Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 5 . 4 A ( Static ) Preparing a worksheet and financial statements, journalizing adjusting entries, and posting to ledger accounts. LO 5 -

Problem A Static Preparing a worksheet and financial statements, journalizing adjusting entries, and posting to ledger accounts. LO

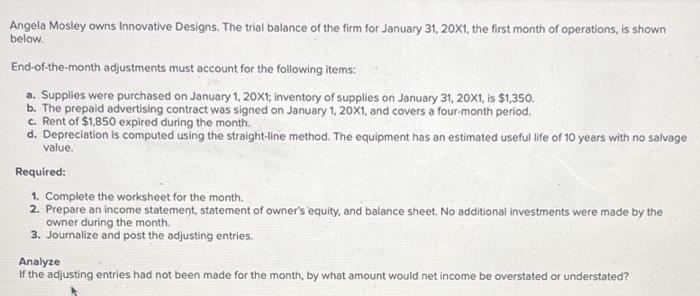

Angela Mosley owns Innovative Designs. The trial balance of the firm for January X the first month of operations, is shown below.

Endofthemonth adjustments must account for the following items:

Supplies were purchased on January X; inventory of supplies on January X is $

The prepaid advertising contract was signed on January X and covers a fourmonth period.

Rent of $ expired during the month.

Depreciation is computed using the straightline method. The equipment has an estimated useful life of years with no salvage value.

Required:

Complete the worksheet for the month.

Prepare an income statement, statement of owners equity, and balance sheet. No additional investments were made by the owner during the month.

Journalize and post the adjusting entries.

Analyze

If the adjusting entries had not been made for the month, by what amount would net income be overstated or understated?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started