Answered step by step

Verified Expert Solution

Question

1 Approved Answer

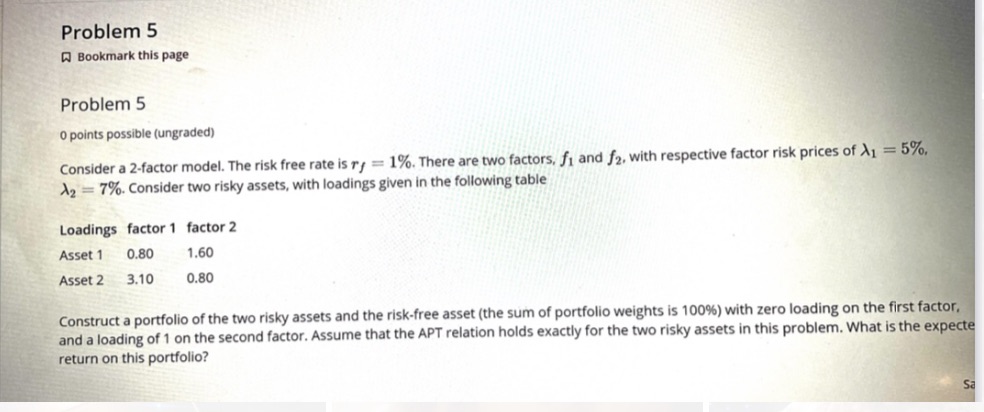

Problem 5 Bookmark this page Problem 5 0 points possible (ungraded) Consider a 2-factor model. The risk free rate is ry=1%. There are two

Problem 5 Bookmark this page Problem 5 0 points possible (ungraded) Consider a 2-factor model. The risk free rate is ry=1%. There are two factors, fi and f2, with respective factor risk prices of X1 = 5%, A2 7%. Consider two risky assets, with loadings given in the following table Loadings factor 1 factor 2 Asset 1 0.80 Asset 2 3.10 1.60 0.80 Construct a portfolio of the two risky assets and the risk-free asset (the sum of portfolio weights is 100 %) with zero loading on the first factor, and a loading of 1 on the second factor. Assume that the APT relation holds exactly for the two risky assets in this problem. What is the expecte return on this portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started