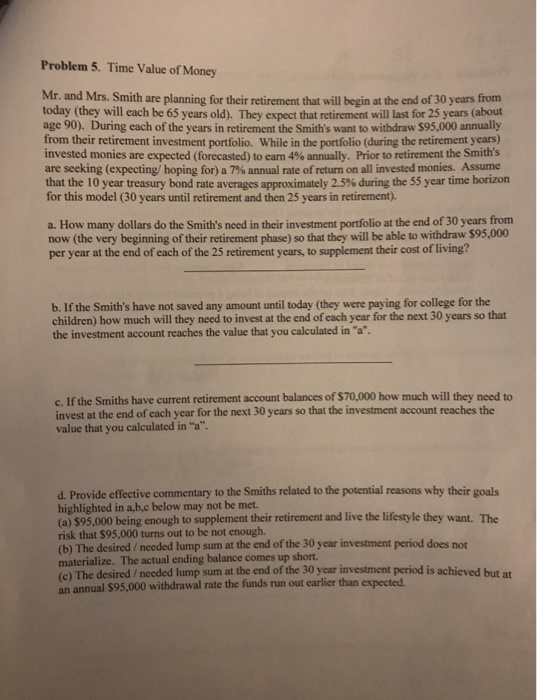

Problem 5. Time Value of Money Mr. and Mrs. Smith are planning for their retirement that will begin at the end of 30 years from today (they will each be 65 years old). They expect that retirement will last for 25 years (about age 90). During each of the years in retirement the Smith's want to withdraw $95.000 annually from their retirement investment portfolio. While in the portfolio (during the retirement years) invested monies are expected (forecasted) to earn 4% annually. Prior to retirement the Smith's are seeking (expecting/hoping for) a 7% annual rate of return on all invested monies. Assume that the 10 year treasury bond rate averages approximately 2.5% during the 55 year time horizon for this model (30 years until retirement and then 25 years in retirement). a. How many dollars do the Smith's need in their investment portfolio at the end of 30 years from now (the very beginning of their retirement phase) so that they will be able to withdraw $95,000 per year at the end of each of the 25 retirement years, to supplement their cost of living? b. If the Smith's have not saved any amount until today (they were paying for college for the children) how much will they need to invest at the end of each year for the next 30 years so that the investment account reaches the value that you calculated in "a". c. If the Smiths have current retirement account balances of $70,000 how much will they need to invest at the end of each year for the next 30 years so that the investment account reaches the value that you calculated in "a". d. Provide effective commentary to the Smiths related to the potential reasons why their goals highlighted in a,b,c below may not be met. (a) 895,000 being enough to supplement their retirement and live the lifestyle they want. The risk that $95.000 turns out to be not enough. (b) The desired / needed lump sum at the end of the 30 year investment period does not materialize. The actual ending balance comes up short. (c) The desired / needed lump sum at the end of the 30 year investment period is achieved but at an annual $95.000 withdrawal rate the funds run out earlier than expected