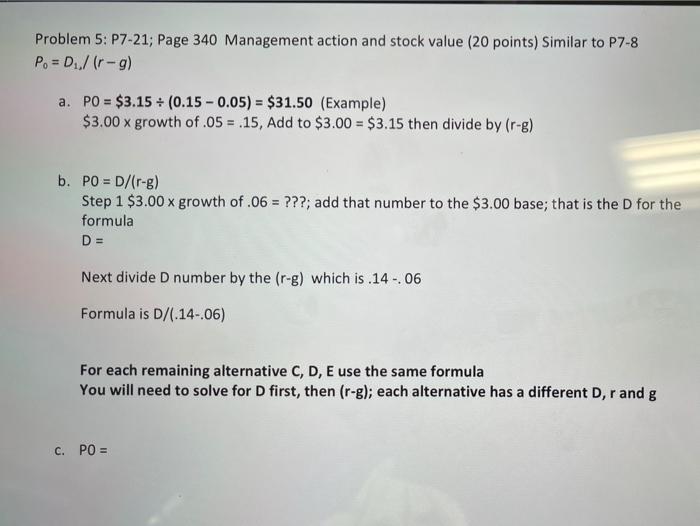

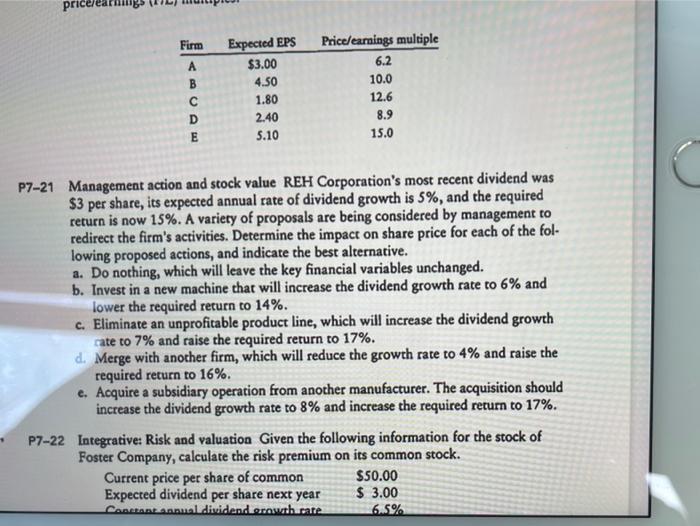

Problem 5: P7-21; Page 340 Management action and stock value (20 points) Similar to P7-8 Po = D../ r-g) a. PO = $3.15 + (0.15 -0.05) = $31.50 (Example) $3.00 x growth of .05 = .15, Add to $3.00 = $3.15 then divide by (r-g) b. PO = D/Ir-g) Step 1 $3.00 x growth of .06 = ???; add that number to the $3.00 base; that is the D for the formula D = Next divide D number by the (r-g) which is .14 - 06 Formula is D/(.14-.06) For each remaining alternative C, D, E use the same formula You will need to solve for D first, then (r-g); each alternative has a different D, r and g C. PO = For each remaining alternative C, D, E use the same formula You will need to solve for D first, then (r-g); each alternative has a different D, r and g C. PO = d. PO = e. PO = What is the best alternative? Choose the alternative that is the highest amount Firm B D E Expected EPS $3.00 4.50 1.80 2.40 5.10 Price/earnings multiple 6.2 10.0 12.6 8.9 15.0 P7-21 Management action and stock value REH Corporation's most recent dividend was $3 per share, its expected annual rate of dividend growth is 5%, and the required return is now 15%. A variety of proposals are being considered by management to redirect the firm's activities. Determine the impact on share price for each of the fol- lowing proposed actions, and indicate the best alternative. a. Do nothing, which will leave the key financial variables unchanged. b. Invest in a new machine that will increase the dividend growth rate to 6% and lower the required return to 14%. c. Eliminate an unprofitable product line, which will increase the dividend growth cate to 7% and raise the required return to 17%. d. Merge with another firm, which will reduce the growth rate to 4% and raise the required return to 16%. e. Acquire a subsidiary operation from another manufacturer. The acquisition should increase the dividend growth rate to 8% and increase the required return to 17%. P7-22 Integrative: Risk and valuation Given the following information for the stock of Foster Company, calculate the risk premium on its common stock. Current price per share of common $50.00 Expected dividend per share next year $ 3.00 CARLANT Annual dividendorowth rate 6.5%