Answered step by step

Verified Expert Solution

Question

1 Approved Answer

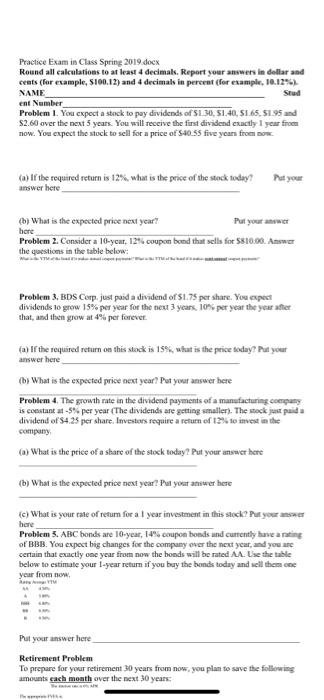

Problem 5. ABC bonds are 10-year, 14% coupon bonds and currently have a rating of BBB. You expect big changes for the company over the

Problem 5. ABC bonds are 10-year, 14% coupon bonds and currently have a rating of BBB. You expect big changes for the company over the next year, and you are certain that exactly one year from now the bonds will be rated AA. Use the table below to estimate your 1-year return if you buy the bonds today and sell them one year from now.

Rating

Average YTM

AA

4.50%

A

5.00%

BBB

6.00%

BB

8.50%

B

9.50%

Put your answer here _________________________________________________

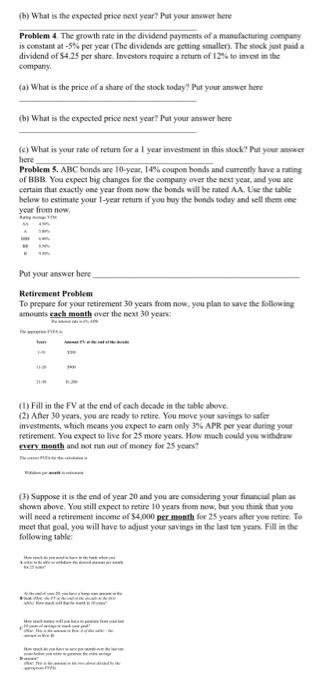

Retirement Problem

To prepare for your retirement 30 years from now, you plan to save the following amounts each month over the next 30 years:

The interest rate is 6% APR

The appropriate FVFA is:

Years

Amount

FV at the end of the decade

1-10

$200

11-20

$900

21-30

$1,200

(1) Fill in the FV at the end of each decade in the table above.

(2) After 30 years, you are ready to retire. You move your savings to safer investments, which means you expect to earn only 3% APR per year during your retirement. You expect to live for 25 more years. How much could you withdraw every month and not run out of money for 25 years?

The correct PVFA for this calculation is:

Withdraw per month in retirement

(3) Suppose it is the end of year 20 and you are considering your financial plan as shown above. You still expect to retire 10 years from now, but you think that you will need a retirement income of $4,000 per month for 25 years after you retire. To meet that goal, you will have to adjust your savings in the last ten years. Fill in the following table:

A

How much do you need to have in the bank when you retire to be able to withdraw the desired amount per month for 25 years?

B

At the end of year 20, you have a lump sum amount in the bank (Hint: the FV at the end of the decade in the first table). How much will that be worth in 10 years?

C

How much money will you have to generate from your last 10 years of savings to reach your goal?

(Hint: This is the amount in Row A of this table the amount in Row B)

D

How much do you have to save per month over the last ten years before you retire to generate the extra savings amount?

(Hint: This is the amount in the row above divided by the appropriate FVFA)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started