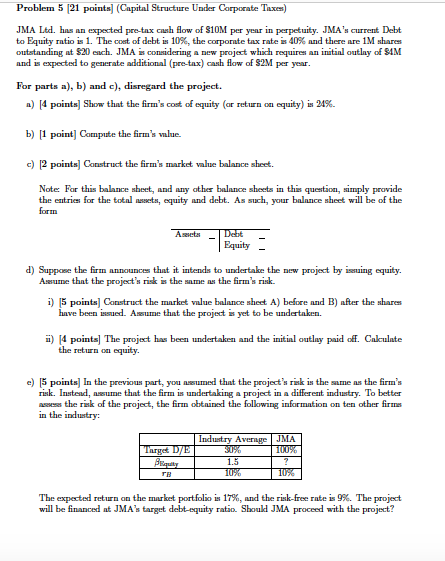

Problem 5 21 points (Capital Structure Under Corporate Taxes) JMA Ltd. has an expected pre-tax cash flow of 10M per year in perpetuity. JMA's current Debt to Equity ratio is 1. The cost of debt is 10%, the corporate tax rate 40% and there are 1M shares outstanding at $20 each. JMA is considering a new project which requires an initial outlay of SIM and is expected to generate additional (pre-tax) cash flow of S2M per year. For parts a), b) and c), disregard the project. a) 4 points) Show that the firm's cost of equity (or return on equity) is 24% b) 1 point Compute the firm's value c) 12 points) Construct the firm's market value balance sheet. Notes For this balance sheet, and any other balance sheets in this question, simply provide the entries for the total assets, equity and debt. As such, your balance sheet will be of the Assets Deut Equity d) Support the firm announces that it intends to undertake the new project by issuing equity. Ar e that the project's risk is the same the firm's risk i) 5 points) Construct the market value balance sheet A) before and B) after the shares have been ied. A m that the project is yet to be undertaken i) (4 points) The project has been undertaken and the initial outlay paid off. Calculate the return on equity. e) (5 points) In the previous part, you sumed that the project's risk in the same as the firm's rink. Instead, me that the firm is undertaking a project in a different industry. To better e the risk of the project, the firm obtained the following information on ten other forms in the industry Target DJE Industry Avere JMA FU 10 1.5 10% 10% The expected return on the market portfolios 17%, and the risk-free rate is 9%. The project will be financed at JMA's target debt-equity ratio. Should JMA proceed with the project? Problem 5 21 points (Capital Structure Under Corporate Taxes) JMA Ltd. has an expected pre-tax cash flow of 10M per year in perpetuity. JMA's current Debt to Equity ratio is 1. The cost of debt is 10%, the corporate tax rate 40% and there are 1M shares outstanding at $20 each. JMA is considering a new project which requires an initial outlay of SIM and is expected to generate additional (pre-tax) cash flow of S2M per year. For parts a), b) and c), disregard the project. a) 4 points) Show that the firm's cost of equity (or return on equity) is 24% b) 1 point Compute the firm's value c) 12 points) Construct the firm's market value balance sheet. Notes For this balance sheet, and any other balance sheets in this question, simply provide the entries for the total assets, equity and debt. As such, your balance sheet will be of the Assets Deut Equity d) Support the firm announces that it intends to undertake the new project by issuing equity. Ar e that the project's risk is the same the firm's risk i) 5 points) Construct the market value balance sheet A) before and B) after the shares have been ied. A m that the project is yet to be undertaken i) (4 points) The project has been undertaken and the initial outlay paid off. Calculate the return on equity. e) (5 points) In the previous part, you sumed that the project's risk in the same as the firm's rink. Instead, me that the firm is undertaking a project in a different industry. To better e the risk of the project, the firm obtained the following information on ten other forms in the industry Target DJE Industry Avere JMA FU 10 1.5 10% 10% The expected return on the market portfolios 17%, and the risk-free rate is 9%. The project will be financed at JMA's target debt-equity ratio. Should JMA proceed with the project