Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 5 With the cold weather fast approaching, J&J is planning to move operations indoors. It is considering buying a customized work trailer and having

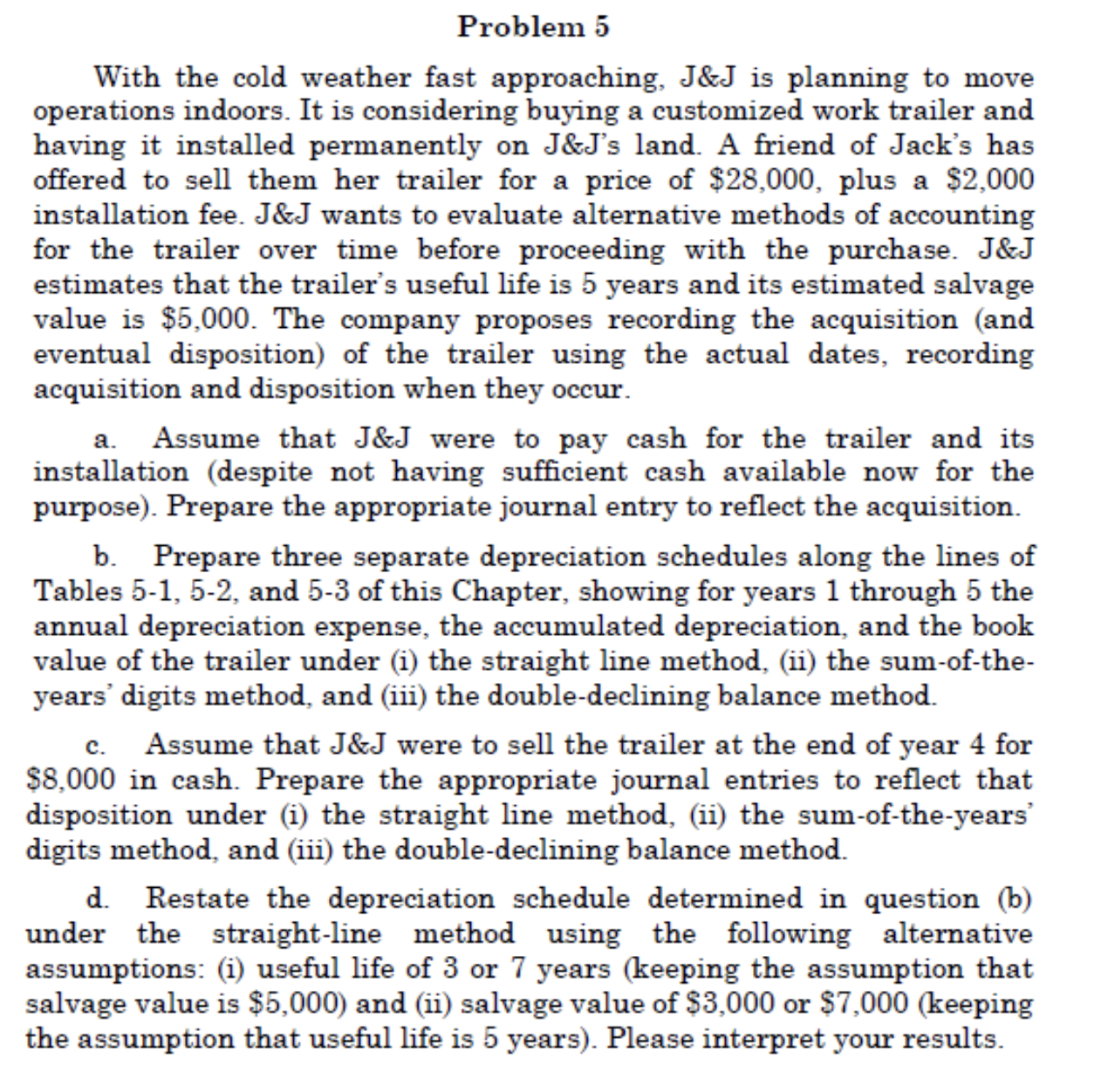

Problem 5 With the cold weather fast approaching, J\&J is planning to move operations indoors. It is considering buying a customized work trailer and having it installed permanently on J\&J's land. A friend of Jack's has offered to sell them her trailer for a price of $28,000, plus a $2,000 installation fee. J\&J wants to evaluate alternative methods of accounting for the trailer over time before proceeding with the purchase. J\&J estimates that the trailer's useful life is 5 years and its estimated salvage value is $5,000. The company proposes recording the acquisition (and eventual disposition) of the trailer using the actual dates, recording acquisition and disposition when they occur. a. Assume that J\&J were to pay cash for the trailer and its installation (despite not having sufficient cash available now for the purpose). Prepare the appropriate journal entry to reflect the acquisition. b. Prepare three separate depreciation schedules along the lines of Tables 5-1, 5-2, and 5-3 of this Chapter, showing for years 1 through 5 the annual depreciation expense, the accumulated depreciation, and the book value of the trailer under (i) the straight line method, (ii) the sum-of-theyears' digits method, and (iii) the double-declining balance method. c. Assume that J\&J were to sell the trailer at the end of year 4 for $8,000 in cash. Prepare the appropriate journal entries to reflect that disposition under (i) the straight line method, (ii) the sum-of-the-years' digits method, and (iii) the double-declining balance method. d. Restate the depreciation schedule determined in question (b) under the straight-line method using the following alternative assumptions: (i) useful life of 3 or 7 years (keeping the assumption that salvage value is $5,000 ) and (ii) salvage value of $3,000 or $7,000 (keeping the assumption that useful life is 5 years). Please interpret your results

Problem 5 With the cold weather fast approaching, J\&J is planning to move operations indoors. It is considering buying a customized work trailer and having it installed permanently on J\&J's land. A friend of Jack's has offered to sell them her trailer for a price of $28,000, plus a $2,000 installation fee. J\&J wants to evaluate alternative methods of accounting for the trailer over time before proceeding with the purchase. J\&J estimates that the trailer's useful life is 5 years and its estimated salvage value is $5,000. The company proposes recording the acquisition (and eventual disposition) of the trailer using the actual dates, recording acquisition and disposition when they occur. a. Assume that J\&J were to pay cash for the trailer and its installation (despite not having sufficient cash available now for the purpose). Prepare the appropriate journal entry to reflect the acquisition. b. Prepare three separate depreciation schedules along the lines of Tables 5-1, 5-2, and 5-3 of this Chapter, showing for years 1 through 5 the annual depreciation expense, the accumulated depreciation, and the book value of the trailer under (i) the straight line method, (ii) the sum-of-theyears' digits method, and (iii) the double-declining balance method. c. Assume that J\&J were to sell the trailer at the end of year 4 for $8,000 in cash. Prepare the appropriate journal entries to reflect that disposition under (i) the straight line method, (ii) the sum-of-the-years' digits method, and (iii) the double-declining balance method. d. Restate the depreciation schedule determined in question (b) under the straight-line method using the following alternative assumptions: (i) useful life of 3 or 7 years (keeping the assumption that salvage value is $5,000 ) and (ii) salvage value of $3,000 or $7,000 (keeping the assumption that useful life is 5 years). Please interpret your results Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started