Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is a one-day expected shortfall with 95% confidence level. Explain two weaknesses of VaR as a risk measure. What are the theoretical advantages of

What is a one-day expected shortfall with 95% confidence level.

Explain two weaknesses of VaR as a risk measure. What are the theoretical advantages of expected shortfall over VaR?

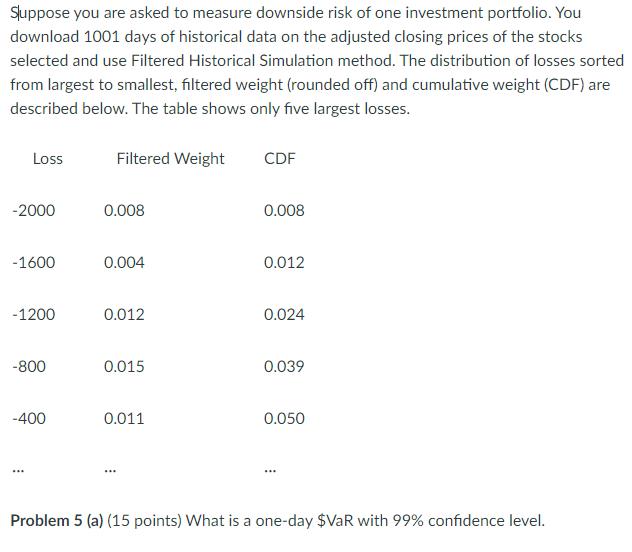

Suppose you are asked to measure downside risk of one investment portfolio. You download 1001 days of historical data on the adjusted closing prices of the stocks selected and use Filtered Historical Simulation method. The distribution of losses sorted from largest to smallest, filtered weight (rounded off) and cumulative weight (CDF) are described below. The table shows only five largest losses. Loss -2000 -1600 -1200 -800 -400 Filtered Weight 0.008 0.004 0.012 0.015 0.011 CDF 0.008 0.012 0.024 0.039 0.050 Problem 5 (a) (15 points) What is a one-day $VaR with 99% confidence level.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the oneday VaR with 99 confidence level we need to find the 99th percentile of the so...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started